Prices

September 10, 2019

U.S Steel Exports Inch Up in July

Written by Brett Linton

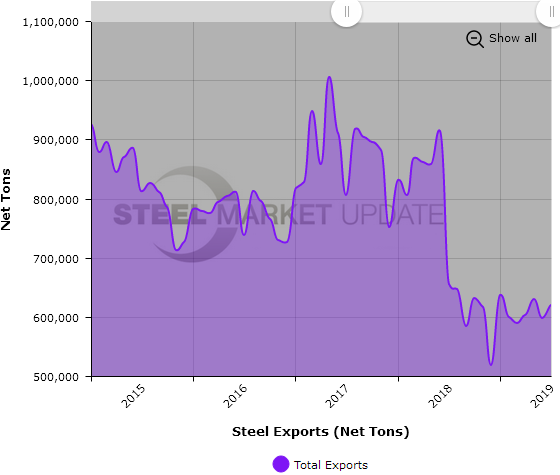

The U.S. exported 620,598 tons of flat rolled steel in July, according to final Census data, a 4 percent rise from June, but down 5 percent from the same month one year ago.

July exports were in line with the 2019 average of 611,019 tons, but down significantly compared to recent years. It was this time last year when exports dropped from their 850,000+ ton levels down to sub-700,000 levels (see purple chart below).

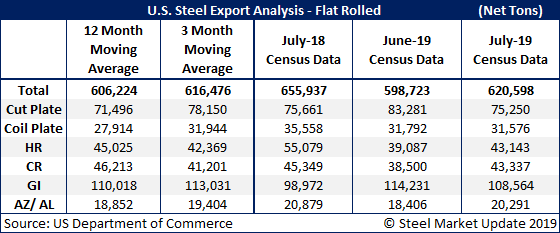

Total July exports were above both the three-month moving average (average of May, June and July), and above the 12-month moving average (average of August 2018 through July 2019). Here is a breakdown by product:

Cut plate exports fell 10 percent from June to 75,250 tons, down 1 percent compared to one year ago.

Exports of coiled plate were 31,576 tons in July, down 1 percent month over month, and down 11 percent year over year.

Hot rolled steel exports rose 10 percent over June to 43,143 tons, down 22 percent over July 2018.

Exports of cold rolled products were 43,337 tons in July, up 13 percent from June, but down 4 percent over the same month last year.

Galvanized exports declined 5 percent month over month to 108,564 tons. Compared to one year ago, July was up 10 percent.

Exports of all other metallic coated products were 20,291 tons, up 10 percent from June, but down 3 percent compared to one year ago.

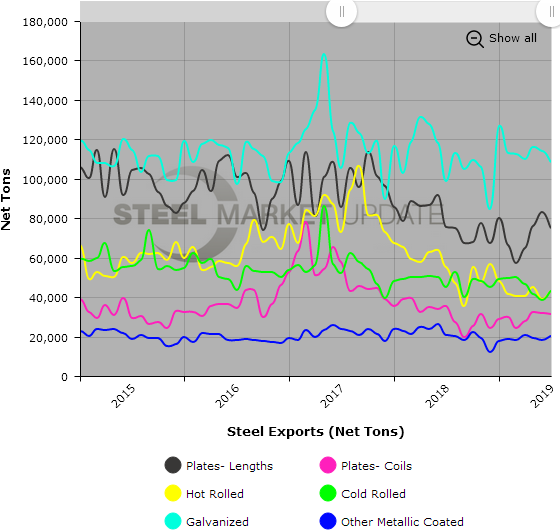

Below are two graphs showing the history of U.S. steel exports, in total and by product. To use their interactive features, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.