Prices

September 22, 2019

SMU Market Trends: Mills Lose Pricing Momentum

Written by Tim Triplett

Domestic steelmakers managed to reverse the year’s long downtrend in steel prices for a few weeks in July and August, but the turnaround was short-lived. As of mid-September, Steel Market Update’s Price Momentum Indicator is pointing firmly lower for hot rolled, cold rolled and coated steel prices, as well as for steel plate, as the market heads into a fourth quarter in which uncertain demand is keeping many buyers on the sidelines.

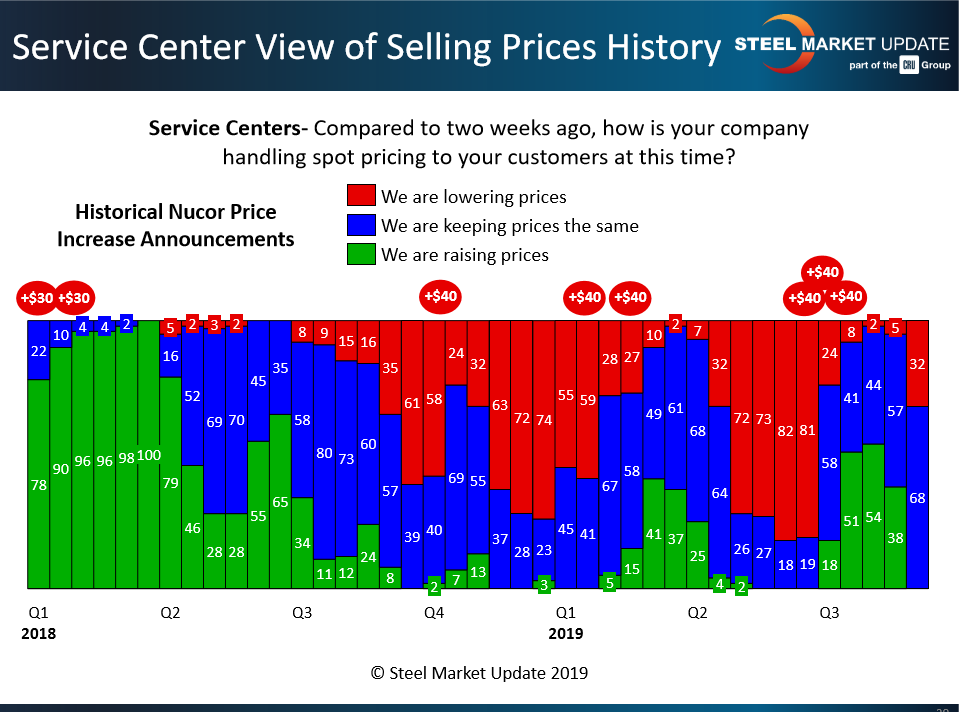

The upward momentum the mills saw from the three $40 per ton price increases they announced earlier this summer has apparently run its course. For mills to successfully collect a price increase, they need a commitment from distributors. And service centers are no longer supporting higher prices, according to findings from SMU’s Sept. 9 market trends questionnaire.

As seen in the chart below, none of the service center executives responding to SMU’s poll said they were still raising prices. Roughly two out of three said they were holding the line, but nearly one-third admitted they were lowering prices to close the sales.

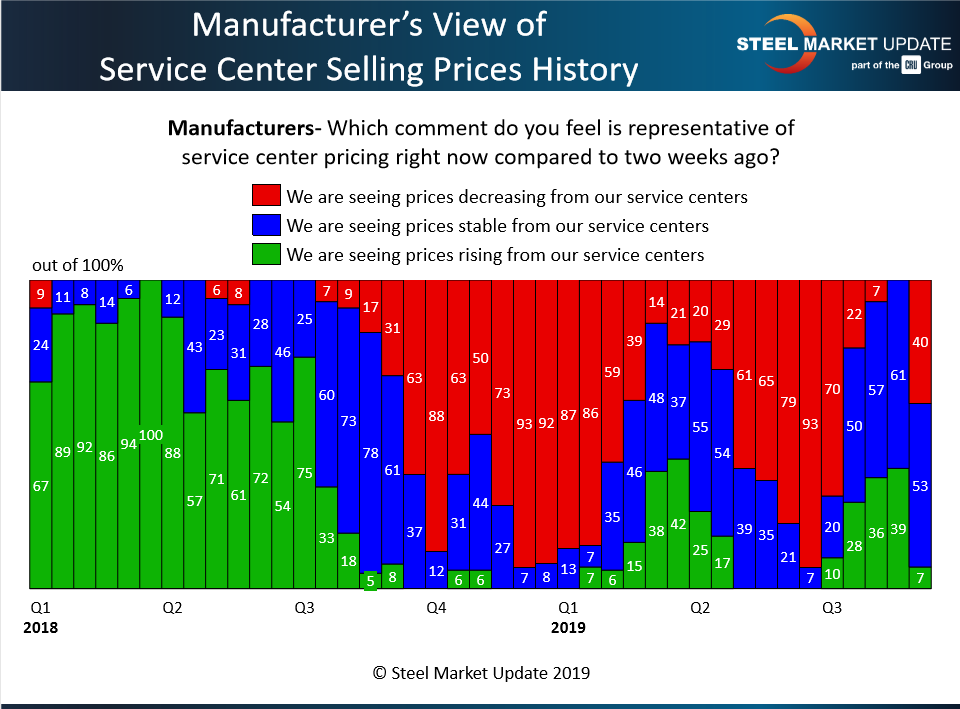

Corroborating the trend, only 7 percent of the manufacturers responding to SMU’s questionnaire reported they were still seeing higher prices from their service center suppliers. Forty-percent said steel offers from service centers were lower—a major shift from just a few weeks prior.

SMU Steel Prices

SMU data shows the benchmark price for hot rolled steel dropped from about $700 per ton at the beginning of the year to around $550 per ton by the end of June when the mills increased prices. In the weeks that followed, the HR price saw a brief bump to an average of nearly $585 per ton, but it failed to sustain any traction.

Flat rolled and plate steel prices have since reversed course as buyer sentiment has become somewhat negative. As of Sept. 16, SMU data showed the average delivered price for hot rolled steel at $560 per net ton, with mill lead times of 3-6 weeks. The price of cold rolled coil averaged $740 per ton, with a lead time of 4-8 weeks. The benchmark price for 0.060-inch G90 galvanized coil averaged $813 per ton, with lead times for spot orders averaging 4-9 weeks. Lead times for steel plate were as short as 3-5 weeks as the price dipped to an average of $730 per ton. Based on the latest feedback from service centers and their customers, it appears likely spot prices will trend further downward in the coming weeks.

SMU Service Center Inventories Report

Another key indicator—service center inventories—also suggests that steel prices are unlikely to get much support from the distribution channel anytime soon. SMU’s new Service Center Inventories Report [ADD LINK] shows industry inventories that are balanced to slightly high considering the market is entering a slow period of the year when companies traditionally pare back their buying. As of the end of August, flat rolled inventories average 55.8 days of supply, and plate inventories 52.1 days, according to SMU data.

SMU surveys key data providers each month to gather the latest information on steel sheet and plate inventories. The results are summarized in the Service Center Inventories Report, which is distributed to SMU’s Premium subscribers around the 10th business day of each month. Companies that volunteer to (confidentially) share inventory data each month receive additional benefits, including a Flash Report with preliminary data about a week prior to other subscribers.

SMU’s Service Center Inventories Report includes:

Total inventory levels from the data providers

Total monthly shipments by the data providers

Shipping days of supply

Months of supply on hand

SMU Inventories Report Analysis, which includes expert commentary on the month-to-month changes in flat rolled and plate inventories, with forecasts based on industry pricing trends and other market factors.

Data providers also qualify to receive information on the average daily shipping rate, tons on order, shipping days of supply on order, percentage of inventory on order, as well as the percentage of inventory committed to contracts vs. available to the spot market. (Contact Paige Mayhair at 724-720-1012 or email Paige@SteelMarketUpdate.com for information on how to subscribe to SMU’s Service Center Inventories Report.)

What the Market is Saying

Service centers and manufacturers are reporting softening demand, shortening lead times and mill prices that are very negotiable. One service center exec pointed to layoffs at farm equipment makers and record low crop prices in the agriculture sector. Farmers have very little cash to invest in grain bins, tractors or other steel-intensive products, he said. The president of another service center put it this way: “Is there more of a problem on the demand side than we have been willing to acknowledge?” He reported sluggish shipments in August and September that are well off projections in sectors including agriculture, energy and heavy equipment. “No one expected the market to turn so quickly,” said another source, commenting on the downturn in steel prices. At this point, he anticipates no new sales activity until the first or second quarter of 2020. Executives also pointed to lower ferrous scrap prices and the expectation for scrap to move even lower in October as more proof of the pressure on prices. Add in widespread concerns about the strike at General Motors, and many people feel the lows of the year will be tested in the coming weeks.

As the GM of one large service center told SMU in mid-September: “This particular downturn has been expected given the market dynamics evolving over the last couple of months. We very well could see a repeat of what occurred in the summer, with a drop-off in price by mid to late fall, followed by a period of heavy orders at very low prices, then lather, rinse, repeat.”