Prices

September 24, 2019

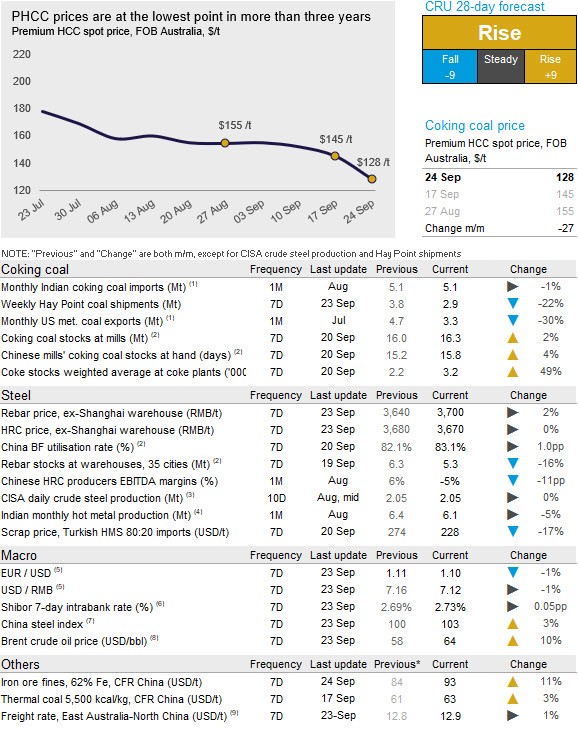

CRU: Coking Coal Crashes to Three-Year Low

Written by Tim Triplett

By CRU Analyst Jordan Permain

The mismatch between seaborne coal supply and demand deepened during the week, causing CRU to assess the Premium HCC $17 /t lower w/w at $128 /t, FOB Australia.

Demand for seaborne coal in China, India and Europe was weak in the past week. The macroeconomic environment in India continues to be bearish and coupled with ongoing steel production cuts in Europe, demand for Premium Mid-Vol HCC – favored in these regions – was low. In China, the expectation of steel capacity cuts in the lead up to the 70th anniversary celebration and the continuation of complications associated with importing coal saw demand for Premium Low-Vol HCC, typically China’s preferred product, remain low.

Persistently strong supply from Australia put further downward pressure on prices. Approximately 2.9 Mt of met. coal was shipped from Hay Point last week representing an increase of ~23 percent m/m compared with the same time in August. At current prices, we do not expect supply from Australia to be curtailed, but this is a different story in other major met. coal exporting countries. According to data from CRU’s Metallurgical Coal Cost Model, more than half of exports from the U.S. are uncompetitive at current prices. The situation in Russia isn’t as dire; the highest cost producers have only just become uncompetitive, but these quantities are negligible.

We expect seaborne coal prices to rise in the coming month. Demand will recover; the Indian government has announced it will lower the corporate tax rate and steel capacity restrictions in China will ease once the 70th anniversary celebrations are over. Furthermore, a cutback in shipments from the U.S. can be expected, which will reduce seaborne supply and put upward pressure on prices.