Market Data

October 3, 2019

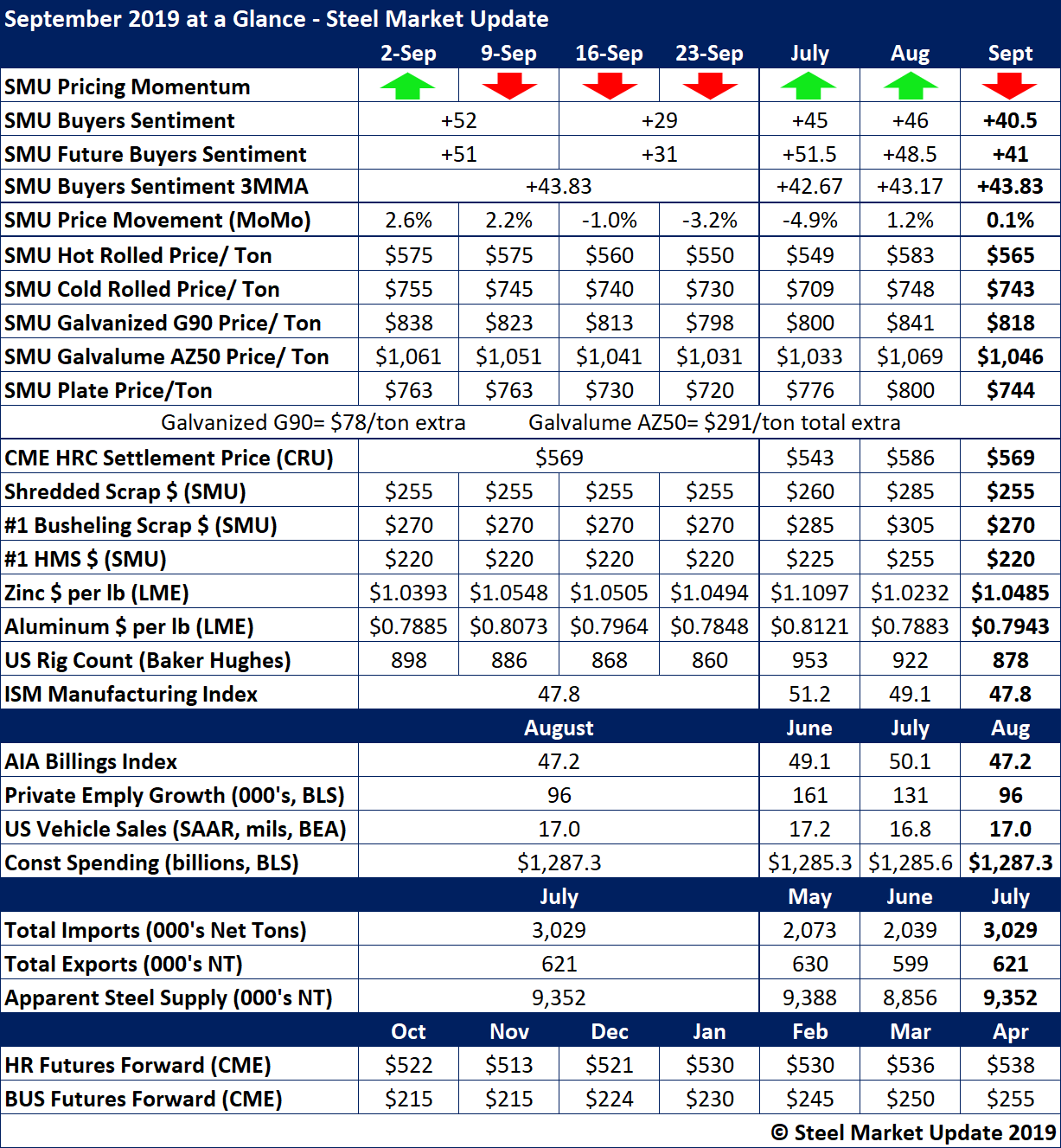

September at a Glance

Written by Brett Linton

September saw big downturns on both steel price momentum and steel buyers sentiment that aren’t readily evident in the monthly data (below) from Steel Market Update.

SMU’s Price Momentum Index was pointing downward for the entire month of September. The benchmark price for hot rolled steel averaged $565 per ton for the month, down nearly $20 from August. More telling about the current state of affairs is the hot rolled price at the end of the month, which averaged just $525 per ton. Given the signs of weakening demand, many buyers expect prices for all steel products to decline further in the fourth quarter.

SMU’s Steel Buyers Sentiment Indexes late in the month dropped by about 20 points to average readings around +30, well below the monthly average readings shown below in the low +40s. Those compare to readings above +60 earlier in the year. Entering October, the ongoing declines in flat rolled steel prices, the uncertainty caused by questionable steel demand and the stress from the contentious political situation in Washington appear to be taking a toll on industry optimism.

Adding to the downward pressure on finished steel prices are scrap prices that saw $30-40 declines in September. Sources tell SMU they expect scrap prices to decline further in October.

Corroborating anecdotal reports of slowing order activity in September is the 47.8 reading in the Institute for Supply Management’s Manufacturing Index. The reading below 50 indicates the manufacturing economy is experiencing contraction.

See the chart below for more key benchmarks in September.

To see a history of our monthly review tables, visit our website here.