Prices

October 17, 2019

CRU: Weak Steel Demand and Mill Outages Keep Scrap Demand Low

Written by Chris Asgill

By CRU Principal Analyst Chris Asgill

Weak steel markets have continued to drive down scrap prices in many regions. In the key supply markets of Europe and the U.S., mills have taken outages as demand has failed to recover seasonally. Meanwhile in Japan, weak steel demand and high steel inventories have continued to limit steel production. Although inflows of scrap in these markets have slowed due to the weak pricing environment of recent months, this was not sufficient to offset the drop in demand during the October buy period. This has been compounded by the weakness in the key scrap importing markets of Turkey and Asia.

Turkish scrap import prices fell as low as $225 /t CFR Turkey for HMS 80:20 a few weeks ago, though have since edged higher to $233 /t, a fall of just $6 /t m/m. When prices dropped to the mid-220s, a “buying spree” (of sorts) ensued, with two weeks of the highest weekly deal volumes recorded since July. Turkish mills were looking to leverage lower scrap prices to sell into Asia, where scrap prices have remained higher. Even with the pickup in buying activity, some mills in Turkey are still reportedly short scrap stocks and may need to continue to buy. That said, some major Turkish mills have idled capacity due to weak domestic demand and export sales and will, therefore, not need to buy significant volumes.

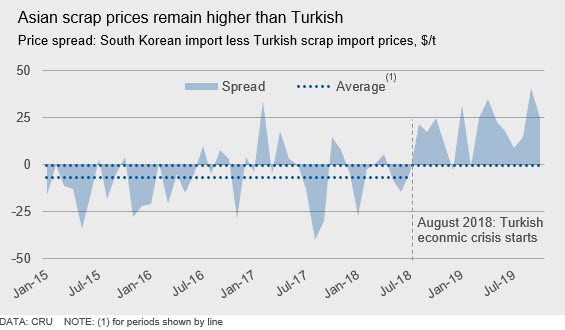

While Asian scrap prices have fallen sharply in October, they remain higher than Turkish import prices. Even so, the spread between these prices narrowed in October to $25 /t, from an all-time high of over $40 /t in September. Historically, prior to the Turkish economic crisis commencing, Asian scrap import prices have been discounted slightly to Turkish prices. The Turkish crisis has been a key factor in the disparity between prices, though so have periods of tightness in the Japanese domestic market. While the latter condition is not so much the case currently, despite falls in Japanese domestic scrap prices, these remain higher than U.S. domestic prices.

Outlook: Near a Floor, But Still Room to Move Lower

Scrap prices have fallen to near a supply floor in October and we do not expect further significant falls. A lot hinges on the performance of the domestic steel markets in the U.S. and Europe and the impact of renewed U.S. sanctions on the Turkish economy. Our expectations are reasonably pessimistic for the U.S. and Europe, as demand remains lackluster and supply cuts have yet to be significant enough to sustain a turnaround. The Asian steel market also remains weak. Consequently, we do not expect a significant turnaround in scrap markets in these regions.

Although new Turkish scrap deals heard after our assessment window closed have moved higher again, we do not expect an immediate sustained or significant recovery. Steel prices and margins remain weak as mills in most regions compete for volume. Thus, there will be limited cases where Turkish mills are willing to pay higher prices, and this is evidenced by the thin deal volumes over the past week or so. We do not expect a sustained uplift in scrap prices until winter, when supply in the northern hemisphere will be impacted by snowfall.

Sanctions Not Tariffs Will Impact Turkish Scrap Demand and Prices

While President Trump’s announcement that tariffs on Turkish steel imports in the U.S. will rise to 50 percent (i.e. after being reduced to 25 percent in May) is grabbing steel headlines, it is the wider sanctions that will have the greatest impact. The tariffs themselves may undermine scrap prices slightly but not significantly. This is because Turkish steel export volumes to the U.S. have been negligible (i.e. little has changed since the 50 percent was first imposed in August last year). Moreover, Turkish steel only became competitive in September due to sizable scrap price falls.

The greater issue will be the wider impact of sanctions on the Turkish economy and steel demand there, which had been showing tentative signs of recovery. Weaker domestic demand would lead more mills to idle capacity and this would undermine scrap demand further as access to export markets will remain limited. To date, Turkish mills have cut semifinished steel imports to sustain steel output as best possible—semis demand is down 21 percent y/y for 2019 to August, while production is down 10 percent y/y over the same period. Mills cannot cut semis imports further, so either steel output would need to drop further or Turkish mills need to find a home for their steel in export markets; the latter seems unlikely. In other words, a further degradation in domestic steel demand would lead to lower scrap imports from Turkey, which are already down 16 percent y/y to August in 2019.