Market Data

November 3, 2019

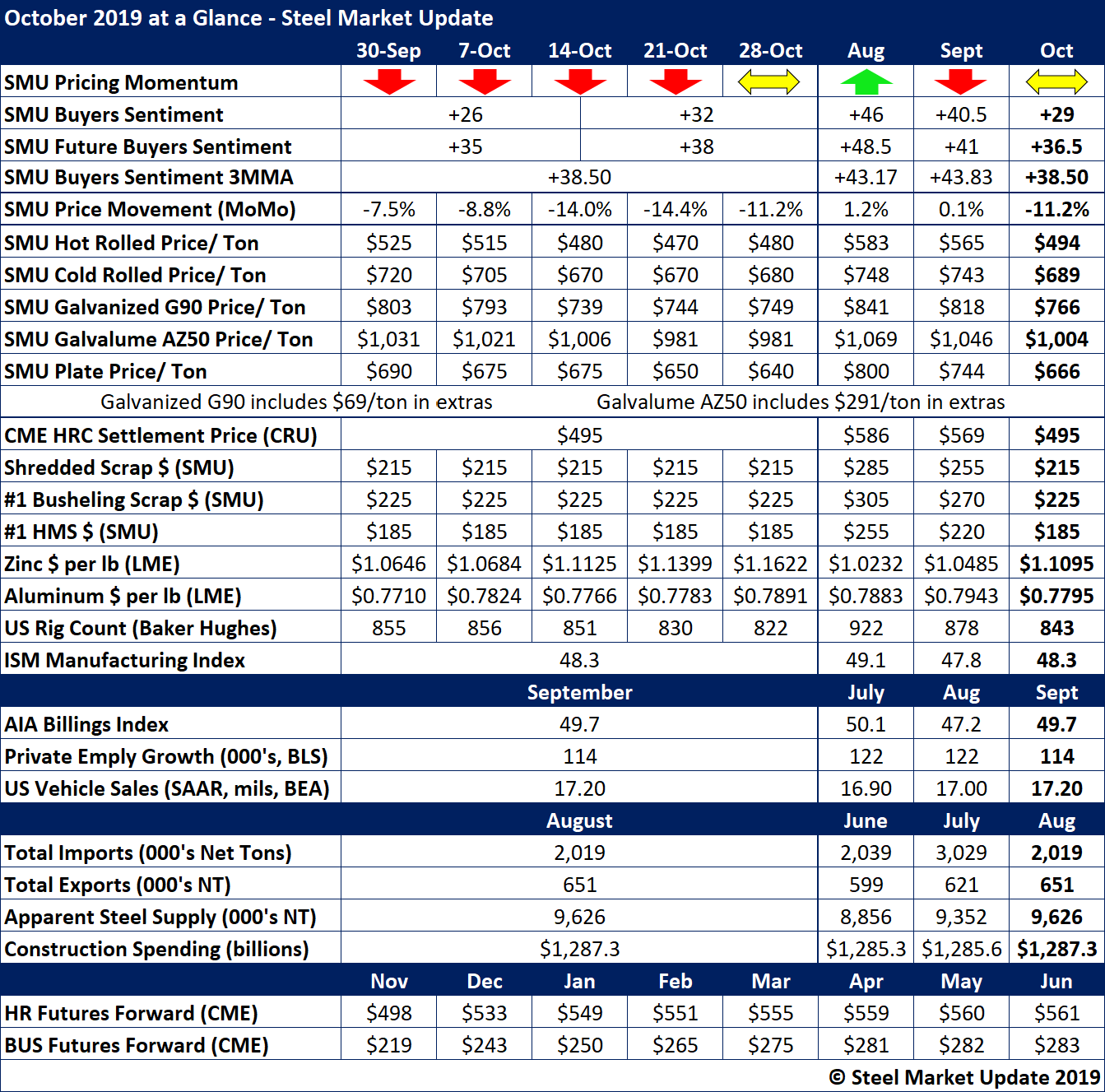

October at a Glance

Written by Brett Linton

Steel prices continued their decline in October to an average hot rolled price below $500 per ton, prompting a $40 per ton price increase announcement by the flat rolled mills late in the month. With a price change in play, Steel Market Update switched its Price Momentum Indicator to Neutral.

Widespread concerns about the declining prices and questionable demand took SMU’s Steel Buyers Sentiment Index to even lower levels in October. The Institute for Supply Management’s PMI, which registered 49.1 in August, 47.8 in September and 48.3 in October, remains in contraction below the 50-point level that signals growth in manufacturing. In the energy sector, the rig count declined further in October. Automotive production remains a bright spot for steel demand, although it will feel some impact from the 40-day strike by the UAW against General Motors

Adding to the downward pressure on finished steel prices in October were weak ferrous scrap prices that have also been on the decline for the past few months. Sources tell SMU they expect scrap prices to increase by at least $20/GT in November, perhaps reversing the slide.

See the chart below for more benchmarks for the month of October.

To see a history of our monthly review tables, visit our website here.