Prices

November 14, 2019

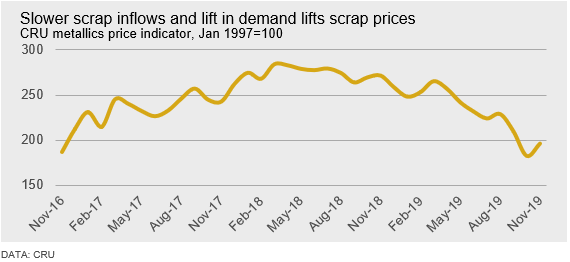

CRU: Scrap Prices Find Floor as Supply Dries Up and Demand Returns

Written by Ryan McKinley

By Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor

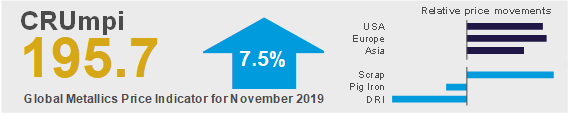

The CRU metallics price indicator (CRUmpi) rose by 7.5 percent m/m to 195.7 (see chart) after prices rose in most markets. The most pronounced rebounds were in the U.S. and European scrap markets, while prices in Asia either rose or were stable. Prices in regions impacted by winter weather will likely find further upward price pressure in the near term.

Metallics markets across the globe appear to have found a floor as supply dries up and demand returns. In the U.S., relatively low scrap prices have squeezed supply while mills returned from scheduled maintenance outages, tightening the market. These factors, in conjunction with higher scrap export prices allowed domestic dealers to secure increases of at least $20 /l.ton. In Europe, demand was strong as mills looked to finish their procurement for the remainder of the year after lower October prices helped constrict supply. While steel demand is weak in southern Europe, mills are waiting for consumers to restock as inventories dwindle throughout the supply chain.

With domestic markets tightening elsewhere, Turkish producers have had to pay higher prices to secure their scrap. Prices there rose every week in October, which has led to margin compression and prevented rebar from being competitive in the U.S. market. We do not expect the current $260 /t price level to be sustainable barring a meaningful increase in international finished steel prices.

In Asia, growing demand for steel in the Vietnamese construction sector boosted scrap import prices by $30 /t m/m. Meanwhile, buying activity in other parts of southeast Asia has been limited on softer macroeconomic trends, but we expect scrap prices to remain stable in the near term.

Downward pressure on Chinese scrap prices eased towards the end of October after scrap yard inventories declined and BS-VI emission standards reduced transportation availability. Inbound flows were also restricted by limited housing demolition and manufacturing activity. Still, any demand increase was limited by a drop in the cost of hot metal production due to lower iron ore and coking coal prices. As a result, domestic scrap prices were little changed m/m.

The stability in Chinese scrap prices has influenced the ore-based metallics market. A drop in merchant pig iron prices in October prompted some Chinese buyers to offset high domestic scrap costs with relatively less expensive pig iron. Over the past six weeks, Chinese buyers procured 250 kt of pig iron from Brazil and are actively looking to secure more material out of the CIS. With Brazil sold out through January, buyers in more traditional import markets will need to either compete harder domestically for prime grade scrap or buy merchant pig iron at higher prices.

Outlook: Winter to Provide Upward Price Pressure

While steel markets in Europe and the U.S. have largely stabilized, we do not expect a major price recovery for the remainder of the year. However, scrap prices will be driven higher in the near term for regions that are seasonally exposed to adverse winter weather conditions. As these are the key supply markets for scrap exports, price support will remain markets dependent on imports.

At the same time, pig iron prices will get a short-term boost from China’s buying activity, but we expect this to be relatively short-lived. China will likely not remain active in the market for long, and raw material costs like coking coal and iron ore have been on a downward trajectory amid loosening supply and weaker buying interest.