Government/Policy

December 2, 2019

Trump Tariff Tweet on Brazil, Argentina Causes Widespread Confusion

Written by John Packard

This morning President Trump tweeted that due to the decline in the Brazilian and Argentinian currencies, he intends to place 25 percent tariffs on steel and a 10 percent tariff on aluminum from both countries. His tweet has created a great deal of confusion in the U.S. steel markets.

Steel Market Update is attempting to help calm industry fears by putting out this special newsletter on the subject of Brazil and Argentina steel exports, the markets that potentially could be compromised by the president’s tweet, and what has to happen before the new tariffs can be collected.

Brazil is a major exporter of steel to the United States. Close to 90 percent of what Brazil sends to the U.S. is slabs (some billets, but mostly slabs) going to domestic steel producers. Our sources have identified the three largest importing mills of Brazilian slabs as California Steel Industries, NLMK USA and AMNS Calvert. We have been told that JSW Texas and Evraz also receive a small number of slabs from Brazilian sources.

Brazil has an annual quota of 3.5 million metric tons on semi-finished steels (slabs, billets, blooms) into the United States. The quota has been filled for fourth-quarter 2019, and inventories are building in bonded warehouses now for material to be released as part of the first-quarter 2020 quota. As of this writing, none of the affected mills are quite certain how the president’s tweet will impact their company.

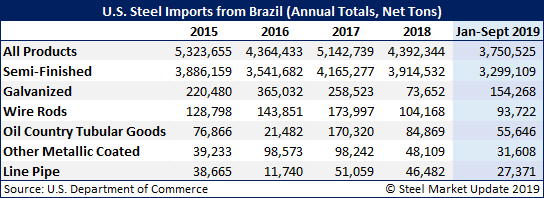

Here are the major steel products exported by Brazil to the United States. Tonnage shown is net tons. Other Metallic Coated is Galvalume.

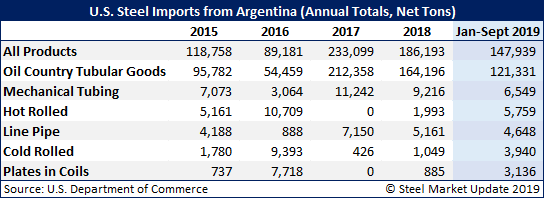

Argentina is a small exporter of steel to the United States having only exported 186,193 net tons of steel products to the U.S. during calendar year 2018. Through September, Argentina has exported 147,939 net tons. The bulk of the exports are oil country tubular goods (OCTG).

Here are the major steel products exported by Argentina to the United States (all items are shown in net tons).

Trade attorney Lewis Leibowitz provided some comments to Steel Market Update early this morning shortly after the president’s tweets . He told SMU that Brazil and Argentina never did have a 25 percent tariff on them as both countries negotiated specific quotas in place of tariffs. Therefore, technically, tariffs cannot be “reinstated” as they did not exist for these countries in the first place. Three countries negotiated quotas: South Korea was first, in April 2018, and Brazil and Argentina followed in May 2018.

Leibowitz advised SMU that based on a recent ruling by the Court of International Trade over the 50 percent tariffs placed on Turkey, the law arguably does not permit the president to modify import restrictions as he asserted in the tweets today. “The imposition of new tariffs on Brazil and Argentina are comparable to the 50 percent tariffs imposed on Turkey under the law,” he said.

He added, “The president’s tweet does not have the force of law. No other announcement, such as a Proclamation, has appeared so far.” This could just be a formality, and SMU expects a formal proclamation or publication in the Federal Register in the coming days. But there will be a delay in the effectiveness of the new tariffs until a formal order is published.

One area of confusion is how tariffs would affect the negotiated quotas with Brazil and Argentina. This is something else that will need to be worked out in the coming days if the tariffs are indeed going to be put in place.

SMU has reached out to a number of mills, trading companies and legal experts to see what this all will mean, and we will continue to report on what we discover in the coming days.