Prices

December 15, 2019

Will Steel Prices Keep Trending Up Into 2020?

Written by Tim Triplett

After declining for much of 2019, steel prices have moved up substantially in the last two months. Will the trend continue into 2020?

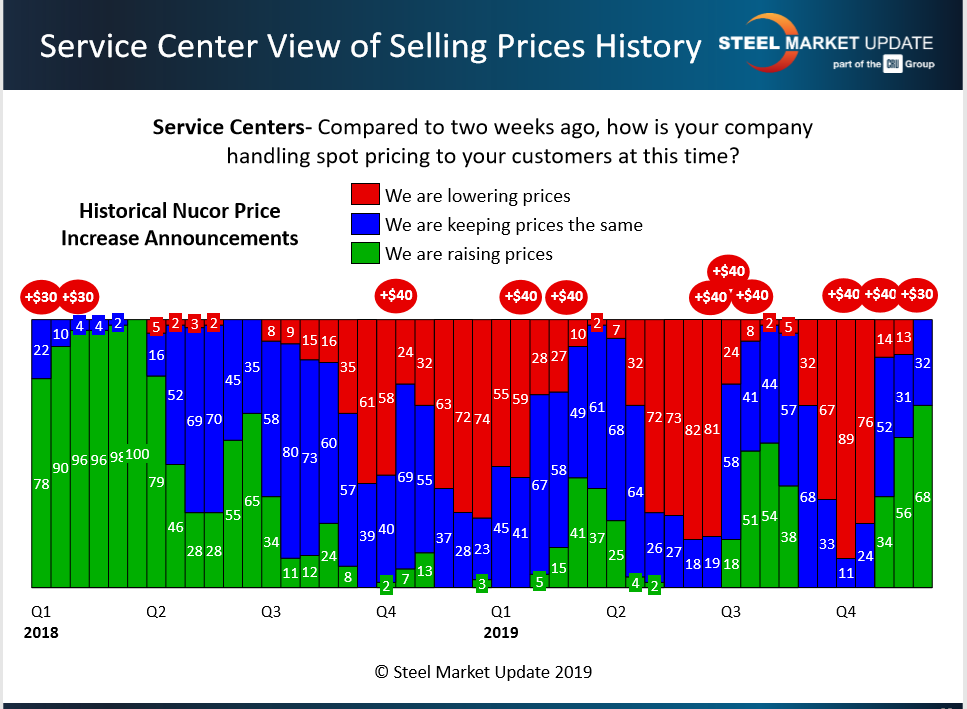

Flat rolled steel producers raised prices three times during October and November for a total of $110 per ton. (Editor’s note: ArcelorMittal USA announced an additional $40 flat rolled increase on Friday. Other mills are likely to follow, making for the fourth round of increases this year.) Likewise, plate producers also announced three increases, raising prices by a total of $130 per ton. Just because they announce higher prices does not mean the mills will be able to collect them. That depends on what the market will bear and how much support they get from distributors (see chart below). But without doubt, the increases have moved the market.

Steel prices increased by approximately 20 percent from late October to mid-December. Steel Market Update survey data as of Dec. 10 showed that the benchmark price for hot rolled steel rose by nearly $100 to an average of $570 per ton ($28.50/cwt) FOB mill, east of the Rockies. Cold rolled and galvanized steels averaged $760 per ton ($38.00/cwt), with Galvalume at $770 ($38.50/cwt). The price of steel plate was up to an average of $690 per ton ($34.50/cwt), from $640 per ton at the beginning of November.

Steel buyers surveyed by Steel Market Update in early December were almost evenly split on the staying power of the recent price hikes. A slight majority (52 percent) said they expected to see prices stall and begin to move lower in the coming six to 10 weeks.

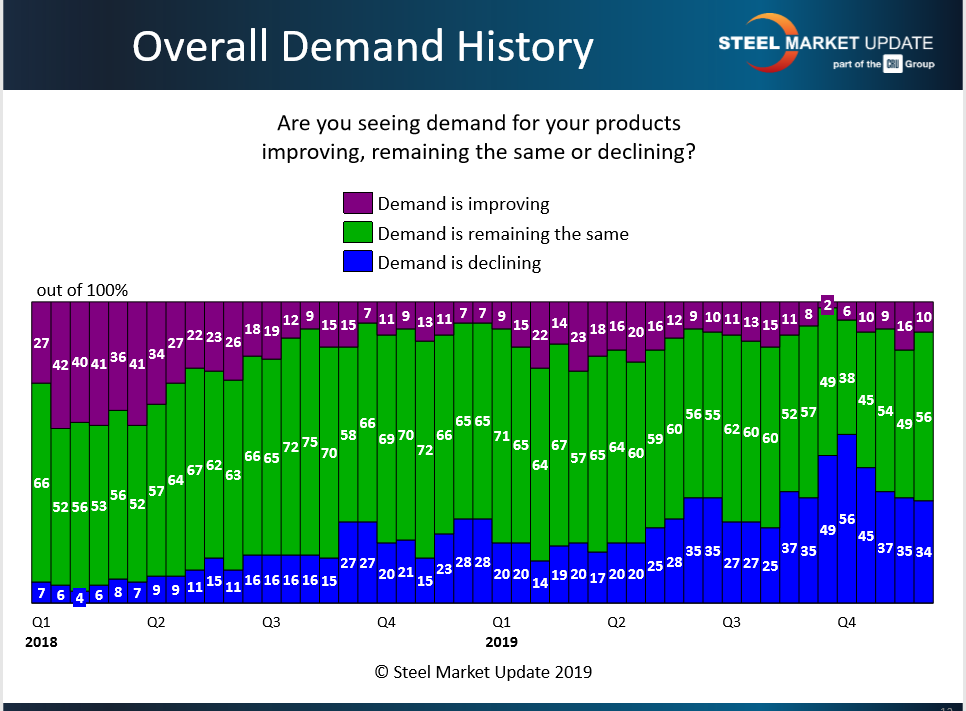

Ultimately, mills can only collect higher prices over the long term if there is sufficient demand. Most buyers (56 percent) were reporting flat or stable demand last month. Another 34 percent saw demand declining. Only 10 percent said demand from their customers was improving, which may not bode well for higher steel prices in the first quarter.

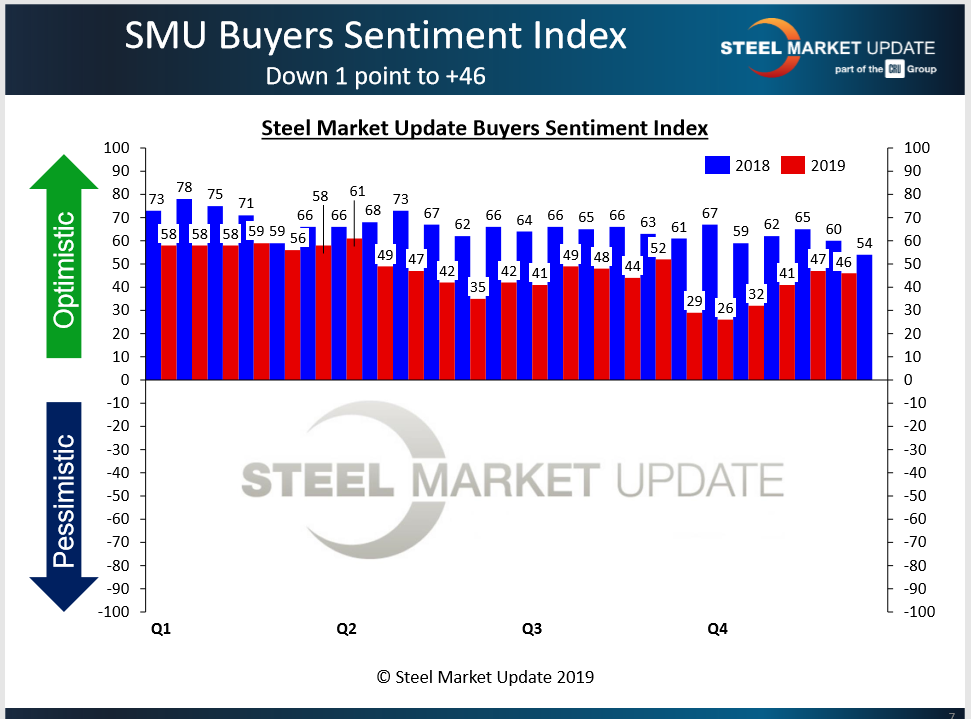

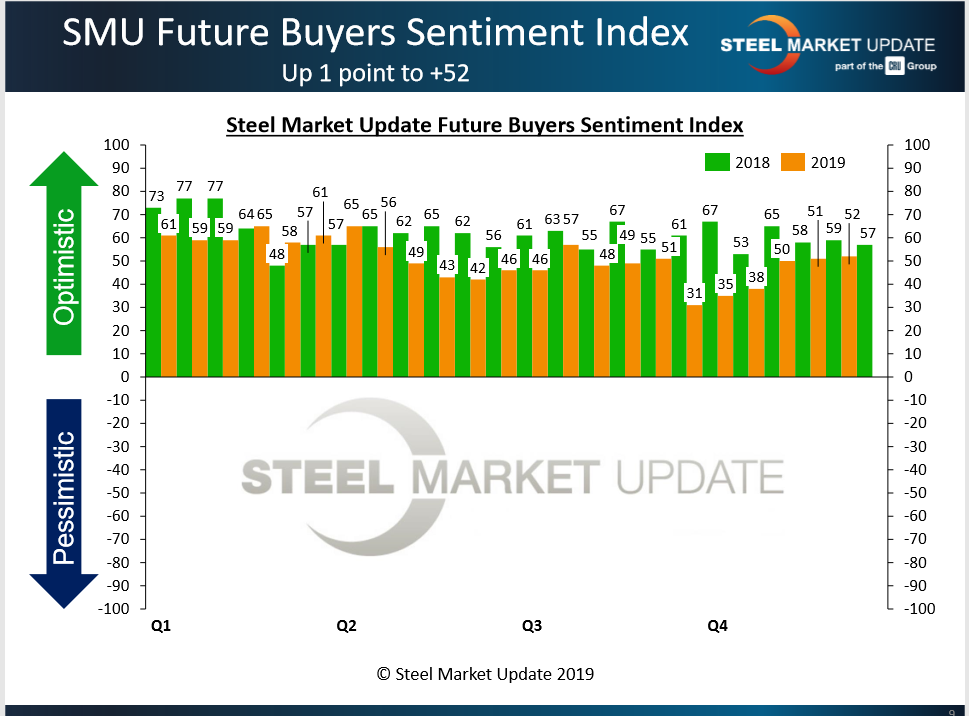

Steel buyers, including service centers and manufacturers, remain relatively upbeat, however, as the year comes to a close. Steel Market Update’s Steel Buyers Sentiment Index has trended up right along with steel prices in the last two months of the year. The goal of the index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today and three to six months into the future. The Current Sentiment reading of +46 in early December was a 20-point improvement from early October. The Future Sentiment reading showed buyers even a bit more optimistic about the next few months with a reading of +52. Although improved, these sentiment readings are still well below levels at this time last year.

Other Events Making News

- Scrap Prices: Ferrous scrap prices increased by $45-60 per ton in November/December, for a few reasons. Demand remained solid as the mills continued to crank out steel at around 80 percent of capacity. Scrap supplies tightened as winter weather began to impede scrap flows into dealers’ yards. And a pickup in foreign demand for U.S. scrap boosted exports to countries such as Turkey, further tightening supplies here at home. Higher costs for scrap and other raw materials help the mills justify higher finished steel prices. Experts anticipate even higher scrap prices in the first quarter. “There is little doubt the U.S. scrap markets will rise again in January,” one executive told Steel Market Update. “January has nowhere to go but up, whether it’s from demand/supply, bad weather or an export-driven scenario. It’s gonna go up!”

- Cleveland-Cliffs/AK Steel Merger: Steel industry consolidation saw a new twist last month when iron ore producer Cleveland-Cliffs acquired integrated steel producer AK Steel. In the past, steel mills have purchased mining operations to guarantee themselves captive supplies of raw materials. In this case, the roles are reversed, with the raw material supplier acquiring a captive customer for its products. Early reviews of the transaction were mixed. “The Cliffs deal to merge with AK Steel was one of the best kept secrets ever in our industry,” observed one SMU source. “From the standpoint of vertical integration, sometimes it works in your favor and sometimes it doesn’t.”

- Tariffs on Brazil: President Trump stunned the market on Dec. 2 when he tweeted his intent to place a 25 percent tariff on steel and a 10 percent tariff on aluminum from Brazil and Argentina, accusing them of currency manipulation. Both nations had negotiated quotas as an alternative to tariffs. Argentina is a relatively small exporter to the U.S., but Brazil is a major supplier of steel slabs. Without access to affordable Brazilian slabs, several mills in the U.S. are in jeopardy and steel supplies could shorten. As of this writing, President Trump had not followed through on his threat with a proclamation that would make the tariffs official, nor had he clarified what would happen to the quotas, leaving trade between the U.S. and Brazil in a sort of limbo.

What Steel Buyers are Saying

“Costs for steel and aluminum are being artificially raised by trade tariffs applied at the whim of a tweet, creating non-uniform costs for some producers like slab converters and their customers. The environment is very challenging.” Trading Company

“Demand has been lackluster this fall compared to normal years. Customers continue to scale back inventory and run much leaner.” Manufacturer/OEM

“There’s too much uncertainty driven by the current U.S. government trade action—or lack of action in the case of U.S.-China.” Trading Company

“I would not be surprised to see a fourth price increase announcement, but I expect pricing will begin to soften at some point in Q1.” Service Center

“We like the business we have booked and the quotes in our system. Barring any weather issues, we should expect to see a strong Q1.” Service Center

“I expect at least $100 of the $120 announced to stick. We expect strong stable business conditions in 2020, in line with 2019 plus a little.” Service Center

“With scrap moving higher and HR lead times moving out, we expect pricing to go up. We are expecting just a small increase in business for Q1. We will enter the year very cautiously. Living in a steel world where a tweet changes the market day to day has forced our company to run lean and put off expansion.” Manufacturer/OEM

“We expect pricing to hit a ceiling in 1Q 2020 and top-out in maybe February or early-March. We think 2020 will look like 2019, in terms of demand. Pretty flat expectations.” Service Center

“We are not expecting prices to move higher through the first quarter. We just don’t see the demand out there to warrant price escalation. With heavy truck and agriculture down, we are expecting a just-so market for our products. Decent, but not strong.” Service Center

“Seasonal factors and inventory levels should give this upturn some staying power.” Service Center/Wholesaler

“Now with AK sold to Cleveland-Cliffs, blast furnaces out at USS, the effect of the Brazil tariffs on NLMK and AM Calvert, it will be Chicken Little the sky is falling. Mills will scare everyone into buying steel. They will raise prices and watch it all disappear before their eyes in February. There is no true demand.” Manufacturer/OEM

“With imports continuing to decline and domestic production beginning to slip, we think pricing will remain stable well into Q1, depending on demand.” Service Center/Wholesaler

“Margins and net profits, or lack thereof, in the mill and service center sectors should support some sustained level of price increase. If the mills get too aggressive with significant and continual price increases, end-users will view it as a ‘will they never learn’ event and wait it out. Frankly, I agree with the end-users. This binge and purge pricing approach hasn’t worked in the past and won’t work in the future.” Service Center/Wholesaler

“The mills are greedy and poor judges of the market.” Service Center/Wholesaler

“I’m not convinced the economy is that strong. Inflation is too low, real wages aren’t going up, low interest rates are not stimulating the economy as much as they should, and manufacturing is slowing. Demand and supply will take over; prices will go down.” Manufacturer/OEM

“Who the heck knows? Nothing makes sense anymore. We can only control what we can control.” Manufacturer/OEM