Overseas

December 19, 2019

CRU: Will Sheet Price Rises Now Pause for Breath?

Written by Tim Triplett

By CRU Prices Analyst George Pearson, from the CRU Steel Sheet Products Monitor

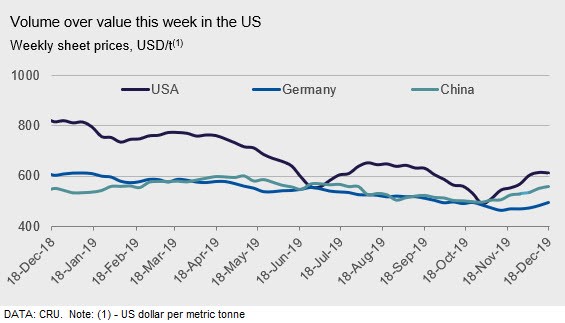

Sheet prices in the U.S. were mixed this week. HR coil at $555 was steady w/w, falling by $2 /s.ton, while CR and HDG coil products gained $26-30 /s.ton w/w after steadying last week. For HR coil, overall volume has picked back up towards the annual weekly average with the vast majority of transactions coming in between $540 and $565 /s.ton. At the very end of last week and early this week, a new $40 /s.ton price increase was announced by multiple mills. Some market participants have noted that current market prices are now in a range where mills can go after market share, though others still see further room for prices to rise, so long as mills are disciplined in holding out for higher prices.

The U.S. West Coast sheet mills answered the Midwest’s latest round of price increases with their own. California Steel Industries opened its February order book up $70 /s.ton, and USS-POSCO Industries, which is booking for March, announced an $80 /s.ton price increase. Buy-side sources said the latest FOB offer prices are around $670 /s.ton for HR coil and $790-800 /s.ton for CR coil and HDG coil base. There were no spot transactions reported, and buyers were skeptical about how high prices would increase.

Europe

Most European sheet prices increased again this week, except for German HDG, which was flat. HR coil prices rose by €8 /t in Germany and by €4 /t in Italy, now up €24 /t and €28 /t off the bottom, respectively. HR coil lead times for EU mills are now March. We have heard of slightly lower demand for HDG, where lead times are February-March. HR coil import offers from Turkey and India are currently uncompetitive. Turkish mill offers are at €465-490 CFR Italy. The majority of the European market will take holidays from Dec. 20-Jan. 7. We expect the market to be slower over this period and potentially up until the Chinese New Year, which lands on Jan. 25, 2020. Contract negotiations for automotive OEMs are expected to enter into January. Buyers are looking at €60-70 /t reductions for the larger part of their contract volumes, with higher reductions in some cases.

China

The Chinese sheet market remained on an upward trend with prices higher w/w. Compared with bearish sentiment weeks ago, participants have regained confidence from a short-term underlying demand recovery because of encouraging end-use sector statistics, including auto and appliances. Tightening supply also helped to sustain prices this week, partly because higher profit previously seen in long products has attracted a sudden production shift from HR coil to rebar at some integrated mills, contributing to a 3 percent w/w fall in sheet inventories. However, we do not expect sheet prices to stay elevated. The shift to rebar production is limited because HR coil prices are higher than rebar, which should see sheet supply outweigh demand towards the end of the year. Due to these factors we expect sheet prices to face downward pressure in the coming weeks.

Asia

Prices of imported sheet products in Asia continued to rise with higher offers and bids.

For HR coil SAE1006, Chinese material was offered at $480-485/t CFR Vietnam with the highest bid at $467/t CFR Vietnam. Offers for Indian material were scarce in the market. Indian mills have sold out their export allocation for February, according to a trader, but the allocation itself might be held by trading houses.

For HR coil/sheet SS400, Chinese material was offered at $490/t CFR Vietnam; several deals of small volume were heard to be concluded at $481-485/t. This grade is currently at a $10/t premium to SAE1006 HR coil.

Formosa Ha Tinh announced their December price for February shipment at $475-480/t for SAE1006 and $470-475/t for SS400. This was $15/t up from their November price.

CRU assessed HR coil at $475/t, CFR Far East Asia, a $7/t increase w/w. CR coil was assessed at $550/t CFR Far East Asia, an increase of $10/t w/w, while HDG was $570/t CFR Far East Asia, flat w/w.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com