Prices

January 14, 2020

Slight Slip in November U.S. Raw Steel Production

Written by Brett Linton

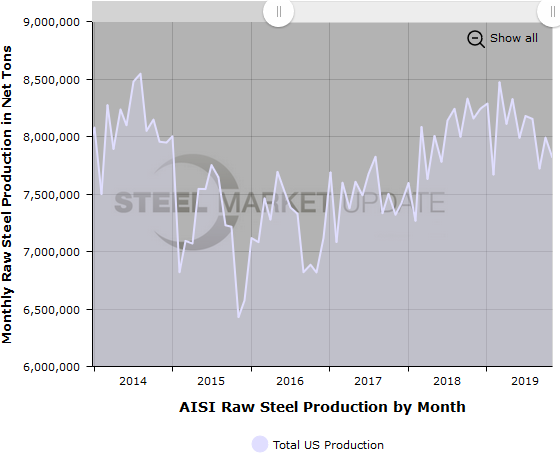

U.S. raw steel production in November fell 2.2 percent to 7,812,925 net tons, reported the American Iron and Steel Institute in Washington. November production is below the 2019 average of 8,063,863 tons and down 4.2 percent compared to the same month last year.

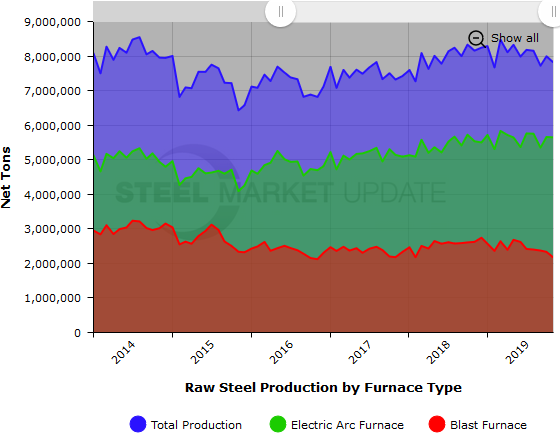

Broken down by production method, 5,646,674 tons (72.3 percent) were produced by electric arc furnaces (EAFs) and 2,166,251 tons (27.7 percent) were produced by blast furnaces. While the November EAF production level is not record breaking, the percentage of steel produced by EAFs in relation to total monthly production is at the highest level seen in our ~10-year limited history, surpassing the previous months’ high of 70.8 percent and the prior high in November 2017 of 70.7 percent.

November production was 178,468 tons lower than October, and 343,152 tons lower than the same month last year. AISI’s monthly estimates are different than the weekly estimates SMU reports each Tuesday; the monthly estimates are based on over 75 percent of the domestic mills reporting versus only 50 percent reporting for the weekly estimates.

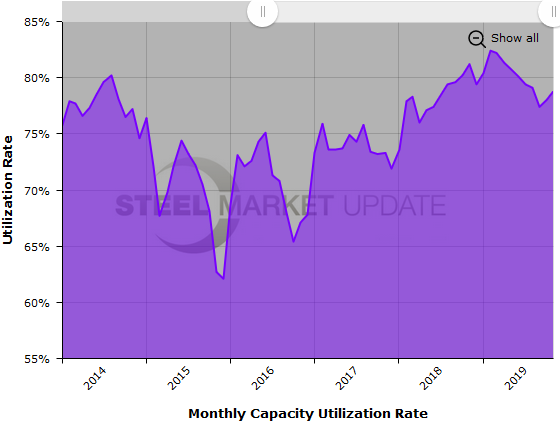

The mill capacity utilization rate for November averaged 78.8 percent, up from 78.0 percent in October, but down from 81.2 percent one year ago. The yearly capacity utilization rate has been adjusted down to 80.0 percent, still up from 78.1 percent compared to the same period last year.

The chart below shows total monthly steel production (blue) broken down by electric arc furnace production (green) and blast furnace production (red).

SMU Note: Interactive versions of the raw steel production graphics above can be seen in the Analysis section of our website here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.