Market Data

January 17, 2020

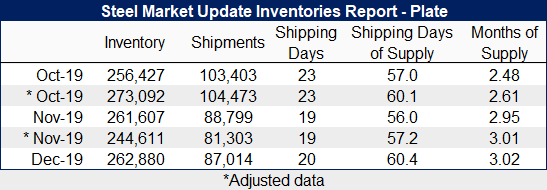

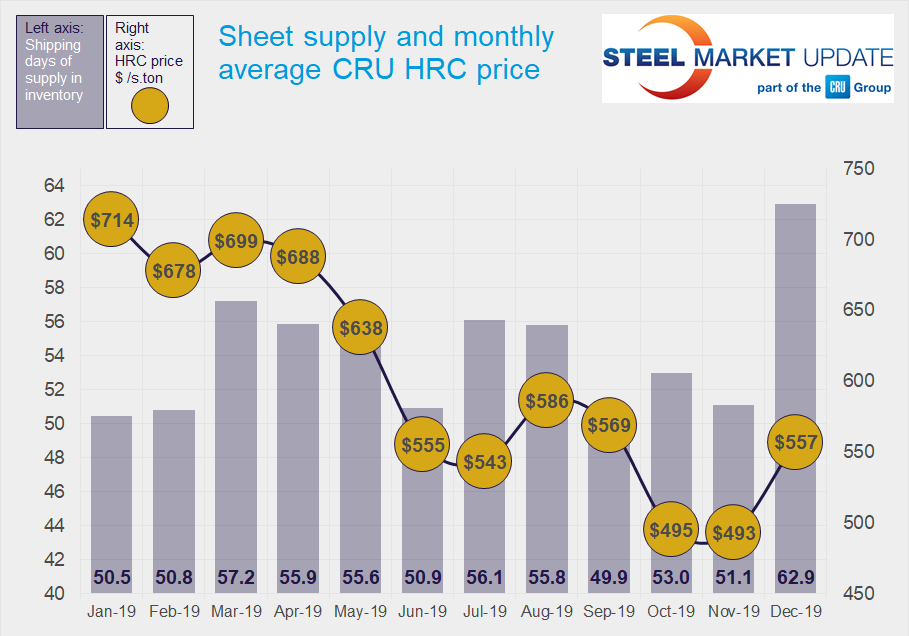

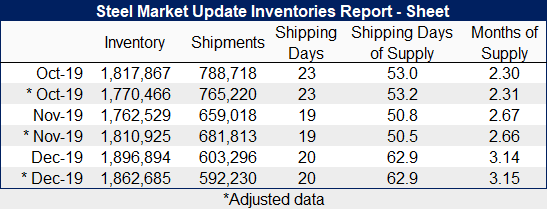

Service Center Inventories and Shipments Report for December

Written by Estelle Tran

Steel Market Update’s analysis of flat rolled and plate inventories and shipments for the month of December:

Flat Rolled = 62.9 Shipping Days of Supply

Plate Steels = 60.4 Shipping Days of Supply

Flat Rolled

Service center flat rolled steel inventories increased 5.7 percent month on month while shipments fell 10.1 percent, according to adjusted December data compared to final November figures. The result was a spike in shipping days of supply. We used 20 shipping days for our calculations, which showed 62.9 shipping days of supply. If you calculate 19 shipping days, the shipping days of supply in December falls to 59.7, which is still a significant increase from 50.8 in November.

In terms of months of supply, service centers carried 3.15 months of sheet inventory at the end of December, up from 2.67.

On-order volumes remained elevated, with about a 1 percent month-on-month decrease in on-order volumes.

The percentage of inventory committed to contracts was 50.7 percent in December, flat compared to 50.8 in November.

Going forward, we expect shipments to pick up in January and service centers to work through some of their heightened inventories. January inventories may remain elevated, though, as we continue to see cautious optimism regarding sheet pricing and steady buying on mill contracts priced below spot levels.

Plate

Plate volumes remained flat month over month, though shipments declined 2 percent. As a result, service center plate inventories increased to 60.4 shipping days of supply, up from 56 in November. This represented 3.02 months of supply, up from 2.95 in November.

On-order volumes rose in December, as service centers saw the bottom for pricing and placed substantial orders in late November and early December.

We expect restocking to remain steady as mill lead times have extended for certain products. While we see a seasonal pickup in the near term, there are few demand drivers for plate aside from pipeline projects. Plate prices do not have as much support as sheet; so, while we see steady orders for now, service centers may soon switch back to booking as needed.