Canada

February 20, 2020

Stelco Posts Q4 Loss Due to Steel Prices

Written by Sandy Williams

Canadian steel producer Stelco Holdings cited challenging market conditions and an “unprecedented” drop in steel prices for its fourth-quarter loss.

Stelco reported a net loss of $27 million for the quarter on sales of $435 million, down from $648 millon in the prior-year quarter, due to lower steel prices and shipping volumes. Full year net income totaled just $20 million on revenues of $1.8 billion, down from $2.5 billion in 2018 (all figures Canadian).

Average selling prices fell 28 percent to $659 per net ton due to lower market prices for flat steel products.

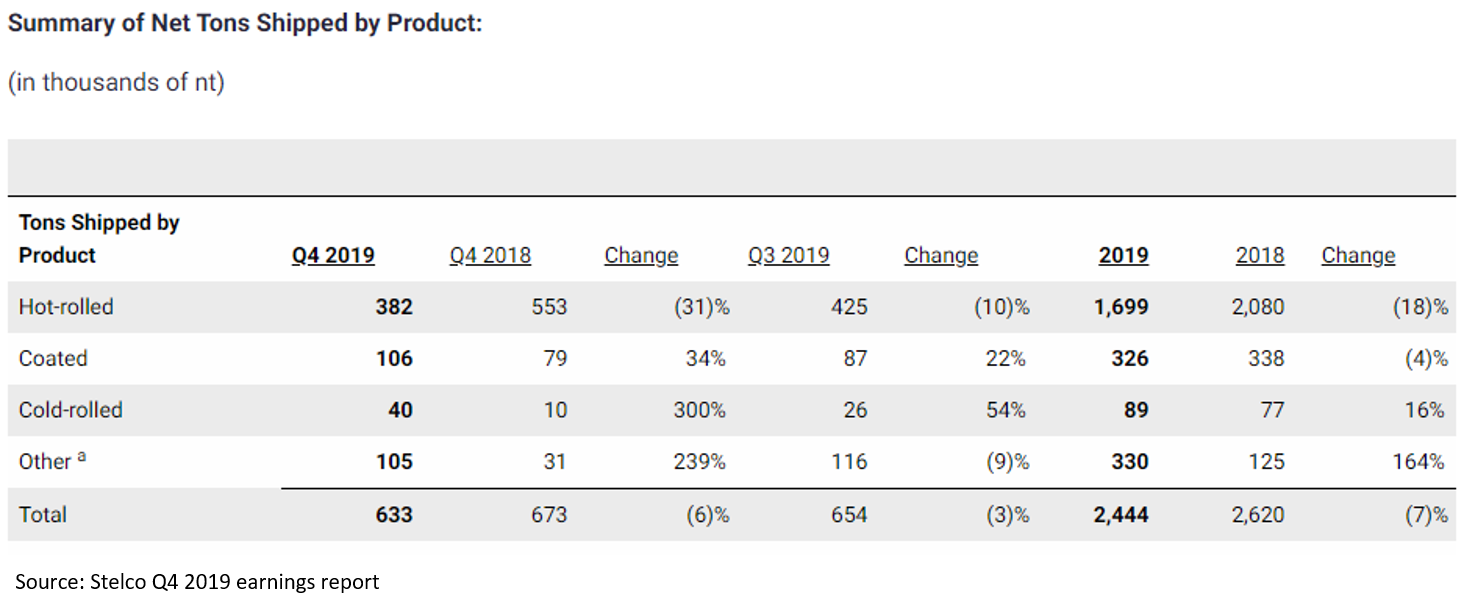

Shipments of 633,000 net tons in Q4 allowed Stelco to meet volume expectations for the second half of 2019. In total, the company shipped 1.29 million net tons in the second half and 2.4 million tons for the year. Lead times are at eight weeks.

CEO David Cheney is optimistic about the future due to value achieved by a successful rollout of Stelco’s new batch anneal and temper facility. “These investments allowed us to diversify our product offerings and increased shipments of cold-rolled and coated steel products by 66 percent in the second half of 2019 over the first half of the year,” said Cheney. “We achieved annual run rate sales of approximately 600,000 tons per year for these products during the quarter, which is an increase of 50 percent of the shipments of cold-rolled and coated products in both 2017 and 2018.”

Regarding the market, Cheney said there has been a “nice uptick” in Stelco’s direct contract auto business as well as an increase in auto shipments through service centers. Shipments of coated and fully processed products have increased to the construction industry.

The company expects to meet or exceed its $50 million run rate cost savings target by the end of the second quarter.

Said Cheney, “It’s an effort of the entire organization on many initiatives, whether it’s around yield, whether it’s around efficiency, material handling on the procurement side, on the contractor side, it’s across the board. So, it’s an all-out effort from the organization. And people are outperforming across virtually every initiative.”

Stelco says it will delay a reline of its Lake Erie blast furnace to the second half of the year, citing strong market demand and improved pricing. “We were ready to have this reline begin on April 1. We had the contractors, materials. We were ready to go,” said Cheney. “But the simple fact is, in this industry, you need to make good when the conditions are strong.”

The reline of the furnace, which includes a new pig caster, is expected to take 60-75 days and will increase the production of hot metal by an estimated 300,000 net tons. Pig iron shipments are expected to commence in the fourth quarter. Likely customers are ArcelorMittal Dofasco, North Star BlueScope and Steel Dynamics Butler

(One Canadian dollar = 0.76 U.S. dollar)