Analysis

March 31, 2020

Architects and Construction Firms Report Declining Business

Written by Sandy Williams

Architecture firms reported fewer new design projects in March as uncertainty grows regarding the length and impact of the coronavirus crisis.

A special mid-month survey by the American Institute of Architects found that 28 percent of respondents reported directed delays in current projects or those slated to start in 30 days. An additional 11 percent reported delays for projects that were to begin more than 30 days out. Delays were driven by supply chain disruption, shortage of construction workers and delays in obtaining permits, inspections or other approvals.

The March 17-19 survey by AIA found that 50 percent of firms expect a decline in design contracts in March and 59 percent expect inquiries to drop off. The trend was strongest in the Northeast and for firms that specialize in residential projects.

Two-thirds of firms reported slowing or halting of projects due to the COVID-19 outbreak and three-quarters of firms report related problems with current projects.

Architectural firms are working remotely when possible, limiting in-person client meetings and restricting work-related travel.

The value of nonresidential projects is also declining. Dodge Data and Analytics reported that commercial project values were lower in the third week of March compared to the second week. Institutional project value declined in the second week of March and dipped even further in the third week.

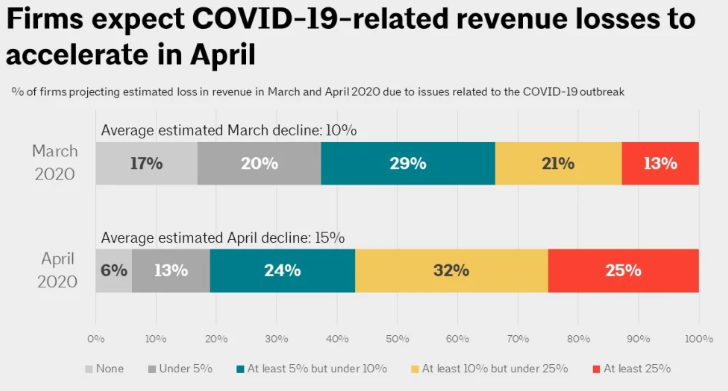

When asked how the COVID-19 outbreak is expected to impact revenue, architecture firms on average estimated a 10 percent revenue loss in March, jumping to 15 percent in April.

The Associated General Contractors of America, in a survey conducted March 23-26, found that 39 percent of 1,640 respondents said an owner had directed a halt or cancellation of construction on their current or near-term project. Eighteen percent said state and local officials or agencies had stopped projects, while 28 percent cited a combination of owners and public officials for project delays.

Forty-five percent of firms surveyed reported various causes for project delays or disruptions:

- 23 percent reported shortage of materials, equipment (including personal protective equipment for their workers) or parts;

- 18 percent reported shortage of essential craftworkers (including subcontractors’ workers);

- 16 percent reported shortage of government workers to issue necessary permits, etc.; and

- 13 percent reported an infected person had visited a job site.

About 35 percent of respondents said they were notified that deliveries would be late or canceled, up from 22 percent the previous week. About 8 percent said they had contracted to do additional work on medical or other facilities.

“The steps firms are taking to protect workers from the coronavirus unfortunately won’t be enough to save many of them from the economic damage the pandemic is creating,” said AGC CEO Stephen Sandherr. “Construction workers and employers need more than a lifeline; they need a recovery plan.”