Prices

April 8, 2020

U.S. Steel Exports Steady in February

Written by Brett Linton

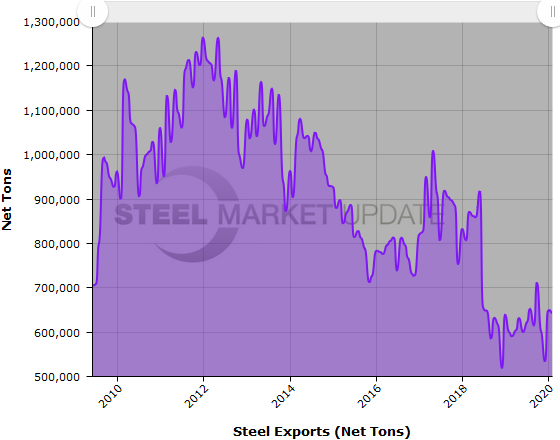

New Commerce Department data shows the United States exported 641,214 tons of steel in February, down 1 percent from January but up 7 percent from the same month one year prior. While steady compared to the previous month, recall that December 2019 was the second lowest export level in the past decade (just ahead of the lowest level in December 2018).

February exports were 4 percent above the 2019 average of 615,698 tons, but remain significantly muted compared to historical levels, as shown in the purple line graph below.

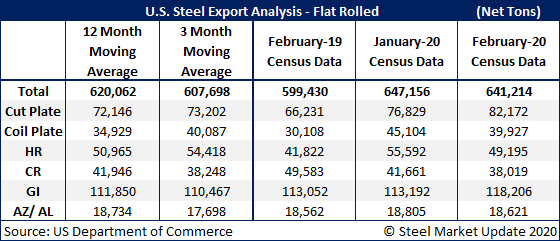

Total February exports were above the three-month moving average (average of December 2019 through February 2020), and above the 12-month moving average (average of March 2019 through February 2020). Here is a breakdown by product:

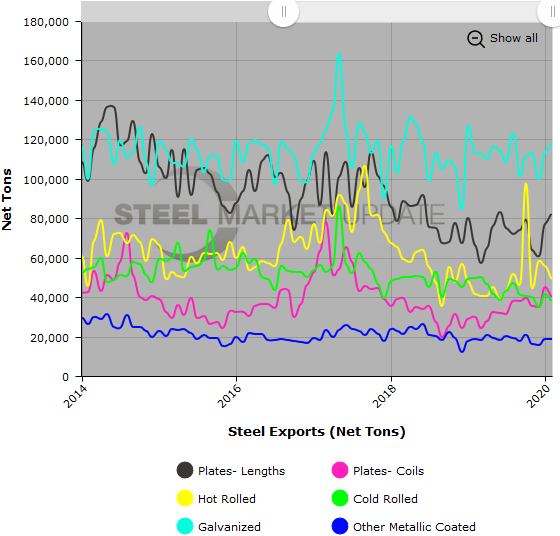

Cut plate exports increased 7 percent from January to 82,172 tons, up 24 percent compared to one year ago.

Exports of coiled plate were 39,927 tons in February, down 11 percent over last month, but up 33 percent year over year. This is the highest level seen since September 2017.

Hot rolled steel exports fell 12 percent over January to 49,195 tons, but were up 18 percent over February 2019.

Exports of cold rolled products were 38,019 tons in February, down 9 percent from January and down 23 percent over the same month last year.

Galvanized exports increased 4 percent month over month to 118,206 tons. Compared to one year ago, February was up 5 percent.

Exports of all other metallic coated products were 18,621 tons, down 1 percent from January and down 0.3 percent compared to one year ago.

Below are two graphs showing the history of U.S. steel exports, in total and by product. To use their interactive features, view the graphs on our website by clicking here. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.