Prices

April 28, 2020

CRU: Iron Ore Prices Declining as Seaborne Supply Improves

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

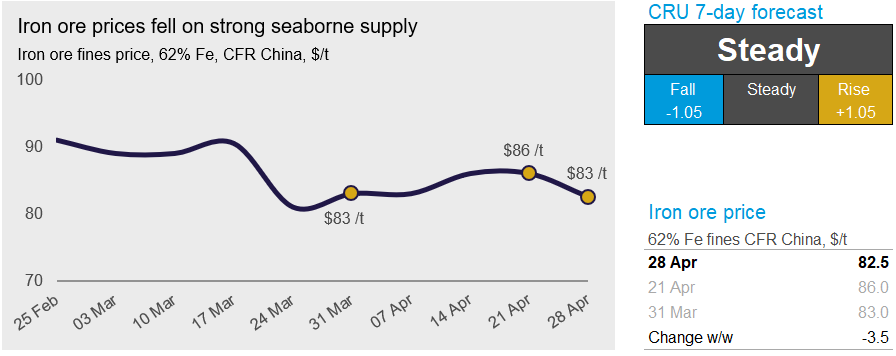

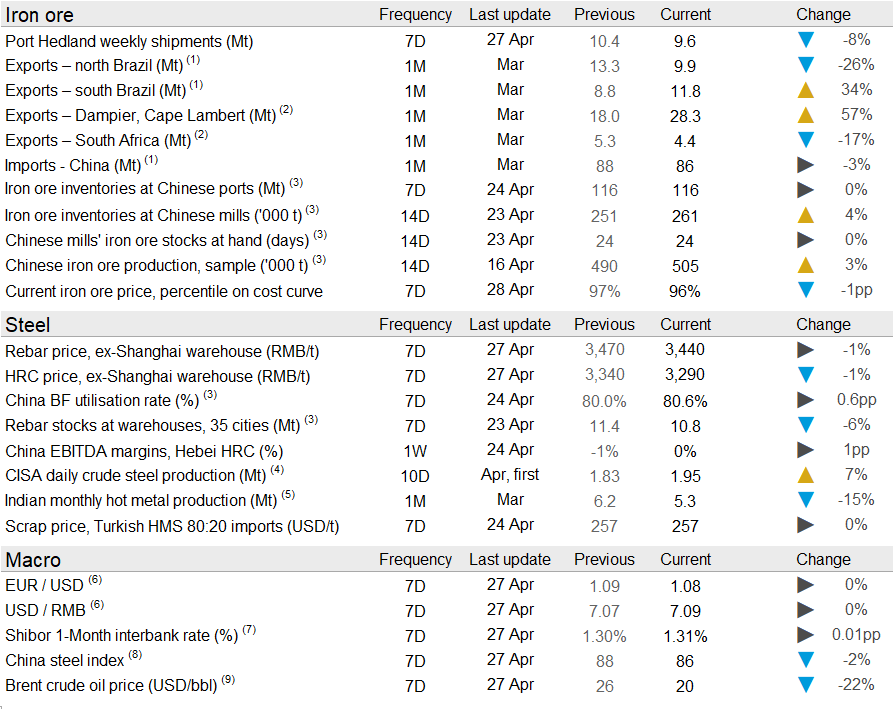

In the past week, iron ore prices have declined as we are seeing mixed sentiment in the Chinese market leading up to the country’s Labor Day holiday (May 1-5). Seaborne supply remained strong as Brazilian exports improved, particularly from the southern part of the country. On Tuesday, April 28, CRU has assessed the 62% Fe fines price at $82.5 /t, down $3.5 /t w/w.

In China, blast furnaces continue to increase production and they are doing so with limited iron ore availability at both mills and ports. Margins are still weak as steel prices have continued to decline on strong supply from mills and destocking of elevated steel inventories. Iron ore demand in other markets remains weak and volumes continue to shift over to the Chinese market. In addition, domestic iron ore production continues to increase with warmer weather in the north and looser transportation restrictions.

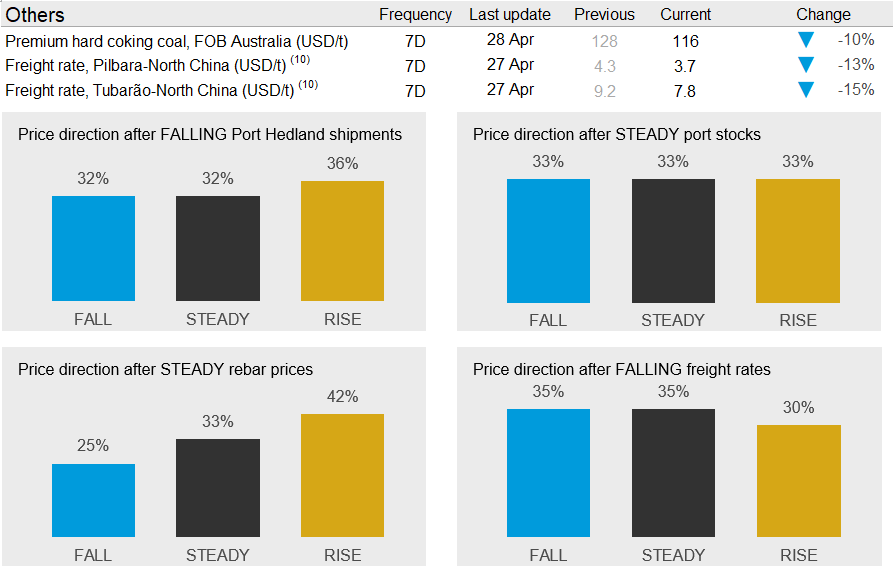

It has been another strong weak for iron ore supply. Seaborne supply from the majors registered another impressive week as Rio Tinto had its best week of the year and shipments from Minas Gerais in southern Brazil are recovering after the heavy rain period. The only weak spots in the market were Roy Hill, which has not shipped a single tonne in the past week due to its quarterly maintenance, and South Africa, which continued to ship at a lower rate due to the country’s mining restrictions.

For the next week, there are mixed signals from the market. Inventories are low, but seaborne supply continues to improve. Our indicators below do not give a strong indication for direction in the coming week and the shorter work week in China leads us to expect a flat price development.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com