Market Data

May 1, 2020

ISM Report on Business Shows Profound Impacts of Pandemic

Written by Sandy Williams

The ISM Report on Business dropped 7.6 percentage points to a PMI reading of 41.5 in April, indicating a sharp contraction of economic activity in the manufacturing sector. Additionally, the overall economy contracted for the first time in 131 consecutive months.

“Comments from the panel were strongly negative (three negative comments for every one positive comment) regarding the near-term outlook, with sentiment clearly impacted by the coronavirus (COVID-19) pandemic and continuing energy market recession,” said Timothy Fiore, chairman of the Institute for Supply Management Manufacturing Business Survey. “The PMI indicates a level of manufacturing-sector contraction not seen since April 2009, with a strongly negative trajectory.”

New orders plunged 15.1 points to 27.1 after posting 42.2 in March. The decrease was the largest one-month decline since April 1951. The production index was at its lowest level since ISM began the survey in 1948, plummeting 20.2 points to a reading of 47.7. Only two manufacturing industries reported growth in April: Food, Beverage & Tobacco Products and Paper Products. Backlogs contracted sharply despite lower production. Prices for goods also continued to decline.

A severe slowdown in global demand resulted in the new export orders index tumbling 11.3 points to a reading of 35.3. Imports rose very slightly but remained in contraction for the third consecutive month with firms citing the coronavirus impact as the primary cause.

Supplier deliveries were slower in April due to global and domestic supply chain disruptions resulting from the COVID-19 pandemic.

Input inventories contracted for an 11th month but the rate eased as production slowed due to government closures, labor shortages and delivery issues. Customer inventories grew slightly and approached levels that were considered a negative for future production.

The employment index at 27.5 plummeted to its lowest reading since June 1949. “This is the ninth month of employment contraction, and at a much faster rate compared to March. All six big industry sectors experienced employment contraction as a result of furloughs and layoffs due to a lack of new orders and/or social-distancing mandates,” said Fiore.

“The coronavirus pandemic and global energy market weakness continue to impact all manufacturing sectors for the second straight month. Among the six big industry sectors, Food, Beverage & Tobacco Products remains the strongest. Transportation Equipment and Fabricated Metal Products are the weakest of the big six sectors,” said Fiore.

Survey respondents had the following comments:

- “We supply the construction industry in various ways, where the slowdown has been a bit slower than most industries. It is, however; beginning to impact our business, and we see more challenges on the horizon.” (Fabricated Metal Products)

- “Our refinery is losing money making gasoline due to the falling demand.” (Petroleum & Coal Products)

- “COVID-19 has created a wave of activities, including vendors closing, vendors focusing only on the medical industry, employees not coming to work, delayed shipments from overseas, etc.” (Transportation Equipment)

- “COVID-19 has destroyed our market and our company. Without a full recovery very soon, and some assistance, I fear for our ability to continue operations.” (Nonmetallic Mineral Products)

- “Thirty-percent decrease for April due to COVID-19’s impact on both customers and suppliers.” (Computer & Electronic Products)

- “Production stopped, other than to make hand sanitizer for those in need.” (Chemical Products)

- “The food processing B2B space remains steady. We are weathering the storm. There is a fortunate increased need for packaged foods. Softening is showing through in some products that find their way into food service and lodging.” (Food, Beverage & Tobacco Products)

- “The company I work for manufactures personal protective equipment [PPE], specifically N95 masks, face shields, as well as selling protective clothing and hand protection. In the area of PPE, our backlog has spiked to numbers we have never seen. While no doubt some of the backorders will be canceled, many of the orders are longer term commitments from the U.S. government.” (Apparel, Leather & Allied Products)

- “Our packaging business is starting to see signs of a slowdown in May after two strong months into COVID-19.” (Paper Products)

- “Dealing with the effects of coronavirus and having 65 percent of our operations down.” (Furniture & Related Products)

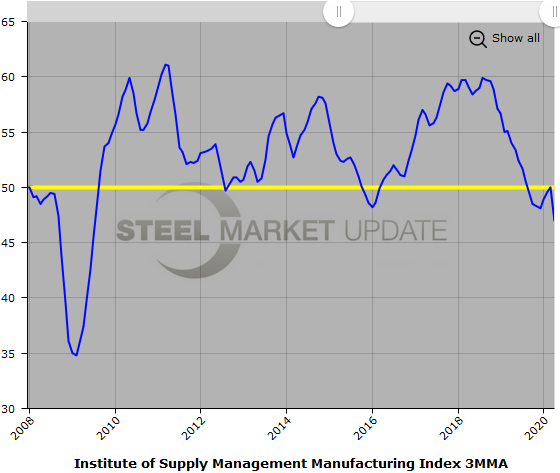

Below is a graph showing the history of the ISM Manufacturing Index as a three-month moving average. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.