Analysis

May 21, 2020

April Existing-Home Sales Lowest in 10 Years

Written by Sandy Williams

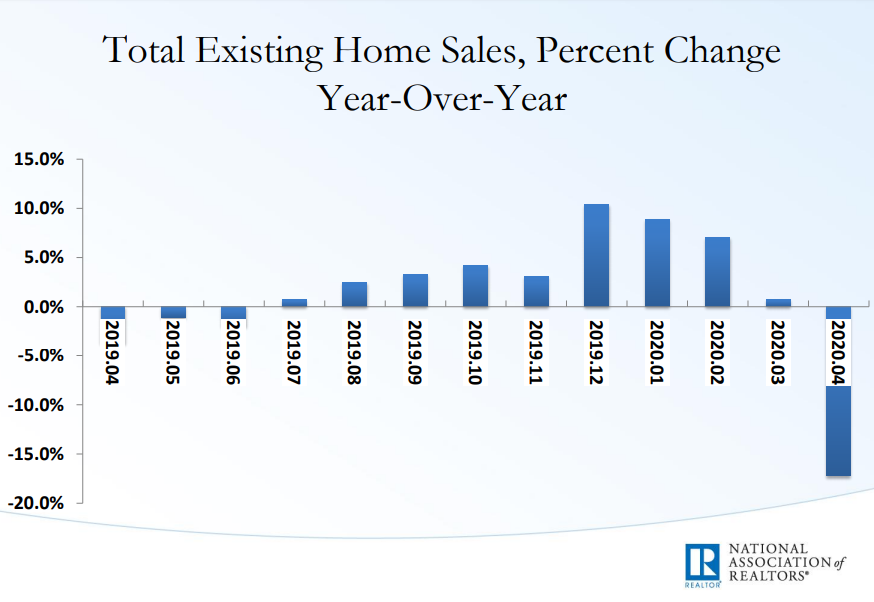

Existing-home sales slid almost 18 percent in April, according to the National Association of Realtors. Sales fell 17.8 percent month-over-month and 17.2 percent from a year ago to a seasonally adjusted annual rate of 4.33 million units. Sales were at the lowest level and worst month-over-month decline since July 2010.

“The economic lockdowns – occurring from mid-March through April in most states – have temporarily disrupted home sales,” said NAR Chief Economist Lawrence Yun. “But the listings that are on the market are still attracting buyers and boosting home prices.”

Inventory at the end of April was 1.47 million units, down 1.3 percent from March and 19.7 percent from a year ago, and a 4.1-month supply at the current sales pace.

Sales of single-family homes slipped 16.9 percent from March. The median price rose 7.3 percent year-over-year to $288,700.

Sales of condominiums and co-ops were down 26.4 percent from March and the median existing price rose 7.1 percent to $267,200 from a year ago.

Home prices increased in all regions to a median of $286,800, an increase of 7.4 percent from April 2019.

Regionally, sales from the previous month fell 16.9 percent in the Northeast, 12 percent in the Midwest, 17.9 percent in the South, and 25 percent in the West.

“There appears to be a shift in preference for single-family homes over condominium dwellings,” Yun said. “This trend could be long-lasting as remote work and larger housing needs will become widely prevalent even after we emerge from this pandemic.”

Danielle Hale, chief economist at realtor.com, says sellers are showing some reluctance to put their homes on the market.

“Fewer sellers are putting homes up for sale than compared to this time last year, which is unsurprising given shelter-in-place orders and record high unemployment,” said Hale. “In the most recent three weeks ending May 2, May 9 and May 16, the volume of newly listed properties decreased by 39 percent, 29 percent and 28 percent year-over-year, respectively, compared to the 5 percent increase we saw the first two weeks of March.

“While new listings supply has yet to return to last year’s levels, the gap is getting smaller. Locally, we are also seeing signs of improvement on the horizon with nearly half (44 of 98) of large metros seeing smaller declines in new listings, including markets that took big initial supply hits such as New York, Miami and Washington, D.C.”

Hale noted, “If the flow of new listings into the market remains minimal, we could see larger declines in total inventory for the weeks to come, especially as buyers come back into the market.”