Prices

May 26, 2020

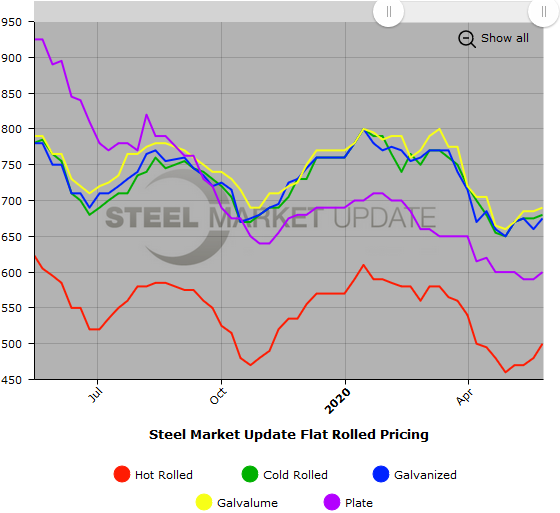

SMU Price Ranges & Indices: Hot Roll Hits $500

Written by Brett Linton

Steel prices gained some strength across the board following the mills’ price increase announcements on flat rolled and plate products last week. The benchmark price for hot rolled has managed to get back to the $500 per ton mark, even as the market continues to struggle with shaky demand due to the coronavirus. The increases, ranging from $5 to $20 per ton, leave prices well short of the minimums of $540 for hot rolled and $740 for cold rolled and coated being sought by the mills. Whether the uptick in pricing has legs remains to be seen. In the meantime, Steel Market Update will keep its Price Momentum Indicator set at Neutral until the market establishes a clearer direction.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $480-$520 per ton ($24.00-$26.00/cwt) with an average of $500 per ton ($25.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 per ton over last week. Our price momentum on hot rolled steel is Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 3-4 weeks

Cold Rolled Coil: SMU price range is $660-$700 per ton ($33.00-$35.00/cwt) with an average of $680 per ton ($34.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $10 per ton compared to last week, while the upper end remained the same. Our overall average is up $5 compared to one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $650-$700 per ton ($32.50-$35.00/cwt) with an average of $675 per ton ($33.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $30 per ton compared to one week ago, while the upper end remained the same. Our overall average is up $15 per ton over last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $719-$769 per net ton with an average of $744 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 3-6 weeks

Galvalume Coil: SMU price range is $680-$700 per ton ($34.00-$35.00/cwt) with an average of $690 per ton ($34.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end fell $10 per ton. Our overall average is up $5 compared to one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $971-$991 per net ton with an average of $981 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-8 weeks

Plate: SMU price range is $580-$620 per ton ($29.00-$31.00/cwt) with an average of $600 per ton ($30.00/cwt) FOB delivered to the customer’s facility. Both the lower and upper ends of our range increased $10 per ton compared to one week ago. Our overall average is up $10 per ton over last week. Our price momentum on plate steel is at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.