Market Data

June 16, 2020

Service Center Shipments and Inventories Report for May

Written by Estelle Tran

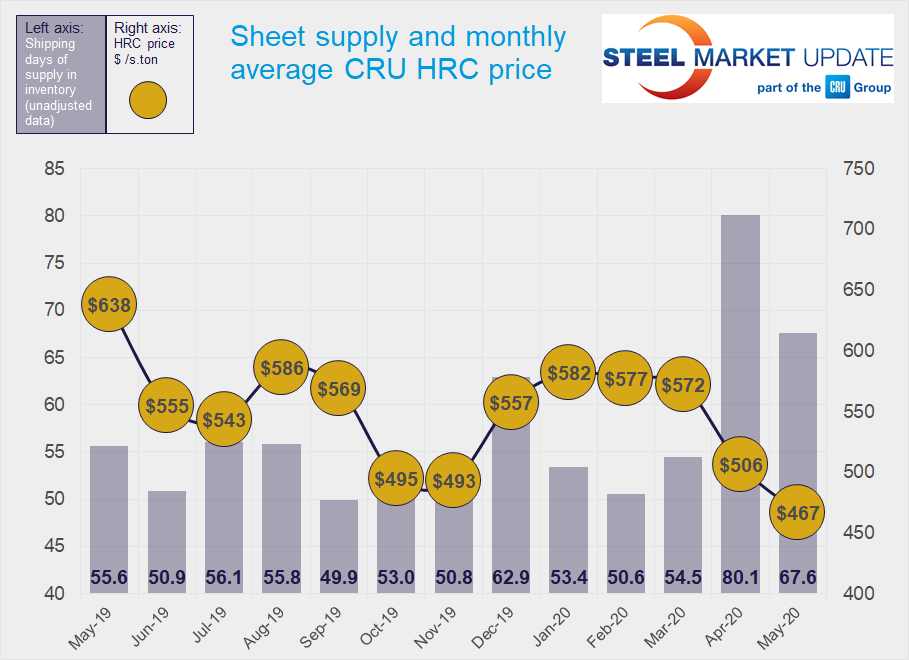

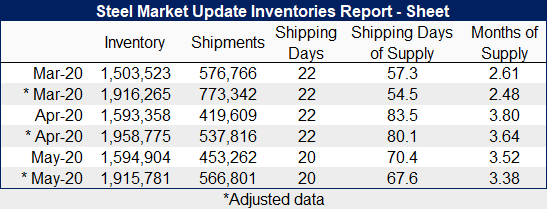

Flat Rolled = 67.6 Shipping Days of Supply

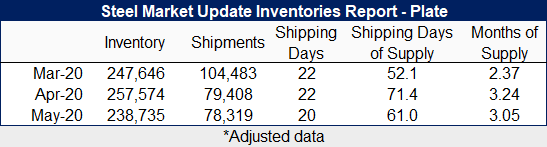

Plate = 61.0 Shipping Days of Supply

Flat Rolled

Service center flat roll inventories edged down in May, which was consistent with lower on-order volumes seen in April as well as higher shipments in May. Service centers carried 67.6 shipping days of supply at the end of May, on an adjusted basis, down from 80.1 shipping days in April. In terms of months of supply, this indicated that service centers stocked 3.38 months of supply in May, down from 3.52 months in April.

Shipments picked up 5.4 percent in May from April’s low, even with two fewer shipping days; May had 20 shipping days, while April had 22.

With attractive contract pricing and automakers restarting in May, some service centers bought heavily, while others remained reluctant to place orders for inventory without a clearer view of a steel demand recovery. On-order sheet volumes increased month on month.

Despite the stronger orders, we are seeing some softness. Prices for HRC have eased back slightly, and HRC lead times have moved in to 3.73 weeks in the June 11th SMU survey, from 3.91 weeks in the May 28th survey. Lead times for CRC and HDG have extended though. The market will be watching the blast furnace restarts and whether new orders will pick up. Since the initial burst of pent-up demand as businesses reopened after Covid-19-related shutdowns, there has been some pessimism about steel demand heading into July.

The percentage of flat roll inventory dedicated to contracts edged down to 52 percent in May, from 54.5 percent in April.

Plate

Plate service centers worked down inventory in May, bringing the number of shipping days of supply down to 61.0 from 71.4. Plate inventories represented 3.05 months of supply in May, down from 3.24 months in April.

Shipments edged down 1.4 percent month on month. However, so far in June, we’re hearing that plate demand has been increasing slowly, particularly in the construction sector. Plate on order increased month on month in May.

ArcelorMittal and Nucor just announced $40/st price increases for plate products late last week. SMU reported in its latest survey that plate lead times remain at four weeks. There are no major supply factors driving the plate markets, and coincidingly, demand is expected to remain consistent around current levels.

The percentage of plate inventory tied to contracts fell to 29.5 percent in May, from 35.8 percent in April.