Prices

June 23, 2020

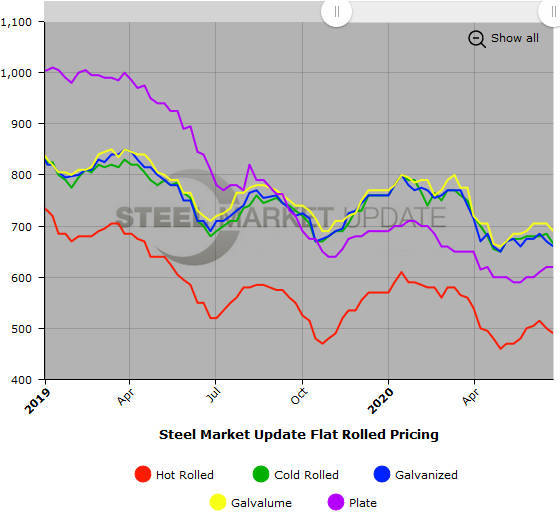

SMU Price Ranges & Indices: Flat Rolled Slips Back Under $500

Written by Brett Linton

Flat rolled steel prices receded by $10-20 per ton in the past week as supplies continue to exceed orders even though demand is improving. The benchmark price for hot rolled dipped below the $500 per ton mark for the first time since the third week in May. Rumblings of furnace restarts could add to supplies in the coming weeks and further frustrate the mills in their efforts to collect their recent price hikes. Steel Market Update’s Price Momentum Indicator remains at Neutral for the time being, but we will be keeping a close eye on the recent weakening to see if it turns into a clear trend.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $470-$510 per ton ($23.50-$25.50/cwt) with an average of $490 per ton ($24.50/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range declined $10 per ton compared to one week ago. Our overall average is down $10 per ton over last week. Our price momentum on hot rolled steel is Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 2-4 weeks

Cold Rolled Coil: SMU price range is $640-$690 per ton ($33.00-$34.50/cwt) with an average of $665 per ton ($33.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $30 compared to last week, while the upper end declined $10. Our overall average is down $20 per ton over one week ago. Our price momentum on cold rolled steel is at Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 4-8 weeks

Galvanized Coil: SMU price range is $640-$680 per ton ($32.00-$34.00/cwt) with an average of $660 per ton ($33.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $20. Our overall average is down $10 per ton over last week. Our price momentum on galvanized steel is at Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $709-$749 per net ton with an average of $729 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-8 weeks

Galvalume Coil: SMU price range is $670-$710 per ton ($33.50-$35.50/cwt) with an average of $690 per ton ($34.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 compared to last week, while the upper end declined $10. Our overall average is down $15 per ton over one week ago. Our price momentum on Galvalume steel is at Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $961-$1,001 per net ton with an average of $981 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 5-7 weeks

Plate: SMU price range is $600-$640 per ton ($30.00-$32.00/cwt) with an average of $620 per ton ($31.00/cwt) FOB delivered to the customer’s facility. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged compared to last week. Our price momentum on plate steel is at Neutral until the market establishes a clear direction.

Plate Lead Times: 3-5 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.