Product

July 20, 2020

Speaker Profile: Beaulieu, ITR on “The Inflation Boogie Man”

Written by Tim Triplett

Popular economist Alan Beaulieu, president of ITR Economics, will again be a keynote presenter during the 2021 SMU Steel Summit Conference Aug. 23-25 in Atlanta, providing insight on the economy’s recovery from the pandemic and the outlook for 2022 and beyond. Below from a recent blog, ITR Economics puts the current inflation fears into perspective.

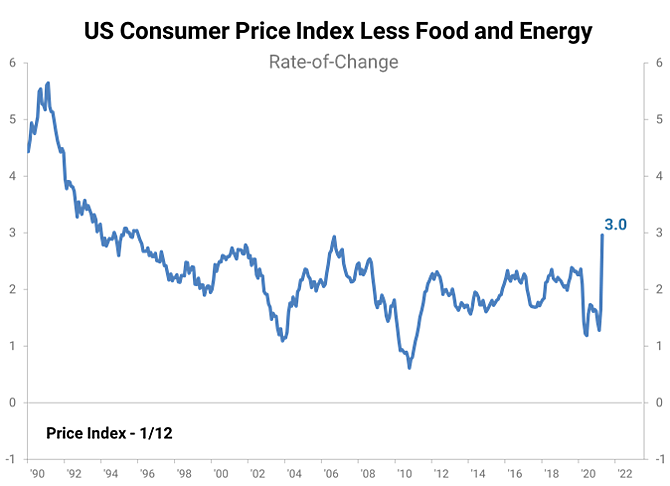

As ITR Economics reported in a recent blog, there is quite a bit of discussion regarding the threat of inflation and its attendant impact on interest rates. The CPI Less Food and Energy (so-called Core Inflation) is a close proxy for the inflation gauge the Fed uses. You can see that the Core Inflation rate rose to 3.0% in April. A 3.0% rate is noteworthy, but it is not cause for alarm if you are concerned about the Fed deciding it is time to move interest rates higher in order to curtail any imbedded inflationary pressures. They have indicated that they will tolerate a higher rate of inflation going forward for as long as a couple of years in order to balance out the periods when the Core Inflation rate was running below 2.0%. Bottom line: even with energy up 25.1% in April from one year ago, the Fed is not expecting the increased inflation rate to endure long enough to force their hand and push interest rates upward.

While the CPI inflation rate is relatively tame, businesses are clearly facing inflationary pressures every day. Those pricing issues are picked up via the Producer Price Indexes. So far, despite the magnitude of input cost increases (including labor), the CPI is not indicating there has been a significant pass-through of these higher costs. That could become a serious issue for individual businesses. Be careful about your profit margins in this difficult environment. Additionally, on a more macro level, be mindful of the cumulative effect this margin squeeze could have on stock prices (further widening of the gap between high share prices and a tepid rise, at best, in profitability).

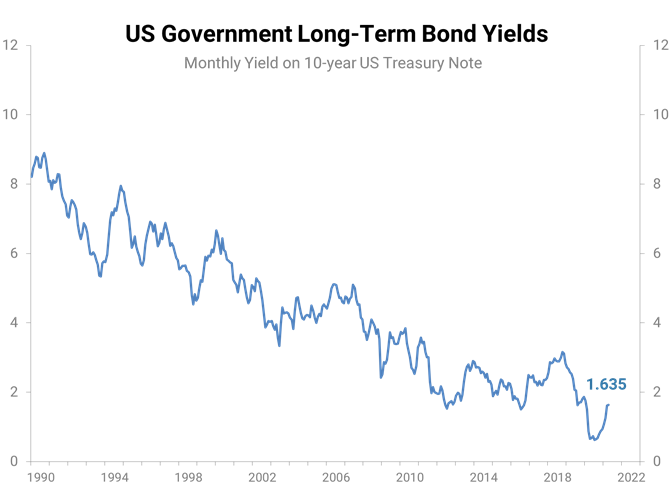

The next chart shows the U.S. Government 10-Year Bond Yield through the same period as in the Core Inflation chart above. This long-term yield is a function of the marketplace, versus the short-term interest rates the Fed controls/influences. So far, the 10-Year Yield has returned to its pre-COVID level and nothing more than that. We are not yet seeing any inflation concerns from this trend. Additionally, the yield curve is favorable (positive) and is also indicative of low inflation expectations.

Don’t allow your own experiences with escalating cost inputs to lead you to conclude that an interest rate rise is imminent and the economic recovery from the pandemic is drawing to a close. Stay aggressive in securing your supply chain and think about putting through another round of price increases. The consumer is flush with cash; they can absorb it if you can justify it. Now is the time to be laser-focused on your margins.

Speaker Bio

Dr. Alan Beaulieu is president and principal of ITR Economics, a highly respected research and consulting firm based in Manchester, N.H. One of the country’s most sought-after economists, Beaulieu has provided workshops and economic analysis seminars to thousands of business executives all over the world for the last 30 years. He is the chief economist for numerous U.S. and international trade associations, and has been quoted in the Wall Street Journal, New York Times, USA Today, the Associated Press, CBS Radio, CNN Radio, Sirius talk radio, and numerous other media outlets.