Analysis

August 21, 2020

Construction Employment Dips in More than Half of States

Written by Sandy Williams

Construction employment declined in 26 states and the District of Columbia from June to July, says the Associated General Contractors of America in a new analysis of government data.

“Renewed outbreaks of coronavirus in numerous states likely caused many project owners and investors to pull back on planned construction,” said AGC Chief Economist Ken Simonson. “Meanwhile, budget problems in state and local governments, most of which started a new fiscal year in July, led to cancellation or postponement of many infrastructure and public facilities projects.”

Monthly job losses were heaviest in California and Texas, with the states shedding 14,800 and 6,300 jobs, respectively. New Mexico had the highest percentage decrease at 5.9 percent followed by a 3.7 percent decline in Vermont.

New York gained the most construction jobs as well as having the largest percentage gain: 36,000 job, an increase of 4.0 percent. Missouri also fared well, adding 4,400 jobs for a 3.7 percent increase.

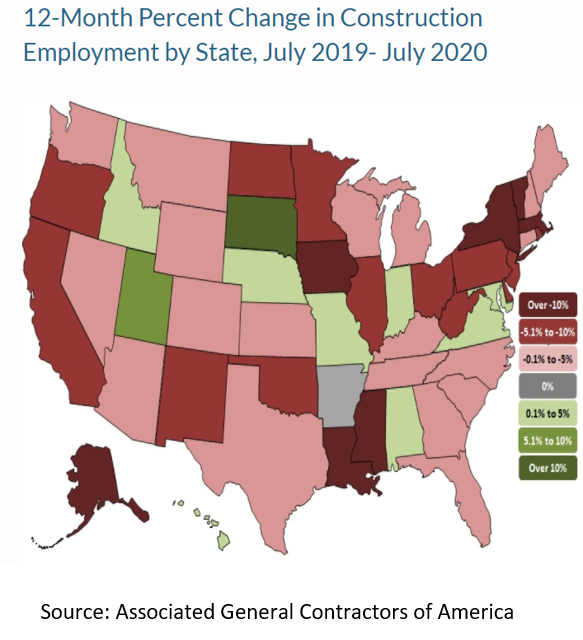

On a year-over-year basis, construction employment fell in 39 states, increased in 10 and held steady in Arkansas and D.C., said AGC. California lost 55,800 jobs over the year and Texas 39,200.

Utah had the strongest yearly increase, adding 8,600 jobs, followed by Maryland with the addition of 4,900 jobs. The highest percentage increase was in South Dakota, which was up 10.5 percent, or 2,500 jobs, during the year.

Project cancellations are likely to continue without fiscal stimulus, liability reforms and new infrastructure spending, said AGC.

“Rebuilding infrastructure, protecting businesses that are complying with coronavirus safety protocols and stimulating private-sector demand will help sustain the industry’s recovery, protect good-paying jobs and support the economy,” said Stephen E. Sandherr, the association’s chief executive officer.