Market Data

October 15, 2020

Service Center Shipments and Inventories Report for September

Written by Estelle Tran

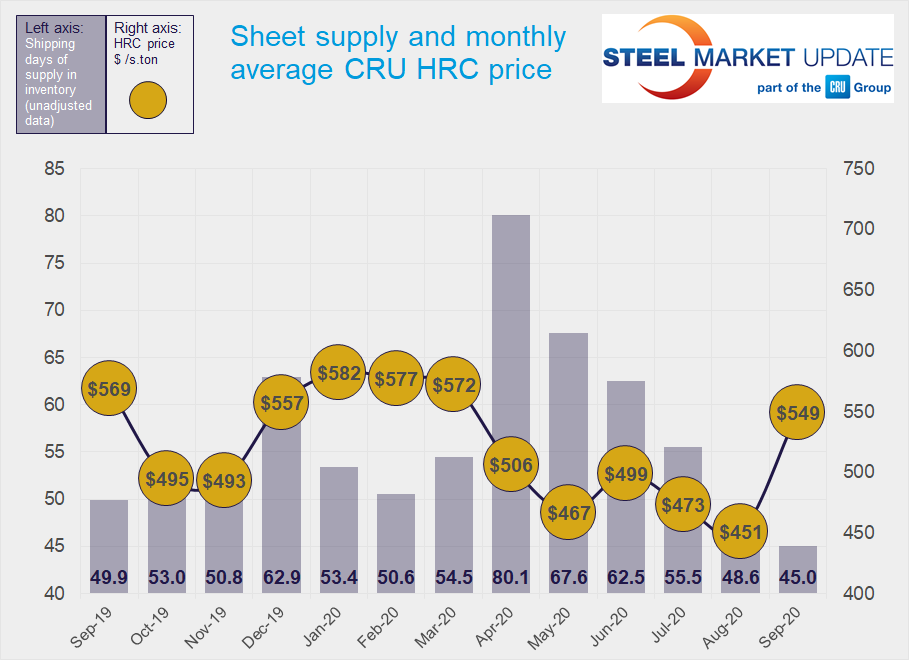

Flat Rolled = 45 Shipping Days of Supply

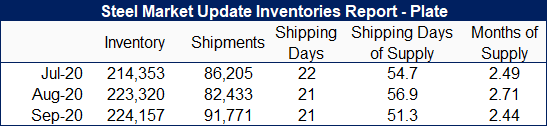

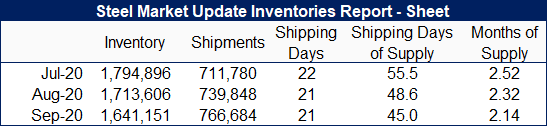

Plate = 51.3 Shipping Days of Supply

Flat Rolled

Service center flat roll inventories fell significantly month on month as shipments increased and mill lead times extended. The SMU service center inventories data for September shows that service centers carried 45 shipping days of supply of flat roll at the end of the month, which was down from August’s adjusted total of 48.6 shipping days. In terms of months, September inventories represented 2.14 months of supply, down from 2.32 months in August.

September had 21 shipping days, which was the same as August. Shipments increased 3.6 percent month on month, and intake rose 5.4 percent.

With supply on hand at the lowest level recorded and a spike in on-order volumes, the percentage of inventory on order in September also reached its highest level recorded.

The further decline in inventories in September, as manufacturing activity picked up, explains the 21.7 percent jump in average CRU HRC prices m/m. Mill lead times have extended with not only robust contract orders but also sizeable spot orders as mill order books became tight, as some service centers were caught short. Mills continue to push up prices and are reportedly targeting $700 /st HRC.

Going forward, we expect to see continued price strength in the next few weeks, and the on-order volumes to remain elevated as mill lead times remain extended

Plate

While the sheer volume of plate in stock at service centers was flat m/m in September, with higher shipments, the number of shipping days of supply decreased in September. Service centers carried 51.3 shipping days of plate supply in September, down from 56.9 days in August. This translates to 2.44 months of plate supply on hand in September versus 2.71 months in August. Similar to sheet, plate supply on hand fell to the lowest level since we started recording data in January 2019.

Plate shipments increased nearly 11.3 percent m/m, and so did on-order volumes.

Plate pricing has struggled to rise, despite multiple attempts by mills to increase prices. The latest SMU lead time survey published Oct. 1 showed mill lead times for plate at 4.91 weeks, down from 5.11 weeks two weeks prior.

Mills have indicated that they are going to enforce price increases for November orders, and there has been chatter of additional price increases. While shipments have picked up, plate does not have the supply-side tightness nor the benefit of increased manufacturing demand that are driving sheet prices.