Market Data

October 21, 2020

Decarbonization in an ESG-Driven Environment

Written by Sandy Williams

ESG (Environmental, Social and Governance) and decarbonization are big concerns for corporate investors in the metals and mining sector, according to a recent survey by CRU. How prepared are global corporations to take on the changes needed to reach zero emissions?

China is a leader in decarbonization, announcing in September a target of net zero emissions by 2060. China continues to increase the stringency of its five-year environmental plans and has achieved or exceeded all of its targets. Although the most recent target is challenging, panelists at the 220 CRU Breakfast this week agreed that given China’s innovative nature and policy mandates, the goal is achievable.

The European Union is the current leader in climate change and is aiming for climate neutrality by 2050 and a 60 percent reduction in emissions by 2030. Toward that goal, the EU is providing funding for innovations in steel and manufacturing.

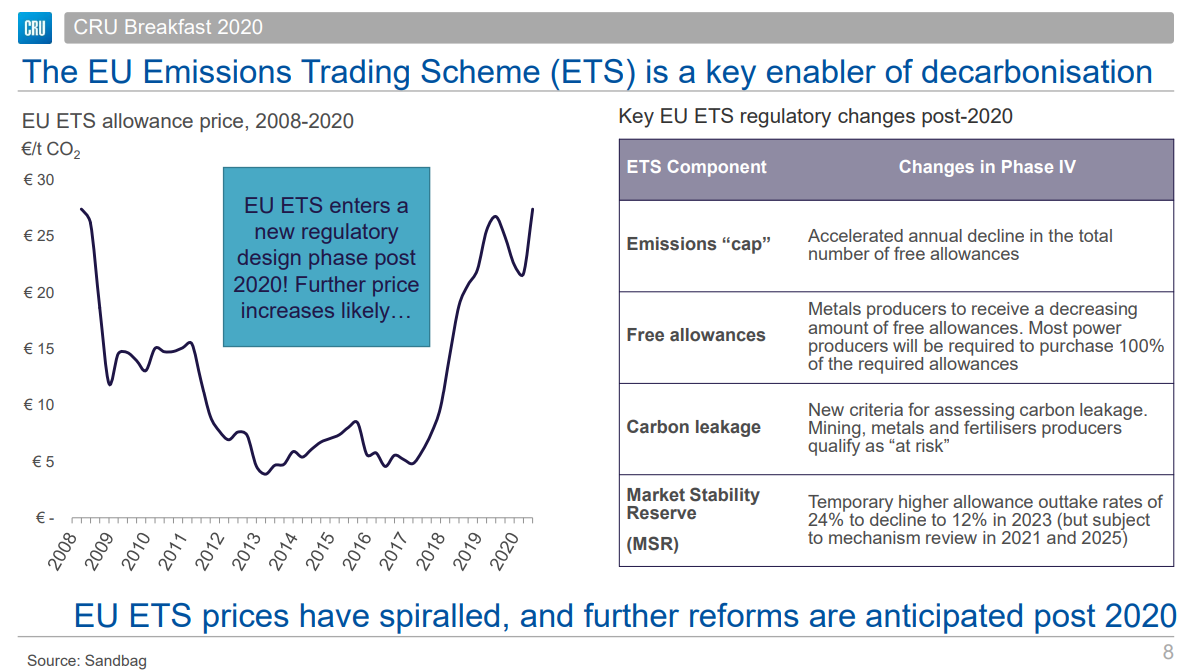

The EU is ahead of most regions in utilizing carbon pricing, a mechanism that places a monetary cost on carbon emissions to incentivize emitters to reduce their releases of greenhouse gases into the atmosphere. The emissions trading scheme allows companies to receive or buy emissions allowances, which they can trade as needed. The number of allowances available is limited to ensure that value is maintained. The EU ETS operates in all EU countries plus Iceland, Liechtenstein and Norway and hopes to expand as other countries and regions develop compatible systems. The EU is working on reform measures that will include a tighter cap on fuel allowances that will result in higher prices and tighter benchmarks.

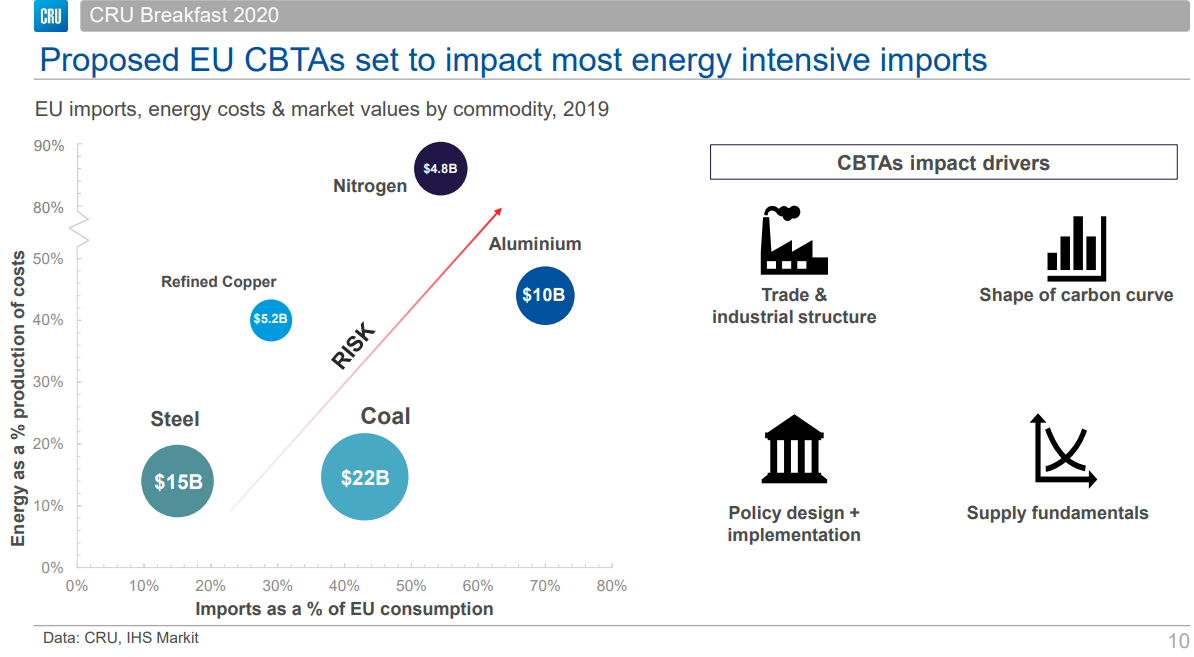

Another option under consideration is a carbon border tax that determines a tax on imported products based on the carbon emissions associated with producing the product. The tax is aimed at reducing “carbon leakage” that occurs when production is transferred to another country with weaker emissions regulations to avoid ETS costs. There are a number of questions to be considered before a carbon tax could be implemented. What industries will be included? How will the emissions be measured? How will it impact the ETS? Is it compatible with WTO rules?

Initially, carbon neutrality focuses on high carbon emitters such as energy and metal producers. A number of methods are being studied to reduce carbon intensity such as power generation through wind, solar and hydrogen, carbon capture, and using hydrogen for the direct reduction of iron.