Prices

December 2, 2020

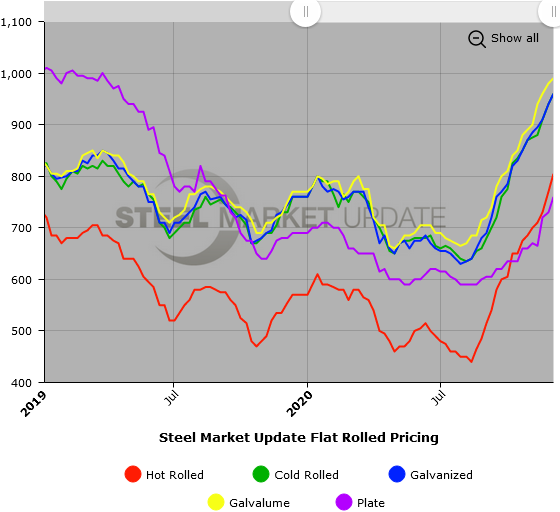

SMU Price Ranges & Indices: Hot Rolled Tops $800

Written by Brett Linton

Steel Market Update’s check of the market this week shows another jump for both flat rolled and plate, taking the benchmark price for hot rolled steel to an average of $805 per ton. Sources commonly reported paying as much as $840 to secure hot rolled in a market where availability is becoming a critical issue. As one source told SMU: “No mill is currently entertaining any new spot orders.”

Gathering pricing data is unusually tricky in the current environment because there are so few spot transactions taking place. Adding to the challenge in assessing plate prices was the announcement by Nucor that it will no longer quote delivered prices, but rather will charge extras for freight depending on the buyer’s location. That makes it difficult to compare one mill’s price to another, at least until the other mills follow Nucor’s lead and change their approach as well. Steel Market Update’s Price Momentum Indicators for both flat rolled and plate continue to point higher for at least the next 30 days

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $770-$840 per net ton ($38.50-$42.00/cwt) with an average of $805 per ton ($40.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $35 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 5-9 weeks

Cold Rolled Coil: SMU price range is $940-$980 per net ton ($47.00-$49.00/cwt) with an average of $960 per ton ($48.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to last week. Our overall average is up $20 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 6-12 weeks

Galvanized Coil: SMU price range is $940-$980 per net ton ($47.00-$49.00/cwt) with an average of $960 per ton ($48.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 per ton compared to one week ago. Our overall average is up $20 from one week ago. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,009-$1,049 per ton with an average of $1,029 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 7-12 weeks

Galvalume Coil: SMU price range is $980-$1,000 per net ton ($49.00-$50.00/cwt) with an average of $990 per ton ($49.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $10 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,271-$1,291 per ton with an average of $1,281 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 7-12 weeks

Plate: SMU price range is $740-$780 per net ton ($37.00-$39.00/cwt) with an average of $760 per ton ($38.00/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.