Prices

December 8, 2020

SMU Price Ranges & Indices: “Fluid” Pricing Up Substantially

Written by Brett Linton

Flat rolled and plate steel prices continue to be quite fluid based on the analysis of the data from Steel Market Update’s survey of the market this week, as well as individual channel checks with both buyers and sellers. By “fluid,” we mean we are capturing variances in prices over a short period of time. Prices that may have been available on Thursday and Friday of last week may well not be available this week.

Steel buyers report situations where the steel mills are either not quoting certain products or are allocating products (controlled order entry). One steel buyer earlier this week described a situation where their main supplier offered them tonnage at “X” price, but the price was only good for a few short hours. They managed to get the mill to agree to 24 hours and did place the tonnage.

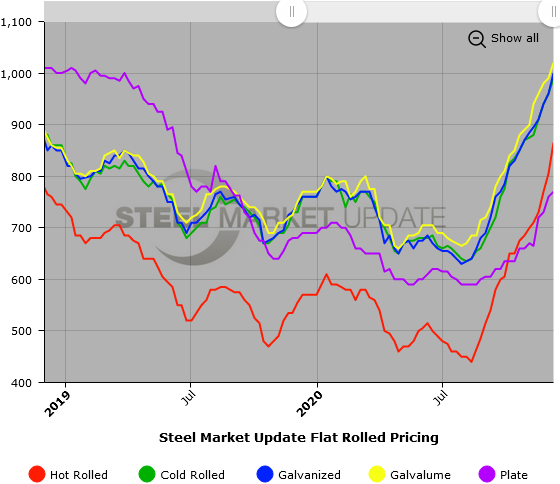

We expect prices to continue to rise as supplies remain tight and lead times extended. As spot hot rolled prices hit $900 per ton (which we are already seeing at the high end of our range), we will be at levels only seen twice in the history of our index (2008 and 2018). In the past, such peaks have been followed by sharp and prolonged drops in prices. Steel buyers are nervous about overpaying or buying at the peak of the market. This may actually help keep prices high as inventories will remain tight.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $820-$910 per net ton ($41.00-$45.50/cwt) with an average of $865 per ton ($43.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $50 per ton compared to one week ago, while the upper end increased $70. Our overall average is up $60 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 5-10 weeks

Cold Rolled Coil: SMU price range is $960-$1,020 per net ton ($48.00-$51.00/cwt) with an average of $990 per ton ($49.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $40. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 6-12 weeks

Galvanized Coil: SMU price range is $980-$1,020 per net ton ($49.00-$51.00/cwt) with an average of $1,000 per ton ($50.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $40 per ton compared to one week ago. Our overall average is up $40 from one week ago. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,049-$1,089 per ton with an average of $1,069 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-13 weeks

Galvalume Coil: SMU price range is $980-$1,060 per net ton ($49.00-$53.00/cwt) with an average of $1,020 per ton ($51.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $60 per ton. Our overall average is up $30 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,271-$1,351 per ton with an average of $1,311 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $740-$800 per net ton ($37.00-$40.00/cwt) with an average of $770 per ton ($38.50/cwt) FOB delivered to the customer’s facility. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $20 per ton. Our overall average is up $10 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.