Prices

December 15, 2020

SMU Price Ranges & Indices: Steel Prices a Moving Target

Written by Brett Linton

Hot rolled steel prices have not yet hit $1,000 a ton, but they are not far behind. Buyers tell Steel Market Update they are seeing offers as high as $1,020 per ton, but no takers so far. SMU puts the average HR price at around $950 per ton, up substantially over last week as the mills push out orders into February and March and service centers and OEMs scramble to fill holes in their inventories.

With supplies so tight and relatively few spot market transactions taking place, it’s unusually difficult for SMU to assess current steel prices. As one buyer said: “It’s a moving target. There are very, very few spot tons available at any mill. For the past few weeks, the mills have been able to collect whatever spot price they offer.”

SMU’s Price Momentum Indicators continue to point toward higher prices for flat rolled and plate products over the next 30 days.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $920-$980 per net ton ($46.00-$49.00/cwt) with an average of $950 per ton ($47.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $100 per ton compared to one week ago, while the upper end increased $70. Our overall average is up $85 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 5-10 weeks

Cold Rolled Coil: SMU price range is $980-$1,080 per net ton ($49.00-$54.00/cwt) with an average of $1,030 per ton ($51.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to last week, while the upper end increased $60. Our overall average is up $40 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 6-12 weeks

Galvanized Coil: SMU price range is $1,000-$1,100 per net ton ($50.00-$55.00/cwt) with an average of $1,050 per ton ($52.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $80. Our overall average is up $50 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,069-$1,169 per ton with an average of $1,119 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-13 weeks

Galvalume Coil: SMU price range is $1,060-$1,120 per net ton ($53.00-$56.00/cwt) with an average of $1,090 per ton ($54.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to last week, while the upper end increased $60. Our overall average is up $70 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,351-$1,411 per ton with an average of $1,381 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $840-$860 per net ton ($42.00-$43.00/cwt) with an average of $850 per ton ($42.50/cwt) FOB delivered to the customer’s facility. The lower end of our range increased $100 per ton compared to one week ago, while the upper end increased $60. Our overall average is up $80 from last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

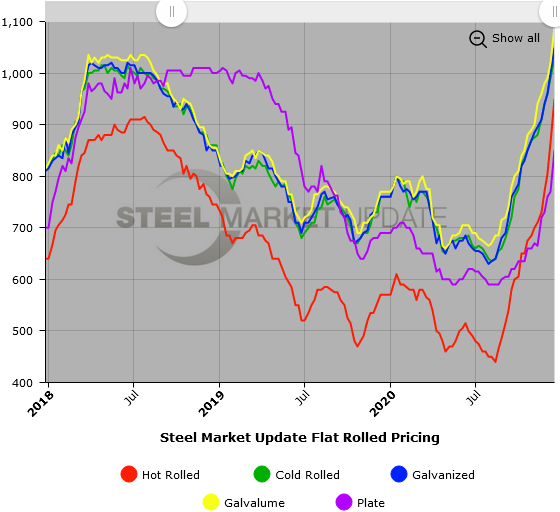

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.