Prices

December 22, 2020

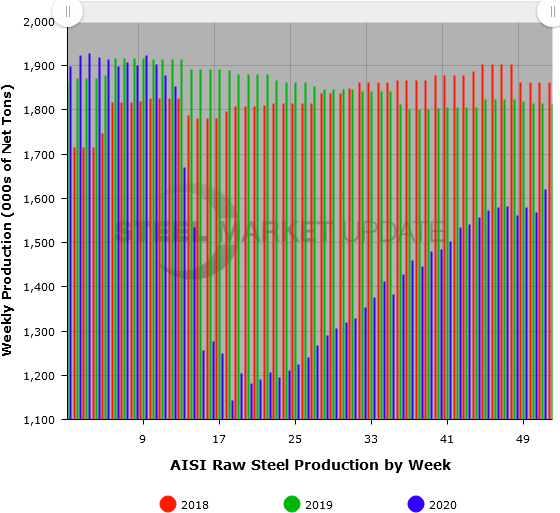

Weekly Steel Production Edges Up 3.3 Percent

Written by David Schollaert

Weekly raw steel production by U.S. mills totaled 1,619,00 net tons in the week ending Dec. 19, up from 1,567,000 net tons week on week. The operating rate was 73.2 percent, up 3.3 percent from 70.9 percent the week prior. The increase is likely a reflection of mills adding capacity, including U.S. Steel’s restart of it’s blast furnace #4 at Gary Works, as well as a potential bump in production ahead of the holidays. It’s a notable increase as demand continues strong, lead times are extended, flat rolled mills are still running at capacity, and HRC prices are nearing the $1,000 per ton mark. Nevertheless, despite present circumstances, capacity utilization is down 10.8 percent compared with year-ago levels as a result of idled capacity.

Adjusted year-to-date production through Dec. 19, 2020 totaled 76,951,000 net tons, at an average utilization rate of 67.4 percent. That is down 18.0 percent from the same period last year, when the utilization rate was 79.8 percent, AISI said.

Following is production by district for the Dec. 19 week: North East, 141,000 net tons; Great Lakes, 581,000 net tons; Midwest, 172,000 net tons; South, 650,000 net tons; and West, 75,000 net tons for a total of 1,619,000. The sole region to report decreased production was the North East.

Note: The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity. Capability for fourth-quarter 2020 is approximately 29.1 million tons, compared to 30.4 million tons for the same period last year and 29.4 million tons for the second quarter of 2020.