CRU

January 5, 2021

CRU: Iron Ore Kicks Off 2021 by Rising $6 Per Ton

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg from CRU’s Steelmaking Raw Materials Monitor

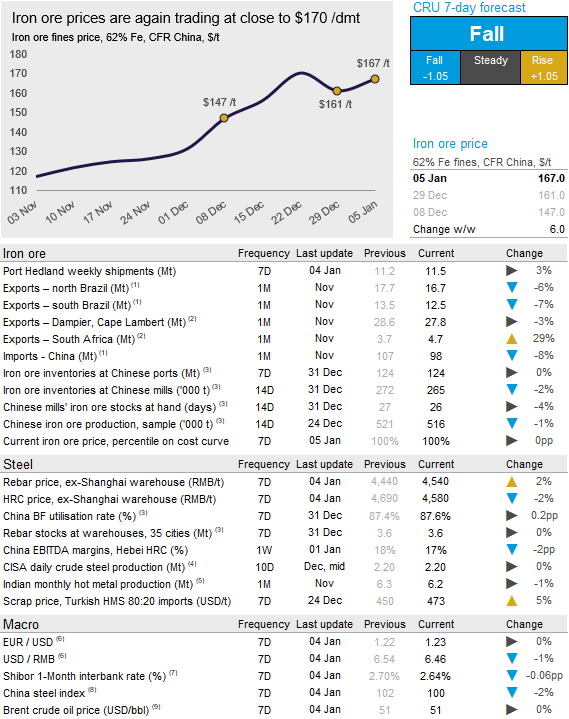

Iron ore prices have risen at the start of 2021 on continued strong appetite in China, while we have seen new short-term disruptions in the supply chain. On Tuesday, Jan. 5, CRU assessed the 62% Fe fines price at $167 /dmt, up by $6 /dmt w/w.

Chinese steel demand slowed in the week prior to the New Year holidays, but the rebar price has been largely stable due to less output from EAF-based steel mills associated with power cuts in Jiangsu province. In contrast, HRC prices declined sharply due to excessive supply, evidenced by an increase of inventories for the first time since the “Golden Week” holidays in early October. Both prices posted gains on Jan. 4 on the back of post-holiday restocking and price hikes in the futures market after factoring in good economic results and positive news including the Chinese government’s call for steel output cuts. According to CRU’s Steel Cost Model, at the prevailing prices, EBITDA margins for Chinese BOF-based HRC and rebar of ~10-12% are sufficient to motivate integrated steelmakers to keep operating at high utilization rates. This is evidenced by higher surveyed BF capacity utilization as a result of BFs previously under maintenance now being restarted.

Having said that, iron ore portside trading slowed in Hebei province due to the environment-led disruptions of port operation, resulting in a rundown of onsite inventories at infected mills but a build-up of port inventories as well as longer ship queue. In addition, the environmental restrictions in China are also resulting in higher demand for direct-charge material, which means higher premium for both pellet and lump.

Seaborne iron ore supply was strong at end-2020, with global supply exceeding 2019 levels for the last two weeks of 2020 and the start of 2021. Australian supply has recovered after the poor weather conditions in mid-December forcing port closures, which resulted in very low arrivals to Chinese ports at end-December. Both Rio Tinto and BHP have shipped at a high level in the past week as Port Hedland shipped 11.5 Mt and Rio Tinto’s strong performance at the end of the month should be enough to meet the lower end of its 324–334 Mt guidance for 2020. Brazilian supply also finished the year strong on improving weather conditions in the north.

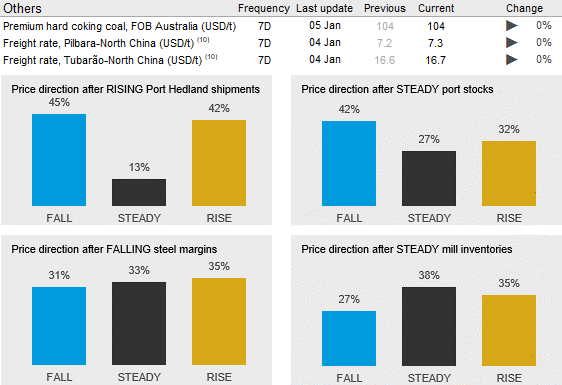

In the coming week, we see a downside risk to prices. Australian shipments have been strong and weather conditions are looking favorable at the moment, although there are reports of rain across the western parts of the Pilbara region. Freight rates are also rising slightly as miners have been active on the market, indicating that short-term supply is looking strong in both Australia and Brazil.