CRU

January 8, 2021

CRU: Iron Ore Breaches $170 on Falling Chinese Inventories

Written by Eduardo Tinti

By CRU Research Analyst Eduardo Tinti, from CRU’s Steelmaking Raw Materials Monitor

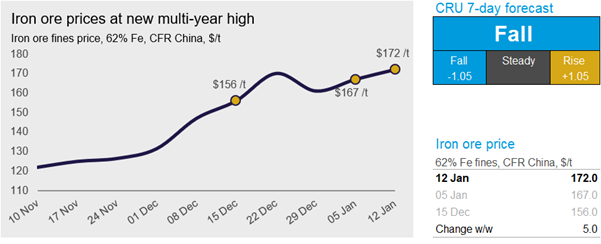

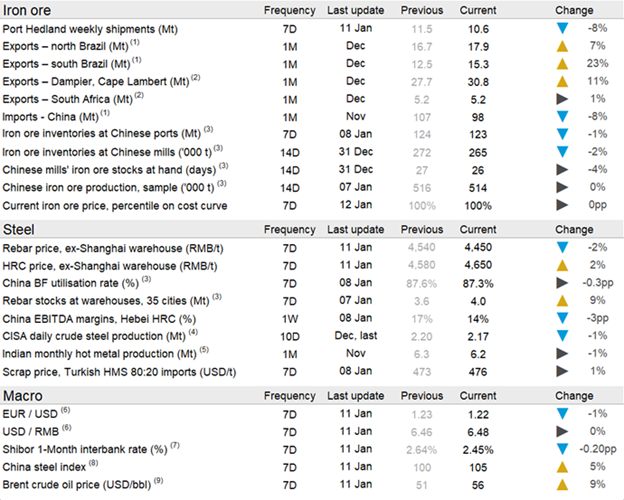

Iron ore prices continued to rise over the past week. Due to offloading constraints at Chinese ports, iron ore port inventories declined, contributing to the recent price hike. On Tuesday, Jan. 12, CRU assessed the 62% Fe fines price at $172.0 /dmt, $5.0 /dmt higher w/w.

Chinese steel long and flat product prices have diverged over the past week with HRC rising by RMB70 /t w/w and rebar falling by RMB90 /t w/w. The higher HRC price was supported by w/w improvement of underlying demand. In contrast, rebar prices fell due to weaker demand associated with extreme cold weather sweeping across the country, causing work at many construction sites to be suspended.

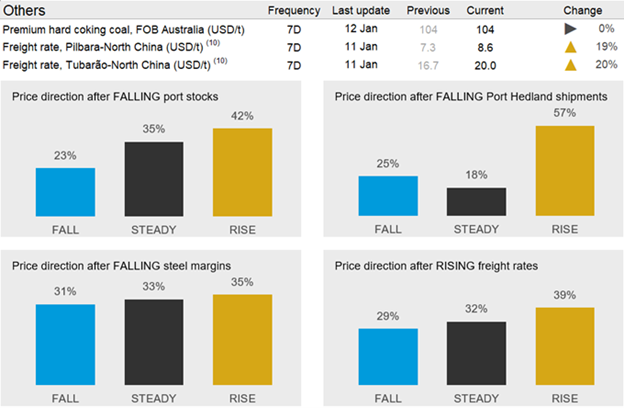

Chinese steelmaking output and iron ore appetite remain robust. Though BF capacity utilization edged down as more BFs were put under maintenance, iron ore demand remained high on steel mills’ restocking demand following the truck transportation disruptions in Hebei province that limited iron ore availability in the previous week. The vessel queue at Chinese ports has been increasing again as adverse weather conditions are limiting vessels’ offloading. Together with rising port outflows, this resulted in a sharp ~1.5 Mt w/w decrease in iron ore inventories at ports. The strong Chinese demand and low inventory levels are two of the main reasons behind the high level of iron ore prices. The rising vessel queue at Chinese ports summed with strong Brazilian exports in December is also having an impact on the freight market, with freight rates jumping by around 20% w/w.

The demand for lump was particularly strong this past week as iron ore buyers considered it to be underpriced compared to other products. As a result of rising buying interest, lump inventories at ports declined by 1.7 Mt w/w and lump premium rose by around 30%.

Seaborne supply, which has been quite strong throughout December, edged down last week, though it remained higher compared to year-ago levels. In Australia, Port Hedland weekly shipments were at a strong 10.6 Mt while exports from Rio Tinto faced some headwinds. In Brazil, exports fell both from the north and from the southeast. Rainfall has been on the high side in the southeast and anecdotal evidence suggests that Vale has been facing some operational challenges at its Northern Range (Serra Norte) mining complex in the north.

In the coming week, we expect prices to decline though upside risks remain. While the seaborne supply, especially from Australia, is expected to remain strong, Chinese buying interest will also be on the high side as steelmakers start to restock iron ore prior to the Chinese New Year holiday in mid-February. Despite such mixed supply/demand signals, we expect weather conditions in China will improve, allowing iron ore offloading to increase. This will help lift port stocks, contributing to lower prices.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com