Prices

January 8, 2021

U.S. Raw Steel Production Up 1.3 Percent in November

Written by Brett Linton

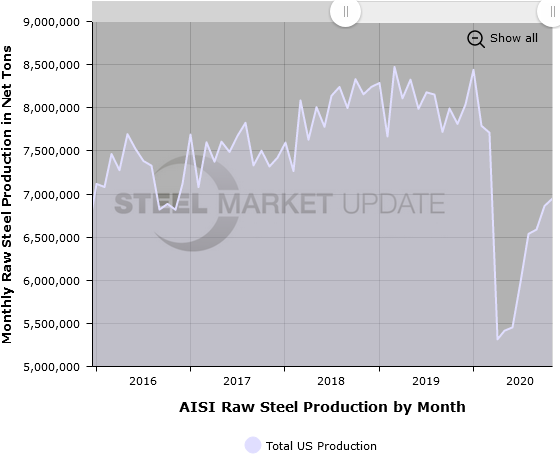

U.S. raw steel production inched up 1.3 percent in November to 6,947,000 net tons, as reported by the American Iron and Steel Institute. This was the highest monthly production figure seen since March 2020 when 7,710,000 tons were produced in a single month.

AISI’s monthly raw steel production estimates are different than the weekly estimates SMU reports each Tuesday; the monthly estimates are based on over 75 percent of the domestic mills reporting versus only 50 percent reporting for the weekly estimates. Monthly production data is released 4-6 weeks after the end of each month.

November raw production was 86,000 tons higher than in October, but down 865,000 tons (11.1 percent) compared to the same month one year prior. November production was above the 2020 monthly average of 6,640,000 tons. The January-November 2019 monthly average was 8,064,000 tons.

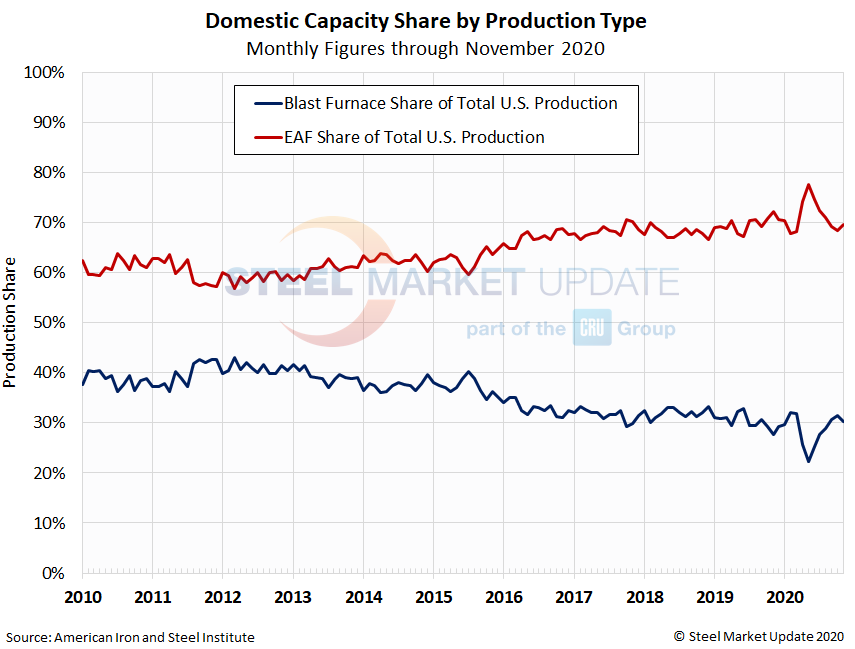

Broken down by production method, 4,844,000 tons (69.7 percent) were produced by electric arc furnaces (EAFs) and 2,104,000 tons (30.3 percent) were produced by blast furnaces.

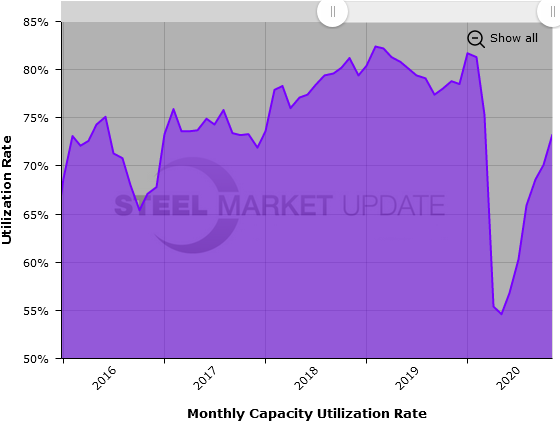

The mill capacity utilization rate increased to 73.3 percent in November, up from 70.1 percent in October, but down from 78.8 percent one year ago. The average capacity utilization rate for the year is now 67.7 percent, down from 80.0 percent in the same 11-month period of 2019.

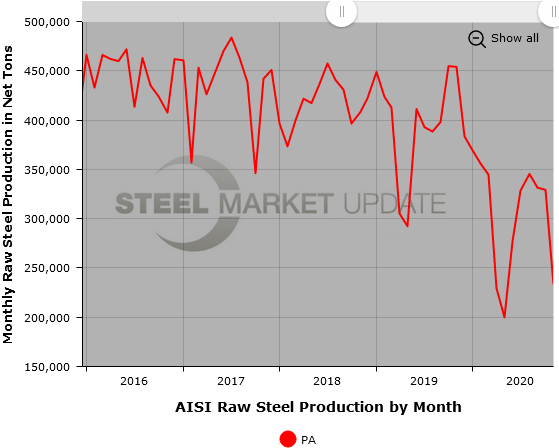

SMU Note: Interactive versions of many of these raw steel production graphics can be seen in the Analysis section of our website here. We have detailed regional data available as well, as displayed in the example below showing production from the Pennsylvania region. If you need assistance logging into or navigating the website, contact us at info@SteelMarketUpdate.com.