CRU

January 18, 2021

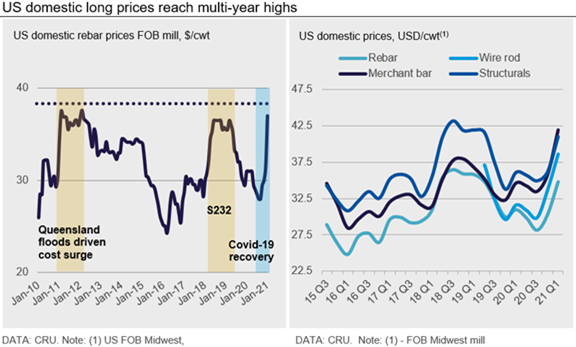

CRU: U.S. Long Product Prices Surge to Highest Levels in a Decade

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley and Analyst Dave Thewlis, from CRU’s Steel Long Products Monitor

U.S. domestic long product prices rose further m/m in January, hitting multi-year highs (see chart) as limited supply met with strong demand. Buyers are increasingly relying on domestic mills to acquire material, as global prices have made importing less viable. Further supporting higher prices have been a large increase in input costs like scrap. We see this domestic market tightness extending into February, with some easing on the horizon in late 2021 Q1 or 2021 Q2.

Tight supply coupled with strong demand has caused U.S. longs prices to continue their rise and, in some cases, reach decade-level highs. Beam prices rose to $45.50/cwt in January, marking an 18% jump over December’s prices. Rebar and Merchant bar prices surged as well, up 17% and 15% m/m respectively. Wire rod prices increased by13% m/m in January to $39.50/cwt, reaching a roughly two-year high and expected to continue rising into February.

Demand from the construction sector remains strong, with spending continuing to rise from pandemic-induced lows last spring. In November, total construction spending increased 0.9% m/m and 3.8% y/y, according to the U.S. Census Bureau. This was fueled primarily by growth in residential construction, which helped offset declines in non-residential spending.

With the demand environment strong, domestic mills are running at higher capacity utilization rates to meet demand, and output is still rising as a result. Per the American Iron and Steel Institute, production increased the week of Jan. 2 by 3.1% w/w to reach a utilization rate of 72.3%. Still, many EAF mills are likely running at a much higher rate given the high price and demand environment.

In addition to strong construction demand, upside price pressure for wire rod has come from both strong automotive and agricultural sectors. Some wire mills are now reporting lead times into May and are putting customers on allocation. Intermittent production issues have tightened the market further, which has some buyers worried that they will not receive sufficient material from mills. Imports are not an attractive option for domestic buyers either, given that import prices are still ~$50 /s.ton above the domestic market and lead times are long. Total wire rod imports, as a result, were down y/y during 2020 H2, running 11% below 2019 H2 levels.

A similar situation has occurred for rebar, and preliminary census data suggests that imports will be at their lowest level in at least two years during December. Still, a greater diversity in end uses has kept material more widely available than for wire rod. Structural steel and merchant bars were also not as undersupplied, but prices have been driven higher by a large increase in scrap prices over the past 60-day time period.

Outlook: Yet More Upside Price Pressure Ahead

We expect these seasonally unique price pressures to persist into February as import prices, especially for wire rod, remain unworkable for U.S. buyers. Meanwhile, scrap prices in January surged by $90-100 /l.ton m/m, and we see little downside pressure moving into February. As such, we expect long prices to again increase in February, albeit at a slower rate.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com