Prices

February 9, 2021

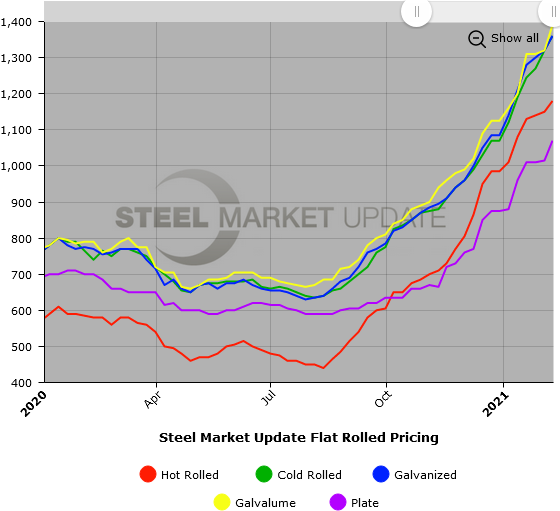

SMU Price Ranges & Indices: Hot Rolled Hits $1,180 Per Ton

Written by Brett Linton

Despite all the speculation about an impending peak, Steel Market Update’s check of the market this week shows steel prices continuing to rise. SMU puts the current average HR price at a new high of $1,180 per ton, the fifth new high-water mark since the second week of January when the spot market surpassed the prior record of $1,070 per ton published by SMU in 2008. The HR price saw a $30 jump after stepping up by a modest $10 per ton in each of the prior two weeks. Prices for cold rolled and coated products, as well as plate, recorded substantial increases of $40-70 as well. SMU’s Price Momentum Indicator continues to point toward higher prices over the near term. However, we advise steel buyers to be aware that momentum can change quickly. We understand there are foreign offers into U.S. ports at attractive prices, which may well put a floor on domestic prices in those geographical regions of the country. Watch lead times and order receipts very carefully in the coming weeks on all flat rolled and plate products.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,160-$1,200 per net ton ($58.00-$60.00/cwt) with an average of $1,180 per ton ($59.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $30 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-10 weeks

Cold Rolled Coil: SMU price range is $1,320-$1,400 per net ton ($66.00-$70.00/cwt) with an average of $1,360 per ton ($68.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $40 per ton compared to last week. Our overall average is up $40 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $1,320-$1,400 per net ton ($66.00-$70.00/cwt) with an average of $1,360 per ton ($68.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $40 per ton compared to one week ago. Our overall average is up $40 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,389-$1,469 per ton with an average of $1,429 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 8-12 weeks

Galvalume Coil: SMU price range is $1,360-$1,420 per net ton ($68.00-$71.00/cwt) with an average of $1,390 per ton ($69.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $80 per ton compared to one week ago, while the upper end increased $60. Our overall average is up $70 from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,651-$1,711 per ton with an average of $1,681 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-12 weeks

Plate: SMU price range is $1,020-$1,120 per net ton ($51.00-$56.00/cwt) with an average of $1,070 per ton ($53.50/cwt) FOB mill. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $90. Our overall average is up $55 compared to last week. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.