Prices

March 9, 2021

Update on U.S. Steel Exports through January

Written by Brett Linton

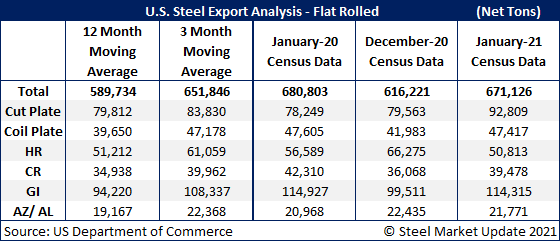

After declining 8% in December, U.S. steel exports recovered by 9% in January to 671,000 tons, according to recent U.S. Department of Commerce data. Of our six monitored product groups, the largest month-to-month increase went to cut-length plate products, up 17%. Galvanized exports increased 15% over December, and exports of coiled plates increased 13%. On the other hand, hot rolled steel exports declined 23% from one month prior. Total January exports were down 1% compared to January 2020 levels.

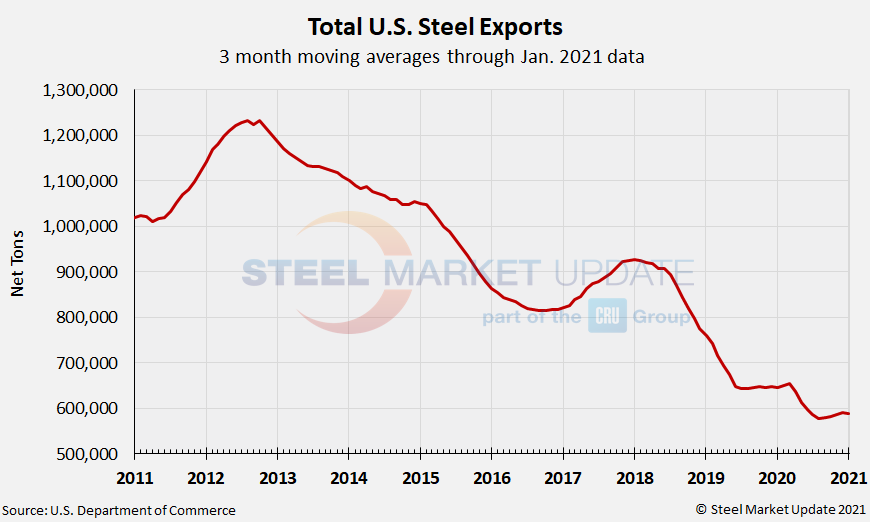

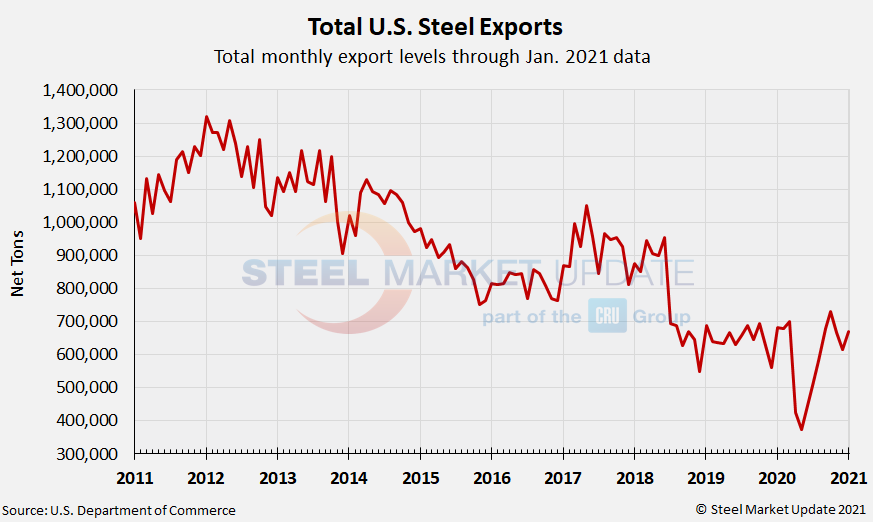

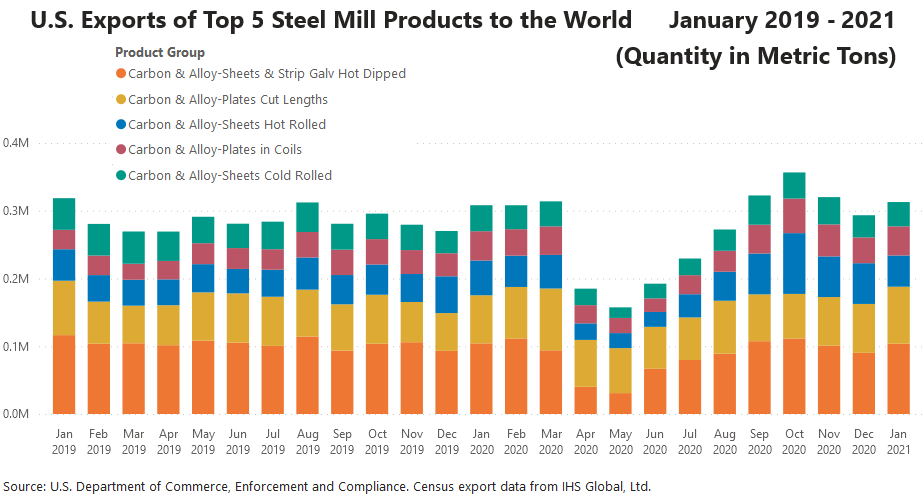

Recall that 2020 saw quite a swing in monthly export levels; the year started strong, nearing 700,000 tons in January through March. Then the COVID downturn choked exports in April and May, with May levels reaching the lowest seen in SMU’s 24-year data history at 374,000 tons. Monthly export levels recovered each month afterward through October, reaching a 2.5-year high of 730,000 tons, but slowed again through the remaining months of the year.

The 2020 monthly average for exports was 591,000 tons, below both the 2019 monthly average of 648,000 tons and the 2018 monthly average of 775,000 tons.

Total January exports were above the three-month moving average (average of November 2020 through January 2021), and above the 12-month moving average (average of February 2020 through January 2021). Here is a detailed breakdown by product:

Cut plate exports were up 17% from December to 92,809 tons, up 19% compared to one year ago. Click here to see a 10-year export graphic on cut plate products.

Exports of coiled plate were 47,417 tons in January, up 13% over last month, and in line with levels seen one year prior.

Hot rolled steel exports were down 23% from December to 50,813 tons, and down 10% from December 2019. Click here to see a 10-year export graphic on hot rolled products.

Exports of cold rolled products were 39,478 tons in January, up 9% from December, but down 7% from the same time last year.

Galvanized exports increased 15% month over month to 114,315 tons. Compared to levels one year ago, January was down 1%. Click here to see a 10-year export graphic on galvanized products.

Exports of all other metallic coated products were 21,771 tons, down 3% from December, but up 4% year-over-year.

Below are two graphs showing the history of total U.S. steel exports through the latest final data, one with unadjusted monthly figures and the other with data as a three-month moving average. We also have interactive graphics available on our website here. If you need assistance logging into or navigating the website, contact us at Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com