CRU

March 16, 2021

CRU: U.S. Zinc Demand Still Strong

Written by Sam Grant

By CRU Analyst Sam Grant, from CRU’s Zinc Monitor

The U.S. COVID-19 vaccination program has continued to make impressive headway over the past month, with over 100 M doses now administered across the country. With more transmissible strains of the virus now present in the U.S., and with many states continuing to roll back containment measures, there is a risk of a renewed spike in cases that could pose a threat to the current pace of recovery. Meanwhile, the Biden administration has been able to get its $1.9 trillion “American Rescue Plan” passed by Congress, which will provide support to both individuals and businesses. This continued fiscal support will inevitably be positive for consumer demand in the short term but may contribute to the U.S. inflation risk. There has been a sharp increase in expectations of future U.S. inflation, as measured by the difference between yields on inflation-protected and nominal government bonds (“breakeven” rates), which have come to the fore in recent weeks. This could result in depreciation of the dollar and be supportive of dollar-denominated commodity prices.

We continue to hear that refined zinc demand in the U.S. remains strong, supported by automotive and construction sector end uses, despite severe weather in February weighing on industrial activity. Demand from the U.S. galvanizing industry and die casters continues to impress and we understand that orderbook visibility is improving for consumers. As a result, many are increasingly confident of holding raw material inventories, even at current high price levels. With firm orders and healthy profits, no one wants to be caught short of refined zinc at present.

In the automotive sector, the ongoing semiconductor shortage is expected to impact U.S. vehicle output in Q1. However, there have not been any reports of this feeding through to weaker refined zinc demand and output is still expected to increase by 21% y/y in 2021, following severe weakness last year. Our economics team recently revised down their estimate of Q1 vehicle production by 230,000 units. For some perspective, this is only around 2.3% of annual U.S. production, and we calculate that this is equivalent to around 5,000 t of lost zinc demand. This output should be made up for later in the year, assuming the current semiconductor shortage comes to an end in H1.

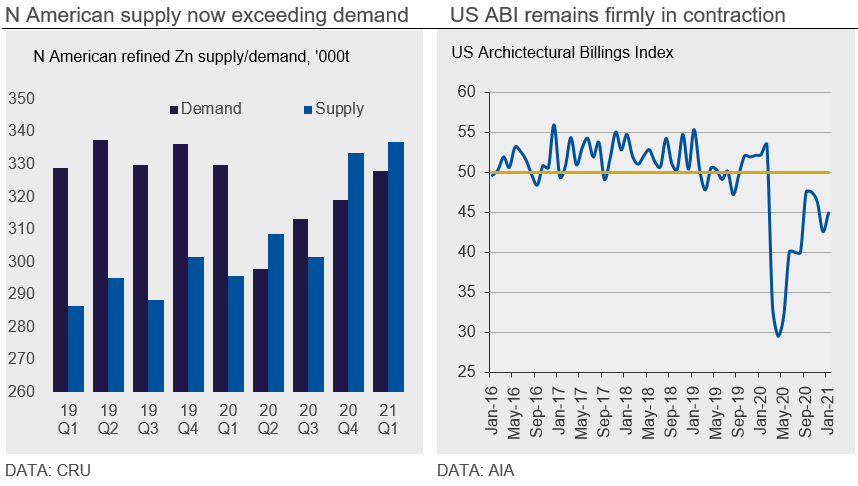

The residential construction sector is also performing well, following a robust year in 2020, due to low mortgage rates and a widespread shift towards moving away from crowded cities. This year we expect new housing completions in the U.S. to reach 1.46 M units, up 3.5% y/y. This is in stark contrast to non-residential construction, especially retail and office space. Here we expect the sector to weaken further in 2021, with non-residential construction spending falling since March 2020 and the forward-looking AIA’s Architecture Billings Index at 44.9 in January, still firmly in contraction territory.

Peñoles & AZR to Boost North American Refined Output

We estimate that North American smelter output will increase by 14.0% y/y in 2021 Q1, to 337,000 t, on significant growth in the U.S. and Mexico. This is despite the explosion and fire at the Potosi smelter, operated by a subsidiary of Grupo Mexico. The fire is believed to have resulted in a shutdown of around 2-4 weeks, removing at least 4,000 t of refined zinc supply. We currently understand that the smelter is still not back to full production. In 2021, with Peñoles and AZR lifting utilization rates, refined zinc output in the region is expected to increase, taking the North American market into surplus. AZR has been operating at 70% of capacity since starting up last March, producing around 90,000 t of refined zinc.

U.S. imports of refined metal declined by 19% y/y in January, with volumes from key suppliers Canada, Mexico and Peru falling 16%, 32% and 41%, respectively. This follows on from a 9.8% increase in imports during 2020. LME stocks have gradually declined by around 6,000 t over the past month, with LME reporting showing a decline in North American off warrant stocks of 57,300 t in January, to 21,400 t. This change likely partly reflects the 55,300 t increase in warranted material in NOLA and Baltimore in late January.

Spot demand in the U.S. market has been at a good level in March, thanks to strong demand and consumers concerned about being caught short of metal. Furthermore, spot demand has benefitted from some consumers taking lower volumes on 2021 long-term contracts and the fire at the Potosi smelter in February. With logistics globally remaining a challenge and shipping from both Asia and South America experiencing delays, security of supply has become a concern for many consumers. As a result, SHG premia in the U.S. have ticked up again this month to around 8.0 ¢/Ib on a DDP Midwest basis.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com