Prices

March 30, 2021

SMU Price Ranges & Indices: Praise for Profitability

Written by Brett Linton

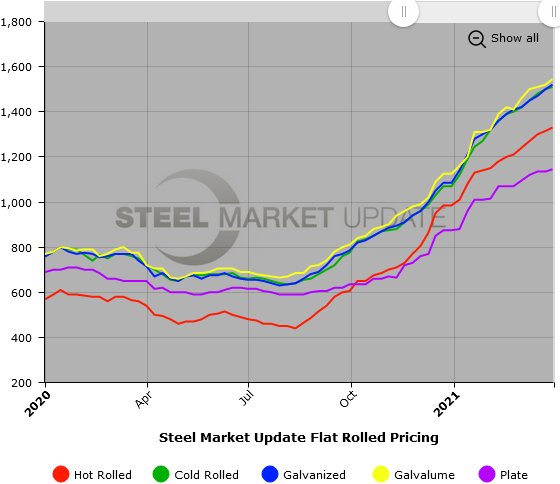

Mills and service centers report historic profitability, thanks to steel prices that continue to set new records every month. Steel Market Update’s canvass of the market this week puts the current price for hot rolled coil at $1,330 per ton, fully triple the pandemic-induced trough of $440 per ton in August last year. That amazing recovery appears still to have some legs, with flat rolled steel prices rising by another $10-25 per ton in the past week. SMU’s Price Momentum Indicators continue to point toward higher steel prices over the next 30 days. As one service center exec commented: “January was a record-setting month with regards to profitability, only to be outdone by February, which will be outdone by March. Looking ahead, I have no doubt that April will then surpass March’s figures. Needless to say, this is a fun run and something every service center needed/deserved.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,300-$1,360 per net ton ($65.00-$68.00/cwt) with an average of $1,330 per ton ($66.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end increased $30. Our overall average is up $15 from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 6-12 weeks

Cold Rolled Coil: SMU price range is $1,460-$1,560 per net ton ($73.00-$78.00/cwt) with an average of $1,510 per ton ($75.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end increased $20. Our overall average is up $10 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 8-12 weeks

Galvanized Coil: SMU price range is $1,480-$1,560 per net ton ($74.00-$78.00/cwt) with an average of $1,520 per ton ($76.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range increased $20 compared to one week ago. Our overall average is up $20 from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,549-$1,629 per ton with an average of $1,589 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 9-12 weeks

Galvalume Coil: SMU price range is $1,530-$1,560 per net ton ($76.50-$78.00/cwt) with an average of $1,545 per ton ($77.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 compared to last week, while the upper end increased $30. Our overall average is up $25 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,821-$1,851 per ton with an average of $1,836 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-13 weeks

Plate: SMU price range is $1,095-$1,195 per net ton ($54.75-$59.75/cwt) with an average of $1,145 per ton ($57.25/cwt) FOB mill. The lower end of our range increased $5 compared to one week ago, while the upper end increased $15. Our overall average is up $10 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 6-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.