Prices

May 11, 2021

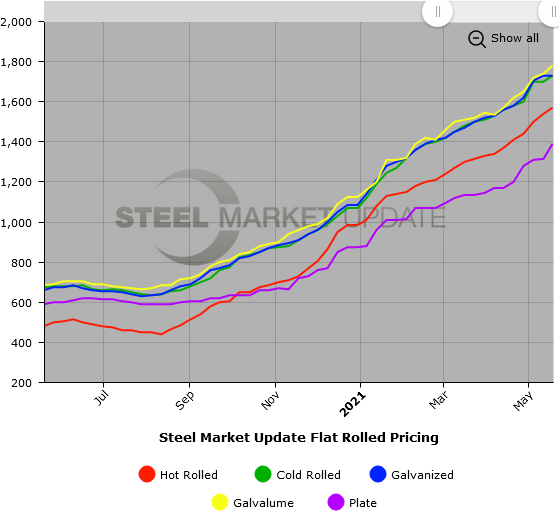

SMU Price Ranges & Indices: HR Rises for 40th Week in a Row

Written by Brett Linton

Hot rolled steel prices have been on the rise for 40 weeks in a row now, reaching a new pinnacle of $1,570 per ton—at least until next week when they likely set another new record. Steel Market Update’s Price Momentum Indicator continues to point toward higher prices over the next 30 days. SMU’s check of the market this week shows flat rolled prices generally up another $30-40 per ton. The average price for galvanized is unchanged from SMU’s calculation last week. Demand continues to overwhelm supplies, as buyers struggle to find enough steel to meet their customers’ needs. As one said this week: “It used to be easy to get steel and hard to make the sale. Today it’s the opposite.”

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $1,500-$1,640 per net ton ($75.00-$82.00/cwt) with an average of $1,570 per ton ($78.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end increased $40. Our overall average is up $30 per ton from last week. Our price momentum on hot rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Hot Rolled Lead Times: 8-13 weeks

Cold Rolled Coil: SMU price range is $1,660-$1,800 per net ton ($83.00-$90.00/cwt) with an average of $1,730 per ton ($86.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $30 per ton from one week ago. Our price momentum on cold rolled steel is Higher, meaning prices are expected to rise in the next 30 days.

Cold Rolled Lead Times: 10-14 weeks

Galvanized Coil: SMU price range is $1,680-$1,780 per net ton ($84.00-$89.00/cwt) with an average of $1,730 per ton ($86.50/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to one week ago, while the upper end declined $20. Our overall average is unchanged from last week. Our price momentum on galvanized steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,749-$1,849 per ton with an average of $1,799 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 11-16 weeks

Galvalume Coil: SMU price range is $1,760-$1,800 per net ton ($88.00-$90.00/cwt) with an average of $1,780 per ton ($89.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to last week, while the upper end increased $20. Our overall average is up $40 per ton from one week ago. Our price momentum on Galvalume steel is Higher, meaning prices are expected to rise in the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,051-$2,091 per ton with an average of $2,071 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 12-14 weeks

Plate: SMU price range is $1,320-$1,460 per net ton ($66.00-$73.00/cwt) with an average of $1,390 per ton ($69.50/cwt) FOB mill. The lower end of our range increased $100 per ton compared to one week ago, while the upper end increased $50. Our overall average is up $75 per ton from one week ago. Our price momentum on plate steel is Higher, meaning prices are expected to rise in the next 30 days.

Plate Lead Times: 5-9 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.