Analysis

May 22, 2021

Final Thoughts

Written by John Packard

The thought is we could well see a pull-back of the Section 232 tariffs by the end of the year. Steel industry executives seem to be leaning in that direction (even though they are lobbying to keep the 232 tariffs) and talking about what is next for the industry. The topic most likely to be moved to the forefront, especially during the Biden administration, is the environment and how to remove carbon emissions from the steelmaking process.

You may have noticed steel mill CEOs speaking about decarbonization during earnings conference calls and press conferences. Lourenco Goncalves of Cleveland-Cliffs, David Burritt of U.S. Steel, virtually all of the U.S. steel mills are talking about cutting emissions. They are also talking about how the U.S. steel mills are already the lowest polluting steel mills in the world.

Decarbonization, managing risks associated with the move toward a more “sustainable” environment, will be one of the subjects tackled during the 2021 SMU Steel Summit Conference.

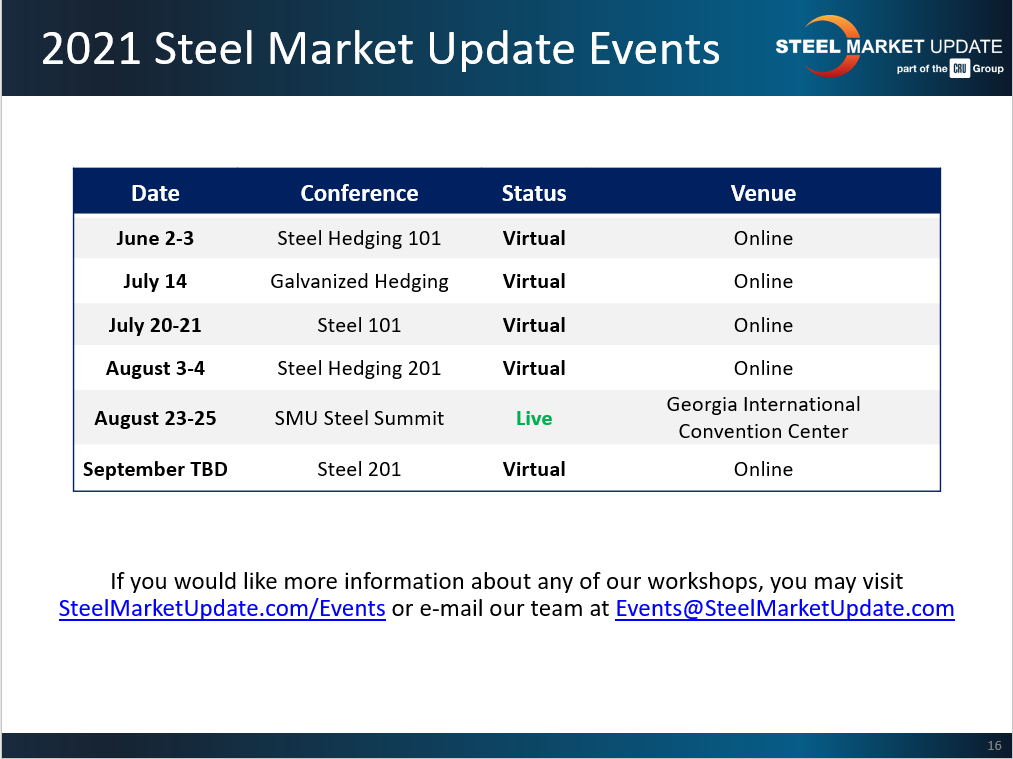

For those of you who have been pondering: What can I do about the wild swings in flat rolled steel prices? How can I protect my cost of goods? How can I quote long-term pricing without risk? These questions (and more) can be answered by attending our Steel Hedging 101: Introduction to Managing Price Risk Workshop. The next virtual workshop with Spencer Johnson of StoneX will be held on June 2 & 3 (half-day each day). You can learn more about the agenda, costs to attend, and how to register by clicking here.

Here is a listing of the upcoming workshops and conferences being hosted by Steel Market Update:

Update on 2021 SMU Steel Summit Conference

![]() We are moving past 450 executives registered for this year’s conference, which will be held at the Georgia International Convention Center in Atlanta. As in past years, we expect this year’s event to be THE conference you will want to attend. We will have a strong agenda, great speakers, many economic/commodity/market segment/steel forecasts, and a wonderful environment to get back to one-on-one networking. Should you not be able to travel to our Aug. 23-25 conference, we will have it available on our platform as well. We will have more information about the “digital” version of the conference in early June.

We are moving past 450 executives registered for this year’s conference, which will be held at the Georgia International Convention Center in Atlanta. As in past years, we expect this year’s event to be THE conference you will want to attend. We will have a strong agenda, great speakers, many economic/commodity/market segment/steel forecasts, and a wonderful environment to get back to one-on-one networking. Should you not be able to travel to our Aug. 23-25 conference, we will have it available on our platform as well. We will have more information about the “digital” version of the conference in early June.

We have been advised by the Georgia International Convention Center that the social distancing rules have been removed and there are no longer any restrictions. The mask mandate remains in place, but there are still three months to go, so the mask requirement could potentially change. We will keep you advised.

If you have any questions regarding the conference, please feel free to reach out to our team. We can be reached at conferences@crugroup.com or events@SteelMarketUpdate.com You can find information about our agenda, speakers, NexGen Leadership Award, dates, location, costs to attend and how to register by clicking here or going to: https://events.crugroup.com/smusteelsummit/home

A quick note to recognize that next Sunday is part of Memorial Day Weekend here in the United States and we will not publish an issue that evening.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com