Analysis

September 10, 2021

July Heating and Cooling Equipment Shipments Slip from June Record

Written by Brett Linton

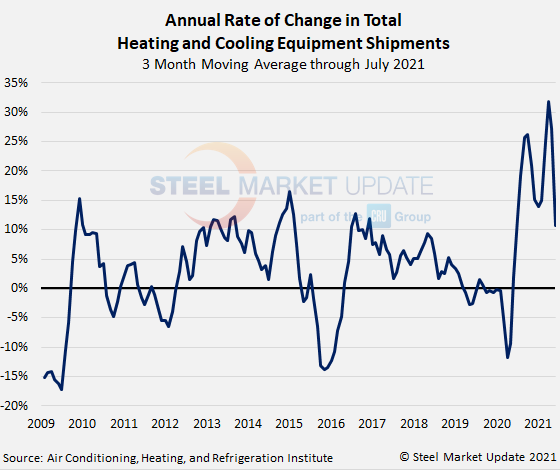

U.S. heating and cooling equipment shipments slowed in July to 2.10 million units, down 9.3% from the June record-high of 2.32 million units, according to recent data from the Air-Conditioning, Heating, and Refrigeration Institute (AHRI).

July levels are down 0.5% from levels one year prior, breaking the 13-month streak of shipments increasing on a year-over-year basis.

As a three-month moving average (3MMA), total heating and cooling shipments rose 10.7% year over year. Recall that May and June 2021 hold the record high 3MMA annual rate of change at 31.9% and 27.2%, respectively, and the record high prior to 2020 was 16.6% in February 2015. As shown in the chart below, July marks the 13th consecutive month that 3MMA shipments have increased on a year-over-year basis.

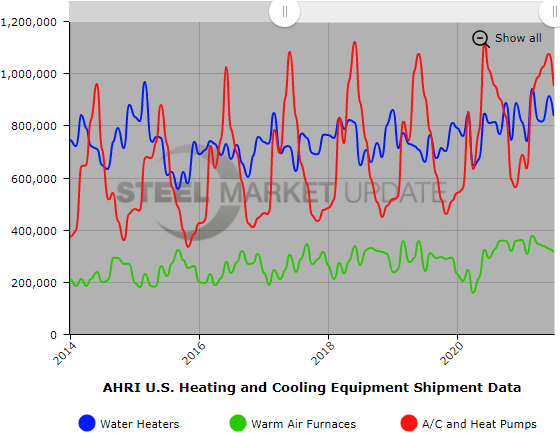

Residential and commercial storage water heater shipments increased 3.1% year over year to a combined 835,359 units in July; 816,588 units were shipped for residential use and 18,771 units for commercial use. July marks the fifth consecutive month that water heater shipments have increased on a year-over-year basis.

July shipments of warm air furnaces totaled 313,696 units, an increase of 7.9% compared to the same month last year. This is now the 13th consecutive month that warm air furnace shipments have increased year-over-year.

Central air conditioners and air-source heat pump shipments were down 5.7% from levels one year ago to 952,323 total units; 615,860 air conditioners and 336,463 heat pumps were shipped in July. This is now the second consecutive month that shipments have decreased year-over-year.

The full press release is available on the AHRI website here.

Below is a graph showing the history of total water heater, warm air furnace and air conditioner shipments through the latest data. To use its interactive features, view the graph on our website by clicking here. For assistance with either logging in or navigating the website, contact Info@SteelMarketUpdate.com.

By Brett Linton, Brett@SteelMarketUpdate.com