Prices

September 21, 2021

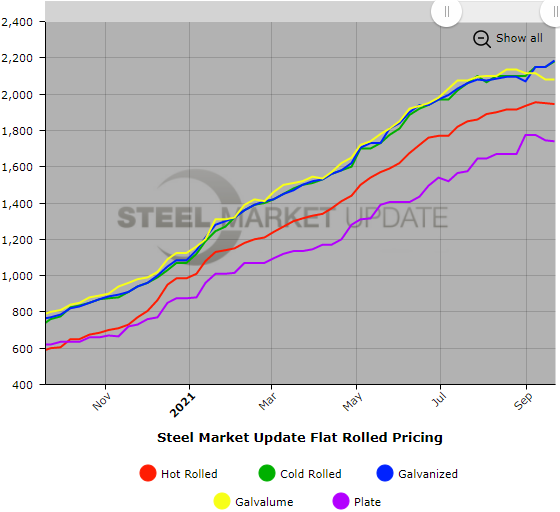

SMU Price Ranges & Indices: Uneven Performance for Prices

Written by Brett Linton

The average hot rolled steel price saw another small dip, based on Steel Market Update’s check of the market this week, but cold rolled and galvanized continued to rise, as the market reacts unevenly to changing conditions. On the supply side, sources report better availability of spot tons from the domestic mills at the same time that thousands of import tons are arriving on U.S. shores. On the demand side, the auto sector remains constrained by the microchip shortage, while service centers report more balanced inventories and more cautious purchasing. It’s too soon to declare that steel prices across the board have turned the corner and are poised to head down. But it’s notable that hot rolled saw its second consecutive decline for the first time in more than a year, albeit a very small -$5 per ton. SMU will keep the Price Momentum Indicators for all products on a Neutral setting until the trends become clear.

Hot Rolled Coil: SMU price range is $1,900-$1,990 per net ton ($95.00-$99.50/cwt) with an average of $1,945 per ton ($97.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $10 per ton. Our overall average is down $5 per ton from one week ago. Our price momentum on hot rolled steel will remain Neutral until the market establishes a clear direction.

Hot Rolled Lead Times: 7-12 weeks

Cold Rolled Coil: SMU price range is $2,160-$2,200 per net ton ($108.00-$110.00/cwt) with an average of $2,180 per ton ($109.00/cwt) FOB mill, east of the Rockies. The lower end of our range increased $60 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $30 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 9-13 weeks

Galvanized Coil: SMU price range is $2,170-$2,200 per net ton ($108.50-$110.00/cwt) with an average of $2,185 per ton ($109.25/cwt) FOB mill, east of the Rockies. The lower end of our range increased $70 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $35 per ton from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,248-$2,278 per ton with an average of $2,263 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 10-14 weeks

Galvalume Coil: SMU price range is $1,960-$2,200 per net ton ($98.00-$110.00/cwt) with an average of $2,080 per ton ($104.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to one week ago. Our overall average is unchanged from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,251-$2,491 per ton with an average of $2,371 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-15 weeks

Plate: SMU price range is $1,640-$1,840 per net ton ($82.00-$92.00/cwt) with an average of $1,740 per ton ($87.00/cwt) FOB mill. The lower end of our range decreased $10 per ton compared to last week, while the upper end remained unchanged. Our overall average is down $5 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 8-10 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.