Prices

September 25, 2021

AISI: Finished Steel Imports Up 27% This Year

Written by Tim Triplett

Finished steel imports into the United States rose by nearly 27% in the first eight months of the year.

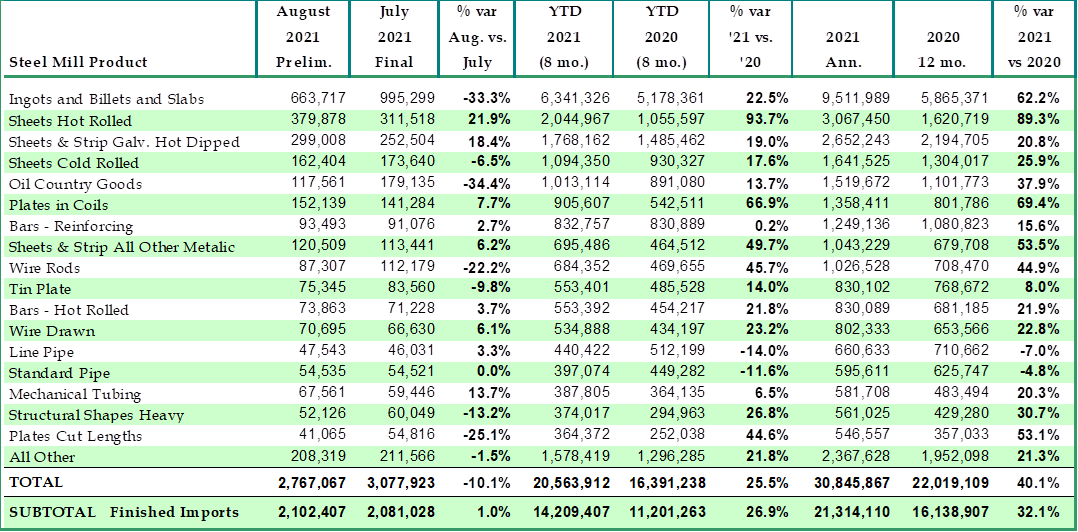

Census Bureau data reported by the American Iron and Steel Institute showed a 25.5% increase in total steel imports to 20.56 million tons, including a 26.9% increase in finished steel imports to 14.21 million tons, for the year to date. Imports have captured an estimated 20% share of the U.S. market so far this year, AISI said.

For the month of August, total steel imports, including semifinished slabs and billets, actually declined by 10.1% to 2.77 million tons, based on preliminary data, while finished steel imports inched up just 1.0% to 2.10 million tons versus final data for July.

Key finished steel imports seeing a significant year-to-date increase versus the same period in 2020 included hot rolled sheets (up 94%), plates in coils (up 67%), sheets and strip all other metallic coatings (up 50%), wire rods (up 46%), cut lengths plates (up 45%), heavy structural shapes (up 27%), wire drawn (up 23%), hot rolled bars (up 22%), sheets and strip hot-dipped galvanized (up 19%), cold rolled sheets (up 18%), tin plate (up 14%) and oil country goods (up 14%).

For the first eight months of 2021, the largest offshore suppliers were South Korea, Japan, Germany, Turkey and Taiwan, AISI reported.

Domestic steel prices are at or near record levels across the board. Steel Market Update reported a benchmark U.S. price for hot rolled coil at $1,945 per ton this week. Foreign offers for certain products are as much as 17-42% cheaper now, based on SMU’s calculations. A high number of buyers tell SMU they have foreign steel on order, seeking relief from the short supplies and lofty prices in the U.S., foretelling even stronger imports in the fourth quarter.