Prices

November 16, 2021

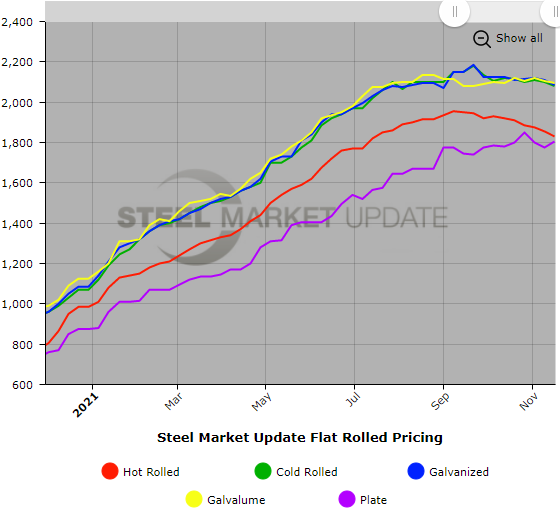

SMU Price Ranges & Indices: Prices Continue to Ease Down

Written by Brett Linton

Steel Market Update’s poll of buyers on Monday and Tuesday showed further small declines for flat rolled steel prices, while plate prices were up a bit. No sign yet of a sharp correction as prices continue to ease downward. The benchmark price for hot rolled is now down to $1,830 per ton, $25 lower than last week and down $125 from the peak in early September. SMU’s Hot Rolled Price Momentum Indicator continues to point Down, as HR prices are likely to see further decreases over the next 30 days. Prices for cold rolled and coated products also dipped by $10-25 per ton this week, but the trend is less certain and SMU’s Momentum Indicators for those products remain at Neutral. Prices are more difficult than usual to track given various end-of-year factors – such as seasonal demand and inventory adjustments. And what happens to prices when the ports manage to work through their bottlenecks and big tonnages of foreign steel finally make it to market? Be on the lookout, as we are, for even more volatility ahead.

Hot Rolled Coil: SMU price range is $1,760-$1,900 per net ton ($88.00-$95.00/cwt) with an average of $1,830 per ton ($91.50/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $15 per ton compared to last week, while the upper end decreased $35. Our overall average is down $25 per ton from one week ago. Our price momentum on hot rolled steel is Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 4-11 weeks

Cold Rolled Coil: SMU price range is $2,000-$2,160 per net ton ($100.00-$108.00/cwt) with an average of $2,080 per ton ($104.00/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $40 per ton. Our overall average is down $20 per ton from last week. Our price momentum on cold rolled steel will remain Neutral until the market establishes a clear direction.

Cold Rolled Lead Times: 6-15 weeks

Galvanized Coil: SMU price range is $1,970-$2,200 per net ton ($98.50-$110.00/cwt) with an average of $2,085 per ton ($104.25/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to last week, while the upper end decreased $50 per ton. Our overall average is down $25 per ton from one week ago. Our price momentum on galvanized steel will remain Neutral until the market establishes a clear direction.

Galvanized .060” G90 Benchmark: SMU price range is $2,048-$2,278 per ton with an average of $2,163 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 7-15 weeks

Galvalume Coil: SMU price range is $2,030-$2,160 per net ton ($101.50-$108.00/cwt) with an average of $2,095 per ton ($104.75/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to one week ago, while the upper end decreased $20 per ton. Our overall average is down $10 per ton from last week. Our price momentum on Galvalume steel will remain Neutral until the market establishes a clear direction.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,321-$2,451 per ton with an average of $2,386 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-12 weeks

Plate: SMU price range is $1,775-$1,835 per net ton ($88.75-$91.75/cwt) with an average of $1,805 per ton ($90.25/cwt) FOB mill. The lower end of our range increased $60 per ton compared to last week, while the upper end remained unchanged. Our overall average is up $30 per ton from one week ago. Our price momentum on plate steel will remain Neutral until the market establishes a clear direction.

Plate Lead Times: 4-8 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.