Prices

January 4, 2022

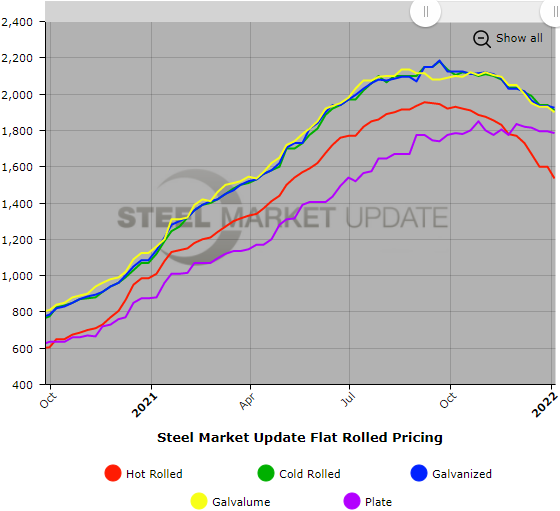

SMU Price Ranges & Indices: New Year, Same Downtrend

Written by Brett Linton

Steel began the New Year with the same old trend of declining prices that began four months ago. Steel Market Update’s first poll of the market in 2022 shows flat rolled and plate prices down again anywhere from $10-65 per ton. The wide spread in this week’s price ranges most likely reflects business hiccups caused by the holidays. SMU’s average benchmark price for hot rolled coil is now $1,535 per ton, down $65 from our last check of the market on Dec. 20-21 and more than $400 per ton below the peak in early September. Cold rolled and coated products saw smaller declines, as did plate. SMU’s Price Momentum Indicators are pointing Lower for all flat-rolled products – meaning further price declines are likely over the next 30 days – but the indicator for plate remains Neutral until the trend becomes clearer. SMU will be keeping a close eye on demand, inventory levels, mill lead times and import arrivals as the downtrend plays out over the first quarter, and possibly beyond.

Hot Rolled Coil: SMU price range is $1,400-$1,670 per net ton ($70.00-$83.50/cwt) with an average of $1,535 per ton ($76.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $100 per ton compared to two weeks prior, while the upper end decreased $30. Our overall average is down $65 per ton from two weeks ago. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-10 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,800-$2,020 per net ton ($90.00-$101.00/cwt) with an average of $1,910 per ton ($95.50/cwt) FOB mill, east of the Rockies. The lower end of our range remained unchanged compared to two weeks prior, while the upper end decreased $60 per ton. Our overall average is down $30 per ton from two weeks ago. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 5-12 weeks*

Galvanized Coil: SMU price range is $1,800-$2,050 per net ton ($90.00-$102.50/cwt) with an average of $1,925 per ton ($96.25/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to two weeks prior, while the upper end remained unchanged. Our overall average is down $10 per ton from two weeks ago. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,887-$2,137 per ton with an average of $2,012 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 6-12 weeks*

Galvalume Coil: SMU price range is $1,800-$2,000 per net ton ($90.00-$100.00/cwt) with an average of $1,900 per ton ($95.00/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $60 per ton compared to two weeks prior, while the upper end remained unchanged. Our overall average is down $30 per ton from two weeks ago. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $2,091-$2,291 per ton with an average of $2,191 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 8-9 weeks*

Plate: SMU price range is $1,750-$1,820 per net ton ($87.50-$91.00/cwt) with an average of $1,785 per ton ($89.25/cwt) FOB mill. The lower end of our range remained unchanged compared to two weeks prior, while the upper end decreased $20 per ton. Our overall average is down $10 per ton from two weeks ago. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 5-7 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.