Market Data

January 20, 2022

SMU Steel Buyers Sentiment: Optimism Holding Steady

Written by Tim Triplett

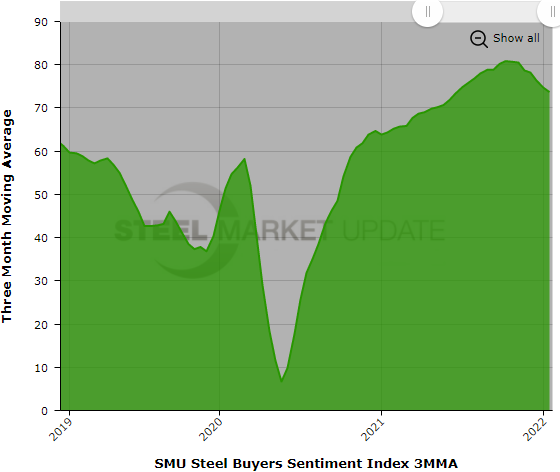

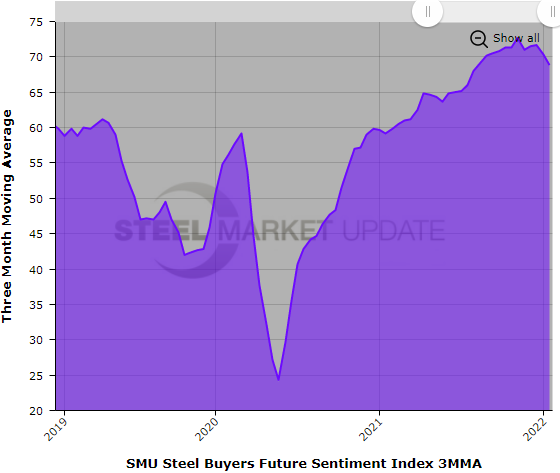

Steel Buyers Sentiment, as measured by Steel Market Update, has seen little change in the past two months despite declining steel prices and concerns about the economy and COVID heading into 2022.

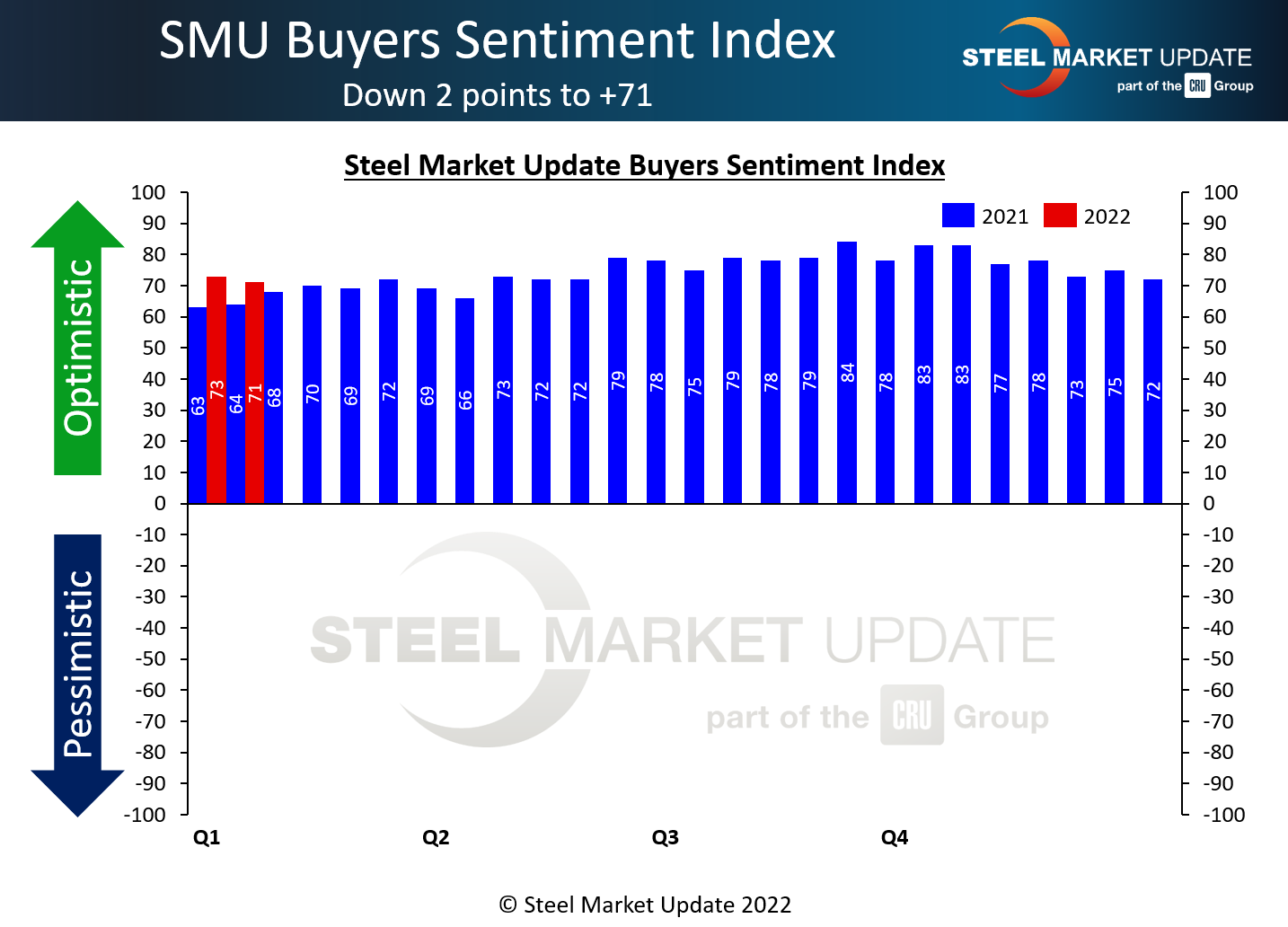

SMU surveys buyers every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Sentiment Index registered +71 this week, down just 2 points since early January. Current Sentiment has been steady in the low to mid 70s since late November.

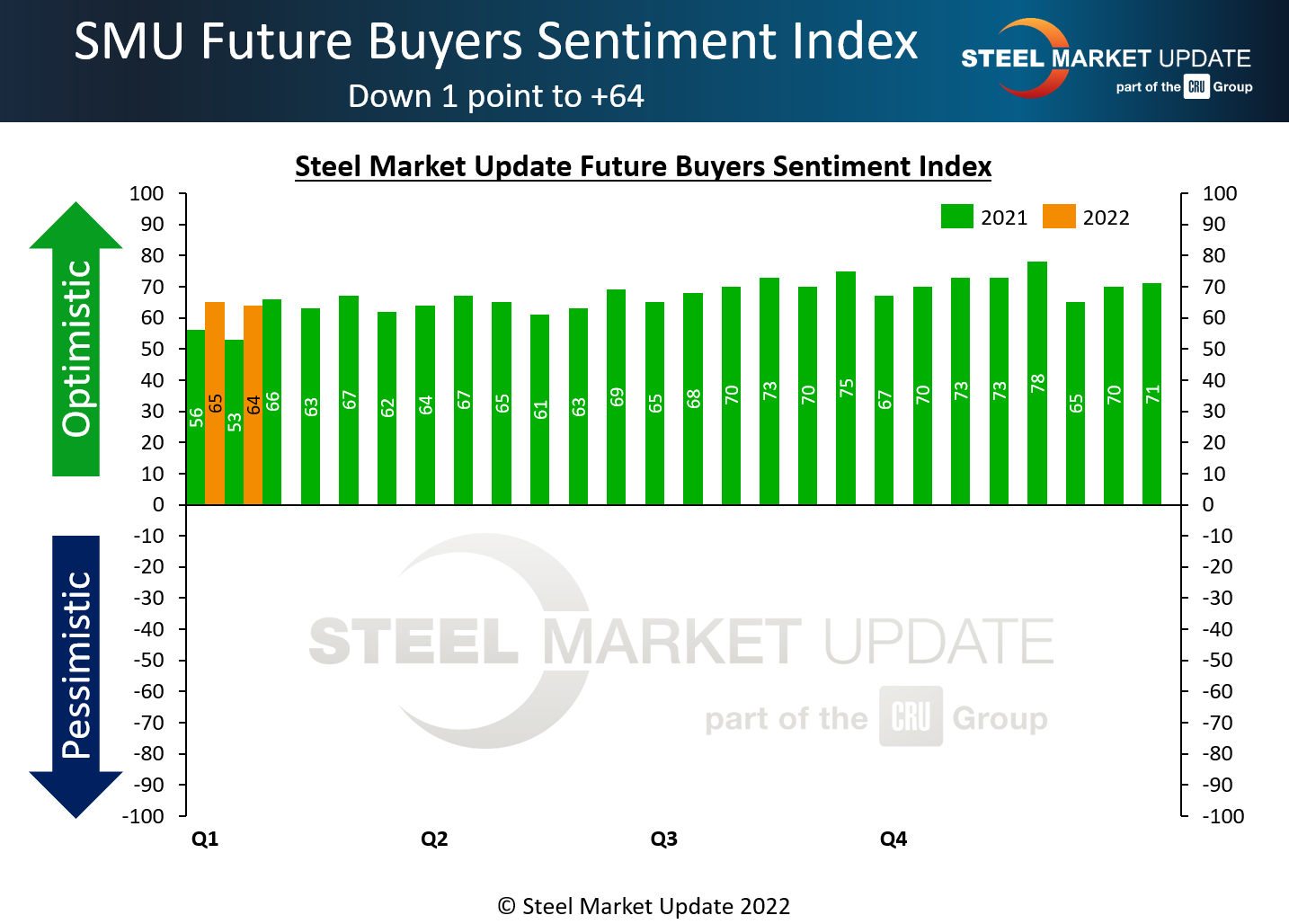

Future Sentiment – which measures buyers’ feelings about their prospects three to six months in the future – has dropped by only a single point since SMU’s last survey to a reading of +64. It also has moved up and down in a very narrow range over the past eight weeks.

Both sentiment readings are still near their all-time highs, which points to a generally positive outlook among steel buyers. Indeed, 72% of the service center and manufacturing executives who responded to SMU’s questionnaire this week said they are optimistic about their prospects for the first half of this year.

What Respondents Had to Say

“It ain’t 2021, but it’s still pretty darn good.”

“We’re good as long as prices don’t go too low.”

“It all depends on how rapidly prices decline and if demand can hold up.”

“The crystal ball gets a bit murkier for the 2H, but as long as we’re still over $1,000/ton, things will be great for mills and service centers.”

“Steel markets will bottom out in the end of the second quarter and should stabilize, so we expect demand to be steady – and to increase when automotive returns.”

“Our inventory is overpriced.”

“Not really sure what to expect, but it’s definitely a different vibe from six months ago.”

“It’s a daily grind.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page.

We send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com