Prices

February 1, 2022

SMU Price Ranges & Indices: Flat Rolled Prices Down Another $60-100 Per Ton

Written by Brett Linton

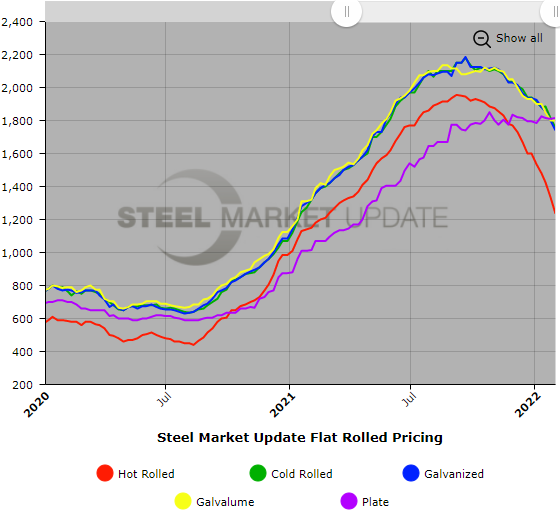

Flat rolled steel prices declined by another $60-100 per ton in the past week, pushing the benchmark hot rolled price down to $1,235 per ton. That’s a decline of about 37% or a total of $720 per ton since the market peaked five months ago. Why the sharp decline? An imbalance between supply and demand as service centers work down excess inventories and buyers postpone purchases to see how low prices will go. How much longer will this slide continue? That’s unknowable, but the majority (64%) of the buyers responding to SMU’s latest survey predict HRC prices will bottom out sometime between now and the end of the second quarter. Meanwhile, SMU’s Price Momentum Indicators continue to point toward lower flat rolled prices over the next 30 days, but remain neutral for plate prices, which appear to be holding their own for the time being.

Hot Rolled Coil: SMU price range is $1,160-$1,310 per net ton ($58.00-$65.50/cwt) with an average of $1,235 per ton ($61.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $90 per ton compared to one week ago, while the upper end declined $110 per ton. Our overall average is down $100 per ton from last week. Our price momentum on hot rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks* (preliminary ranges from our ongoing market survey, final lead times data will be released on Thursday)

Cold Rolled Coil: SMU price range is $1,650-$1,860 per net ton ($82.50-$93.00/cwt) with an average of $1,755 per ton ($87.75/cwt) FOB mill, east of the Rockies. The lower end of our range declined $80 per ton compared to last week, while the upper end decreased $40 per ton. Our overall average is down $60 per ton from one week ago. Our price momentum on cold rolled steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Cold Rolled Lead Times: 4-8 weeks*

Galvanized Coil: SMU price range is $1,650-$1,830 per net ton ($82.50-$91.50/cwt) with an average of $1,740 per ton ($87.00/cwt) FOB mill, east of the Rockies. The lower end of our range declined $50 per ton compared to one week ago, while the upper end decreased $70 per ton. Our overall average is down $60 per ton from last week. Our price momentum on galvanized steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $1,737-$1,917 per ton with an average of $1,827 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks*

Galvalume Coil: SMU price range is $1,700-$1,900 per net ton ($85.00-$95.00/cwt) with an average of $1,800 per ton ($90.00/cwt) FOB mill, east of the Rockies. Both the lower and upper ends of our range remained unchanged compared to last week. Our overall average is unchanged from one week ago. Our price momentum on Galvalume steel is at Lower, meaning we expect prices to decrease over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,991-$2,191 per ton with an average of $2,091 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks*

Plate: SMU price range is $1,800-$1,830 per net ton ($90.00-$91.50/cwt) with an average of $1,815 per ton ($90.75/cwt) FOB mill. The lower end of our range increased $10 per ton compared to one week ago, while the upper end remained unchanged. Our overall average is up $5 per ton from last week. Our price momentum on plate steel remains at Neutral until the market establishes a clear direction.

Plate Lead Times: 4-8 weeks*

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume, and plate price history. This data is available here on our website with our interactive pricing tool. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com.