Market Data

February 3, 2022

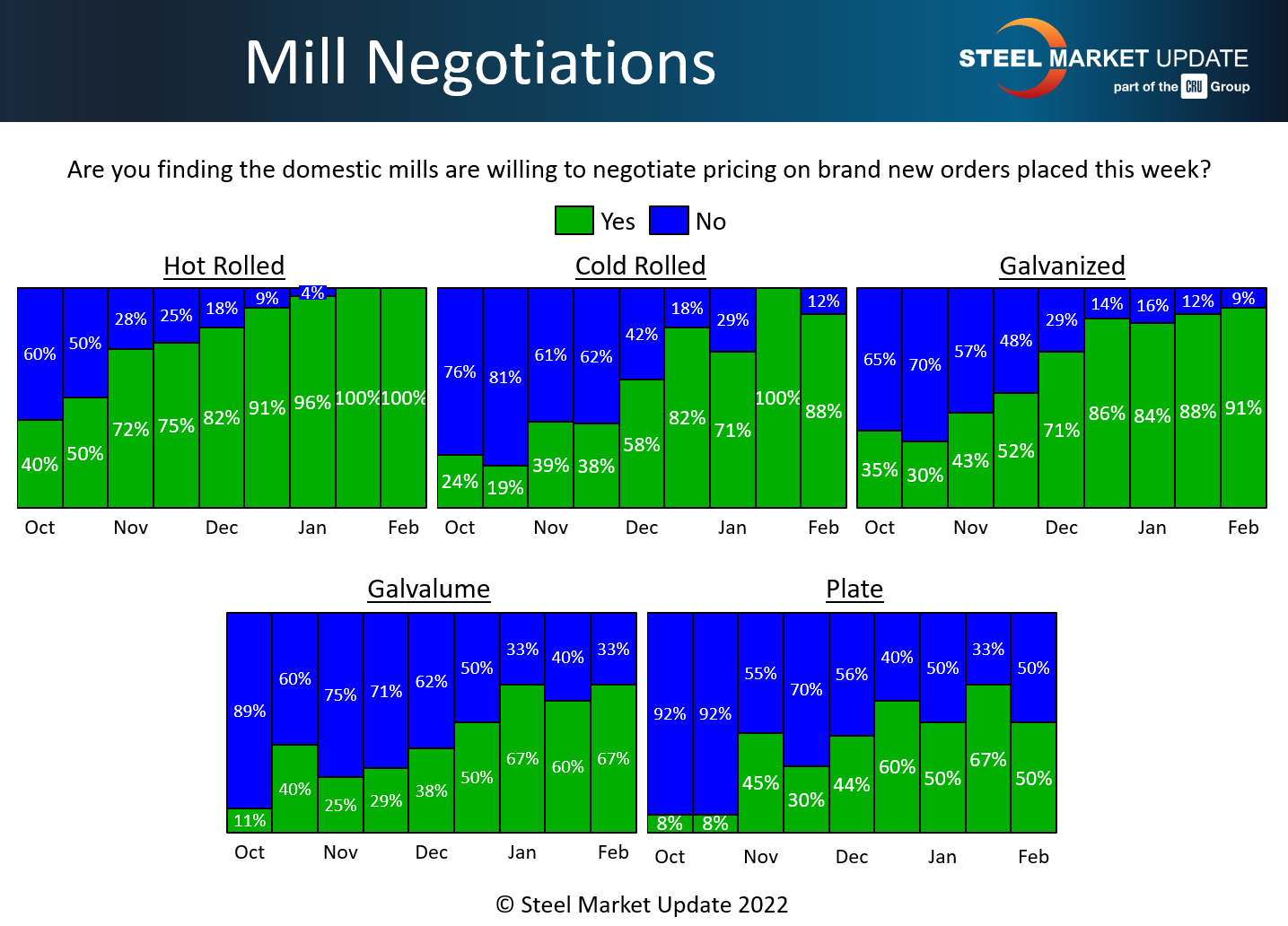

Steel Mill Negotiations: Buyers Still Have the Upper Hand

Written by Tim Triplett

With steel prices continuing to plunge, buyers clearly hold the upper hand in price negotiations with the mills – a position they have enjoyed for the past two months as seen in the upward slope of the green bars in the chart below.

Every two weeks, Steel Market Update asks readers: Are you finding the domestic mills willing to negotiate spot pricing on new orders placed this week? The vast majority of respondents in every product category report the mills willing to make a deal today in order to close a sale.

“Every week, the number is lower,” said one buyer: “Yes, they negotiate, but only to a certain degree. They are still trying to hold the line a bit,” added another.

Why do buyers have such a dominant negotiating position. Steel Market Update’s check of the market this week puts the average hot rolled price at $1,235 per ton ($61.75 per cwt), down by $100 per ton from last week and a decline of more than $700 per ton since last fall. With so many buyers staying on the sidelines to see how low prices go, mills almost without exception are open to discussing discounts. SMU will be keeping a close watch on when negotiations begin to tighten up as a sign that steel prices may be nearing a bottom.

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com