Market Data

April 28, 2022

March Durable Goods Snap Back

Written by David Schollaert

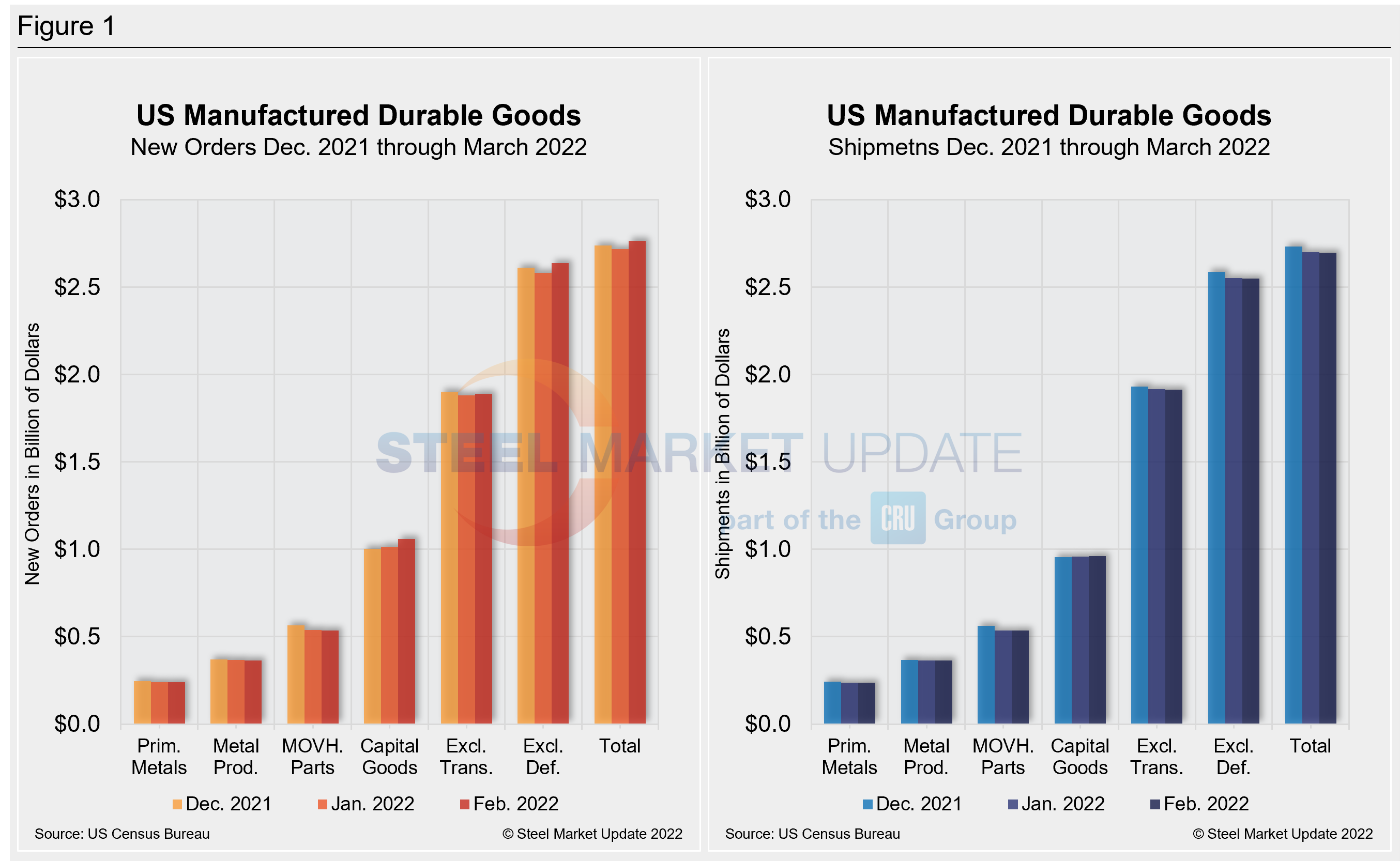

New orders for US manufactured durable goods rebounded in March after sinking for the first time in five months in February. Last month’s bookings for durable goods rose 0.8% following a revised 1.7% decline a month earlier, according to the Commerce Department.

![]() The value of core capital goods orders – a proxy for investment in equipment that excludes aircraft and non-defense capital goods – performed better than expected, expanding by 1%.

The value of core capital goods orders – a proxy for investment in equipment that excludes aircraft and non-defense capital goods – performed better than expected, expanding by 1%.

Core capital goods shipments, a figure that is used to help calculate equipment investment in the government’s gross domestic product report, rose 0.2% in March – growing for a second straight month.

The broad-based gain in durable goods included stronger bookings for communications equipment, machinery, and electrical equipment. Motor vehicle bookings increased 5% after a 0.3% dip in the prior month. Durable goods orders excluding transportation equipment increased 1.1%.

Bookings for commercial aircraft declined 0.9%, while government data showed unfilled orders for all durable goods rose 0.4%, led by transportation equipment. Inventories climbed 0.7%.

Below is the March advance report from the US Census Bureau on durable goods manufacturers’ shipments, inventories, and orders:

New Orders

New orders for manufactured durable goods in March increased $2.3 billion, or 0.8%, to $275.0 billion. This increase, the fifth in the last six months, followed a 1.7% decrease in February. Computers and electronic products, up two of the last three months, led the increase, up $0.7 billion, or 2.6%, to $26.3 billion.

Shipments

Shipments of manufactured durable goods in March, up ten of the last eleven months, increased $3.3 billion, or 1.2%, to $274.2 billion. This followed a 0.1% February increase. Transportation equipment, up five of the last six months, was up $1.9 billion, or 2.4%, to $80.0 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in March, up fourteen consecutive months, increased $5.3 billion, or 0.4%, to $1,294.6 billion. This followed a 0.5% February increase. Transportation equipment, up thirteen of the last fourteen months, led the increase, up $3.7 billion, or 0.4%, to $857.6 billion.

Inventories

Inventories of manufactured durable goods in March, up fourteen consecutive months, increased $3.3 billion, or 0.7%, to $482.9 billion. This followed a 0.6% February increase. Transportation equipment, up four of the last five months, led the increase, up $1.5 billion, or 1.0%, to $156.0 billion.

Capital Goods

Nondefense new orders for capital goods in March decreased $0.5 billion, or 0.5%, to $90.0 billion. Shipments decreased $0.1 billion, or 0.1%, to $84.2 billion. Unfilled orders increased $5.9 billion, or 0.7%, to $805.2 billion. Inventories increased $2.1 billion, or 1.0%, to $212.7 billion.

Defense new orders for capital goods in March decreased $0.7 billion, or 5.6%, to $11.3 billion. Shipments decreased $0.2 billion, or 1.9%, to $12.6 billion. Unfilled orders decreased $1.3 billion, or 0.7%, to $183.4 billion. Inventories increased $0.1 billion, or 0.4%, to $21.4 billion.

Revised and Recently Benchmarked February Data

Revised seasonally adjusted February figures for all manufacturing industries were: new orders, $545.4 billion (revised from $542.0 billion); shipments, $543.6 billion (revised from $541.0 billion); unfilled orders, $1,289.3 billion (revised from $1,288.5 billion), and total inventories, $787.0 billion (revised from $785.2 billion).

By David Schollaert, David@SteelMarketUpdate.com