Market Data

May 3, 2022

ISM: US Manufacturing Expanded in April, But at a Slower Rate

Written by David Schollaert

The outlook among purchasing managers surveyed by the Institute for Supply Management remains positive, and US manufacturing continued to grow April – thought at a slower rate.

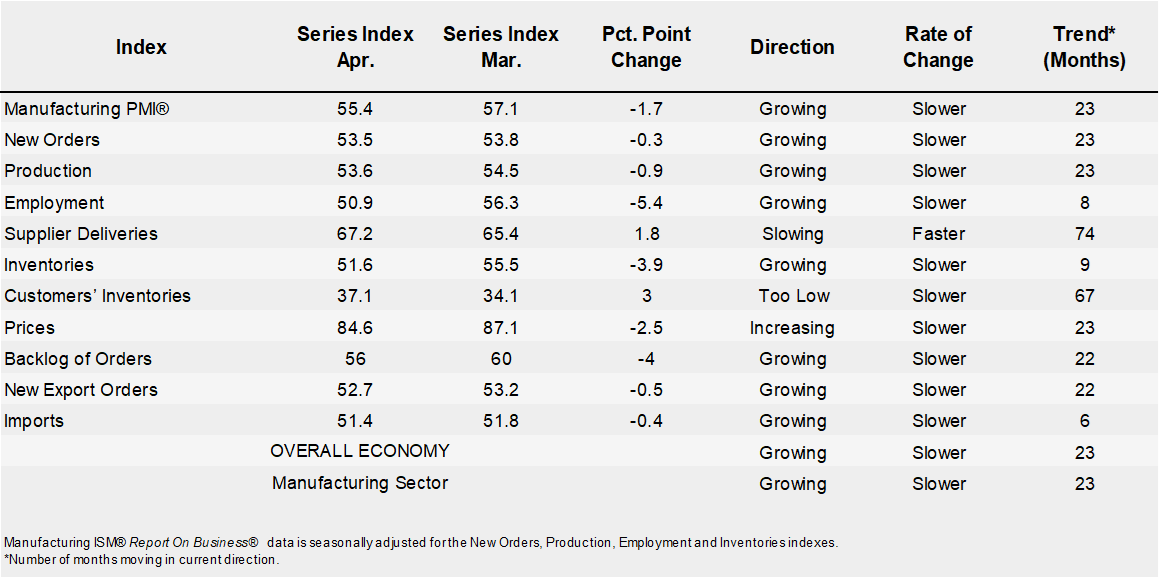

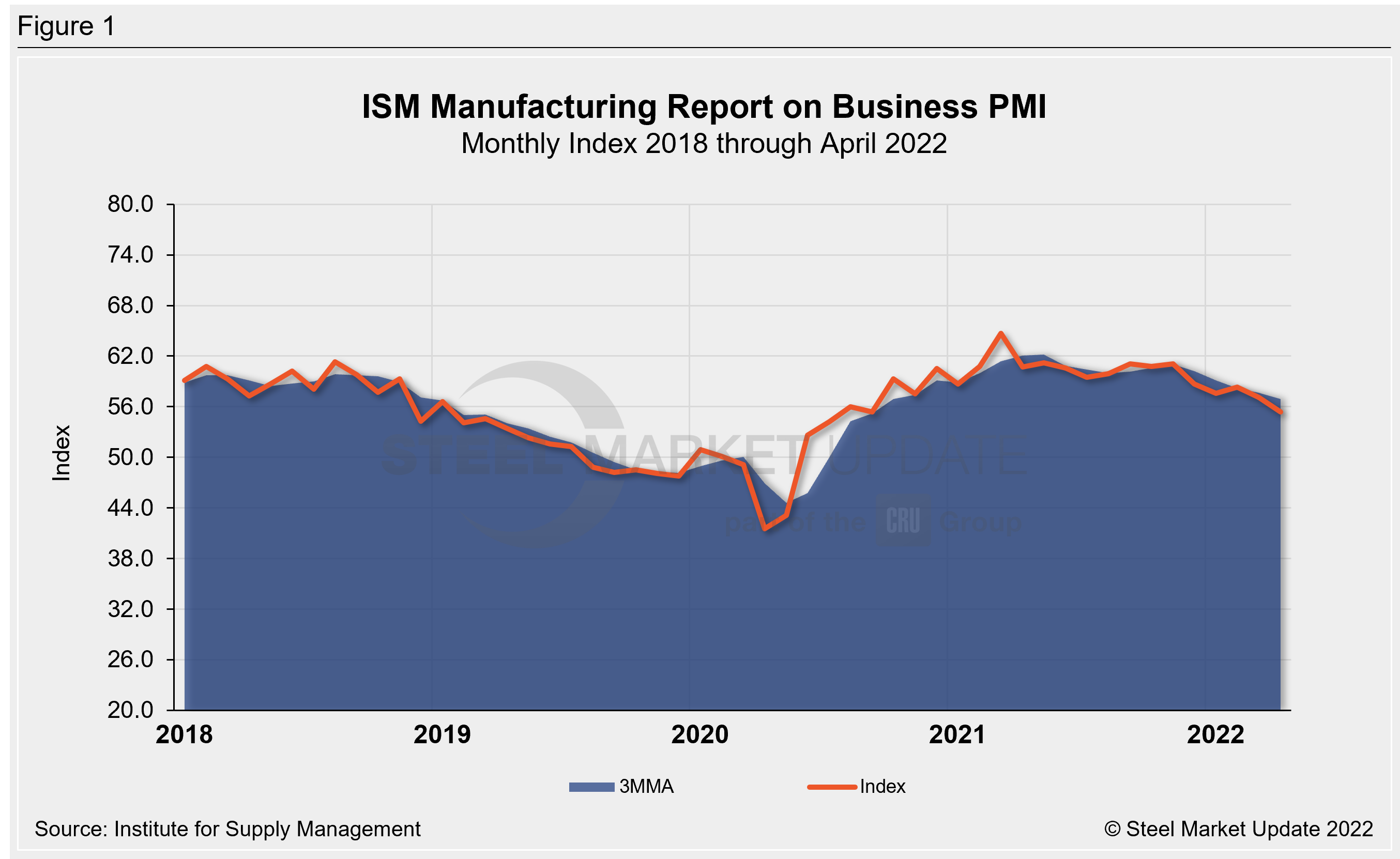

Last month’s Manufacturing PMI edged down to a reading of 55.4% versus 57.1% in March. The index reading above 50% indicates growth in the manufacturing sector. April’s measure marks the 22nd consecutive month of expansion since following the COVID-19 outbreak in the spring of 2020, though it’s the slowest rate of gain since July 2020.

“The US manufacturing sector remains in a demand-driven, supply chain-constrained environment,” said Timothy Fiore, chairman of ISM’s Manufacturing Business Survey Committee. “In April, progress slowed in solving labor shortage problems at all tiers of the supply chain. … (There was) a slight easing of price expansion, but instability in global energy markets continues.”

The headline index decline was driven by slower growth rates in new orders, production and employment.

The new orders index reached 53.5%, a 0.3 percentage point decline from the prior month and the lowest since May 2020, when the US was in a deep but brief recession triggered by Covid. The production index fell to 53.6%, 0.9 percentage points below the prior month and also the lowest since May 2020.

“Hiring and material availability continue to show signs of improvement, but factories are still struggling to hit optimum output rates — primarily due to high levels of employee turnover,” ISM said.

Other findings from ISM’s monthly survey of purchasing professionals:

- Though down, the New Orders Index remains in growth territory.

- The Customers’ Inventories Index remained at a very low level, “too low” according to ISM, registering just 51.6%, 3.9 percentage points lower than March’s reading.

- The Backlog of Orders Index slipped 4 percentage points in April to 56%.

- Consumption (measured by the Production and Employment indexes) grew during the period, though at a slower rate, with a combined minus-6.3-percentage point change to the Manufacturing PMI® calculation.

- The Employment Index expanded for a seventh straight month, while signs that firms’ ability to hire improved very little. This was offset by continued challenges with turnover (quits and retirements) and resulting backfilling. In short, firms continue to struggle to adequately staff their organizations, and to a greater extent compared to March.

An interactive history ISM Manufacturing Report on Business PMI index is available on our website. If you need assistance logging into or navigating the website, please contact us at info@SteelMarketUpdate.com.

By David Schollaert, David@SteelMarketUpdate.com