Canada

May 5, 2022

Stelco Q1 Profits Narrow on Lower Shipments, Q2 Rebound Expected

Written by Michael Cowden

Stelco Holdings Inc. heralded record first quarter net income, but the result nonetheless marked a nearly 50% decline from fourth quarter profit levels.

The Canadian flat-rolled steelmaker chalked up lower quarter-over-quarter earnings to a drop in both shipment volumes and prices.

“While in the early part of the first quarter we saw deterioration in both pricing and volume compared to the fourth quarter of 2021, we did experience some recovery commencing in the last month of the period,” Chief Financial Officer Paul Scherzer said.

Scherzer made the comments in a statement released with earnings data after the close of markets on Thursday, May 5.

Scherzer’s comments reflect trends SMU has collected in its pricing data. US hot-rolled coil prices averaged $1,444 per ton ($72.2 per cwt) in January, fell to $1,131 per ton in February, and then rebounded to $1,229 per ton in March following the outbreak of war in Ukraine, according to SMU’s interactive pricing tool.

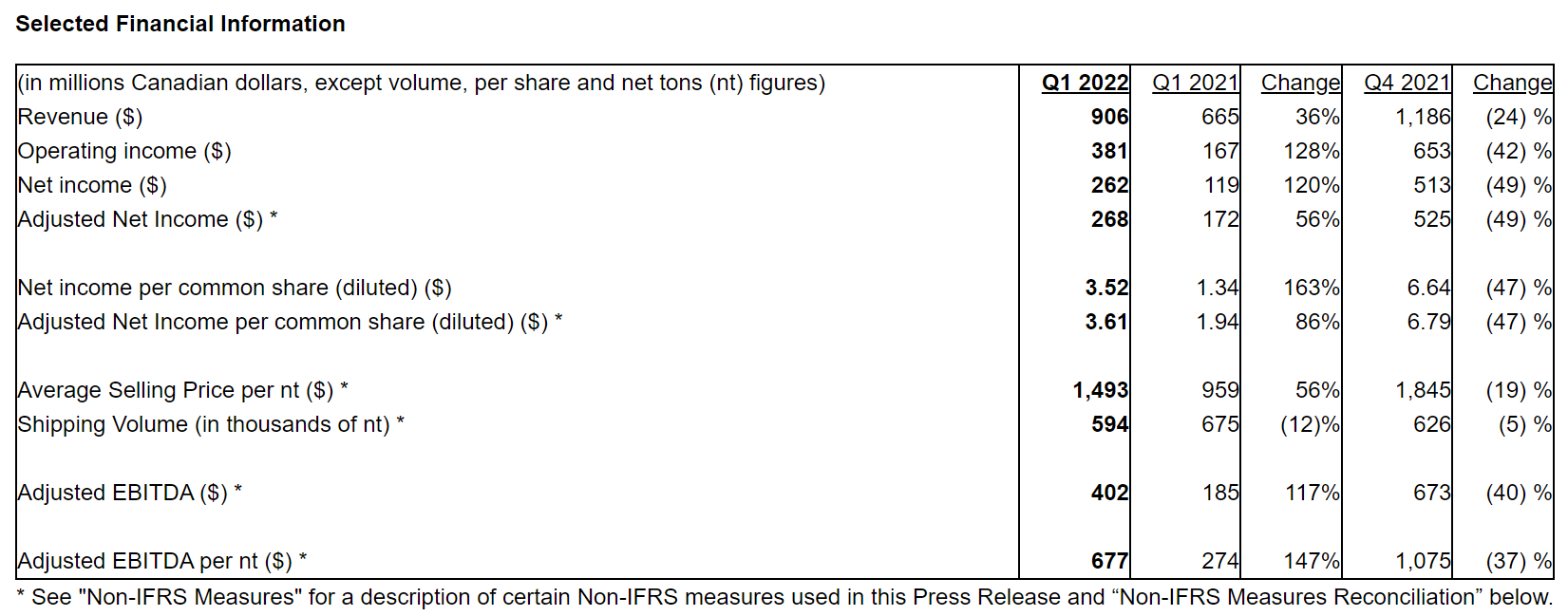

Headline first quarter earnings results for Hamilton, Ontario-based Stelco are below (click to enlarge):

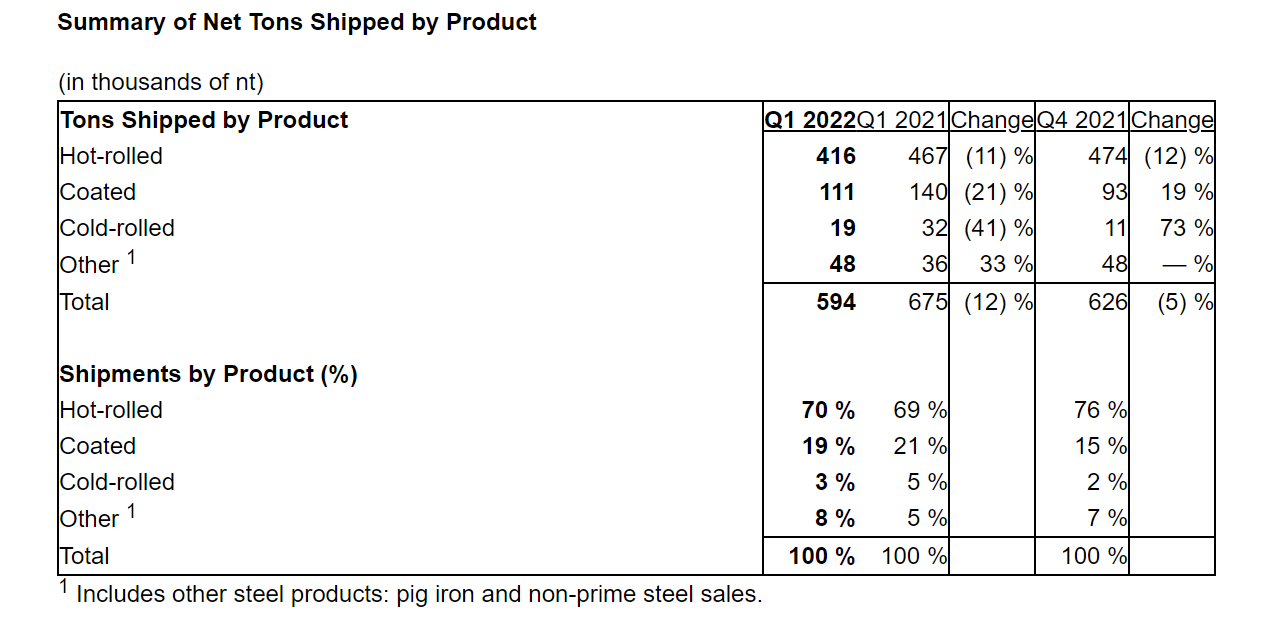

Shipment figures by product are here (click to enlarge):

On the operations side, Stelco recently finished upgrades to the coke battery at its Lake Erie Works in Nanticoke, Ontario. And the company expects to finish work in the second quarter on a 65-megawatt electricity cogeneration facility.

“We expect that these projects will further lower our cost structure, reduce our emissions profile and improve the overall efficiency of our operations,” Stelco executive chairman and CEO Alan Kestenbaum said.

Lower costs should be a big advantage, especially considering that higher scrap prices will boost the cost structures of Stelco’s competitors, he added in an apparent reference ot electric arc furnace (EAF) producers.

Stelco also expects to see higher prices and shipment volumes in the second quarter. “Since the end of the first quarter, we have seen an improvement in end-market demand as well as restocking at the distribution level,” Kestenbaum said.

SMU’s US HRC price averaged $1,460 per ton in April, the highest monthly average of the year to date.

By Michael Cowden, Michael@SteelMarketUpdate.com